PERSONAL STYLIST

CONSULTATIONS FROM

THE COMFORT OF

YOUR HOME.

PERSONAL STYLIST

CONSULTATIONS FROM

THE COMFORT OF

YOUR HOME.

PERSONAL STYLIST

CONSULTATIONS

FROM THE

COMFORT OF

YOUR HOME.

PERSONAL STYLIST

CONSULTATIONS

FROM THE

COMFORT OF

YOUR HOME.

PERSONAL SHOPPING CONSULTATIONS FOR MODEST FAITH BASED APPAREL FROM THE COMFORT OF YOUR HOME

PERSONAL SHOPPING CONSULTATIONS FOR MODEST

FAITH BASED APPAREL FROM THE COMFORT OF YOUR HOME

PERSONAL SHOPPING CONSULTATIONS FOR MODEST

FAITH BASED APPAREL FROM THE COMFORT OF YOUR HOME

PROBLEM

Identifying restaurants that satisfy flavor preferences & food allergy needs remains

a challenge, often leading to overlooked options and missed dining opportunities.

SOLUTION

Develop an innovative app that maps flavor profiles and tracks food allergies, enabling confident restaurant discovery.

MY ROLE

Conduct & synthesize research, and develop iterative solutions through user testing from low to high-fidelity prototypes.

RESEARCH PLAN —

SCHEDULE —

— PHASE 1 —

DISCOVERY

PLAN RESEARCH

1. Formulate Research Plan

2. Define User Audience

CONDUCT RESEARCH

1. Competitive Landscape

2. Secondary Research

RESEARCH

1. User Personas

2. Empathy Mapping

3. Mood Board

— PHASE 1 —

DESIGN R1

DESIGN INFORMATION ARCHITECTURE

1. User Flow Red Routes

DESIGN IN LOW FIDELITY

1. Computer Wireframes

2. Group Critique

3. Combine Concepts

DESIGN INFORMATION ARCHITECTURE

1. Refine Design & Incorporate

Prototype Functionality

— PHASE 3 —

VALIDATE R1

PREPARE TO TEST

1. Create Test Script

2. Identify & Book Test Users

CONDUCT TESTING

1. Conduct Remote Moderated

Usability Tests

SYNTHESIZE RESULTS

1. Create Usability Test Report

2. Address Any Critical Errors

3. Present Concept to Client

— PHASE 4 —

DESIGN R2

DESIGN IN HIGH FIDELITY

1. Refine Design Based On

Usability Test Findings,

Group and Client Feedback

— PHASE 5 —

VALIDATE R2

PREPARE TO TEST

1. Create Modified Test Script

2. Identify & Book Test Users

CONDUCT TESTING

1. Conduct Remote Moderated

Usability Tests

SYNTHESIZE RESULTS

1. Create Usability Test Report

2.Address Errors

3. Present Concept to Client

— PHASE 6 —

DESIGN R3

ITERATE IN HIGH FIDELITY

1. Refine Design Based On

Usability Test Findings,

Group and Client Feedback

2. Final Presentation to Client

3.Handoff Final Deliverables

to Client

RESEARCH PLAN —

SCHEDULE —

— PHASE 1 —

DISCOVERY

PLAN RESEARCH

1. Formulate Research Plan

2. Define User Audience

CONDUCT RESEARCH

1. Competitive Landscape

2. Secondary Research

RESEARCH

1. User Personas

2. Empathy Mapping

3. Mood Board

— PHASE 1 —

DESIGN R1

DESIGN INFORMATION ARCHITECTURE

1. User Flow Red Routes

DESIGN IN LOW FIDELITY

1. Computer Wireframes

2. Group Critique

3. Combine Concepts

DESIGN INFORMATION ARCHITECTURE

1. Refine Design & Incorporate

Prototype Functionality

— PHASE 3 —

VALIDATE R1

PREPARE TO TEST

1. Create Test Script

2. Identify & Book Test Users

CONDUCT TESTING

1. Conduct Remote Moderated

Usability Tests

SYNTHESIZE RESULTS

1. Create Usability Test Report

2. Address Any Critical Errors

3. Present Concept to Client

— PHASE 4 —

DESIGN R2

DESIGN IN HIGH FIDELITY

1. Refine Design Based On

Usability Test Findings,

Group and Client Feedback

— PHASE 5 —

VALIDATE R2

PREPARE TO TEST

1. Create Modified Test Script

2. Identify & Book Test Users

CONDUCT TESTING

1. Conduct Remote Moderated

Usability Tests

SYNTHESIZE RESULTS

1. Create Usability Test Report

2.Address Errors

3. Present Concept to Client

— PHASE 6 —

DESIGN R3

ITERATE IN HIGH FIDELITY

1. Refine Design Based On

Usability Test Findings,

Group and Client Feedback

2. Final Presentation to Client

3.Handoff Final Deliverables

to Client

• Faith-conscious women 25-50

• Prefer elegant/modest fashion

• Desire a curated shopping experience

• Alignment with their beliefs & style

USER AUDIENCE

• Faith-conscious women 25-50

• Prefer elegant/modest fashion

• Desire a curated shopping experience

• Alignment with their beliefs & style

USER AUDIENCE

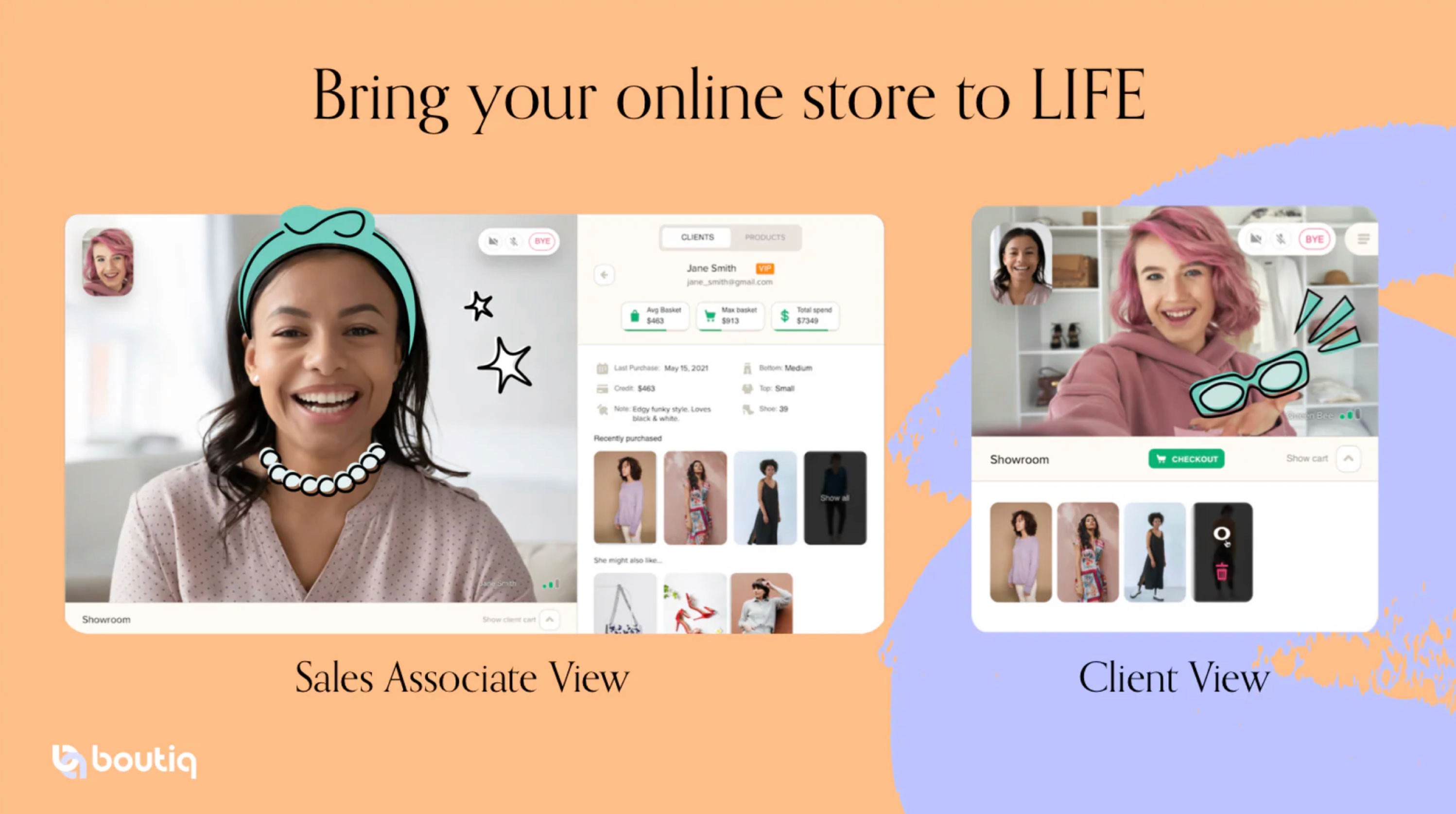

PRELIMINARY RESEARCH —

COMPETITIVE LANDSCAPE / COMPARISON —

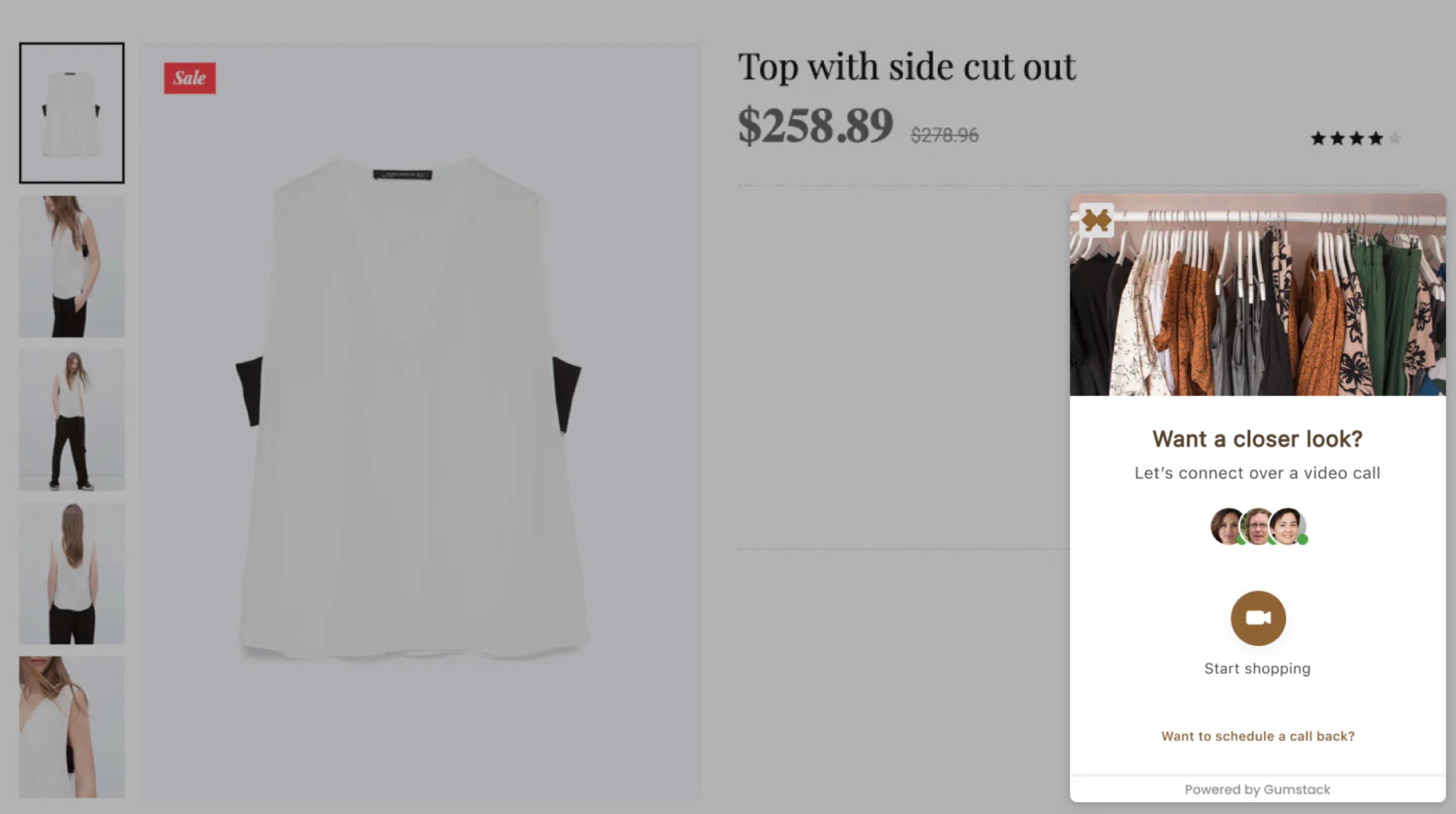

APPLICATION FEATURE

Category

Video Shopping Type

Human Element

Integration Level

Key Features

Pricing

Best For

Example Use Cases

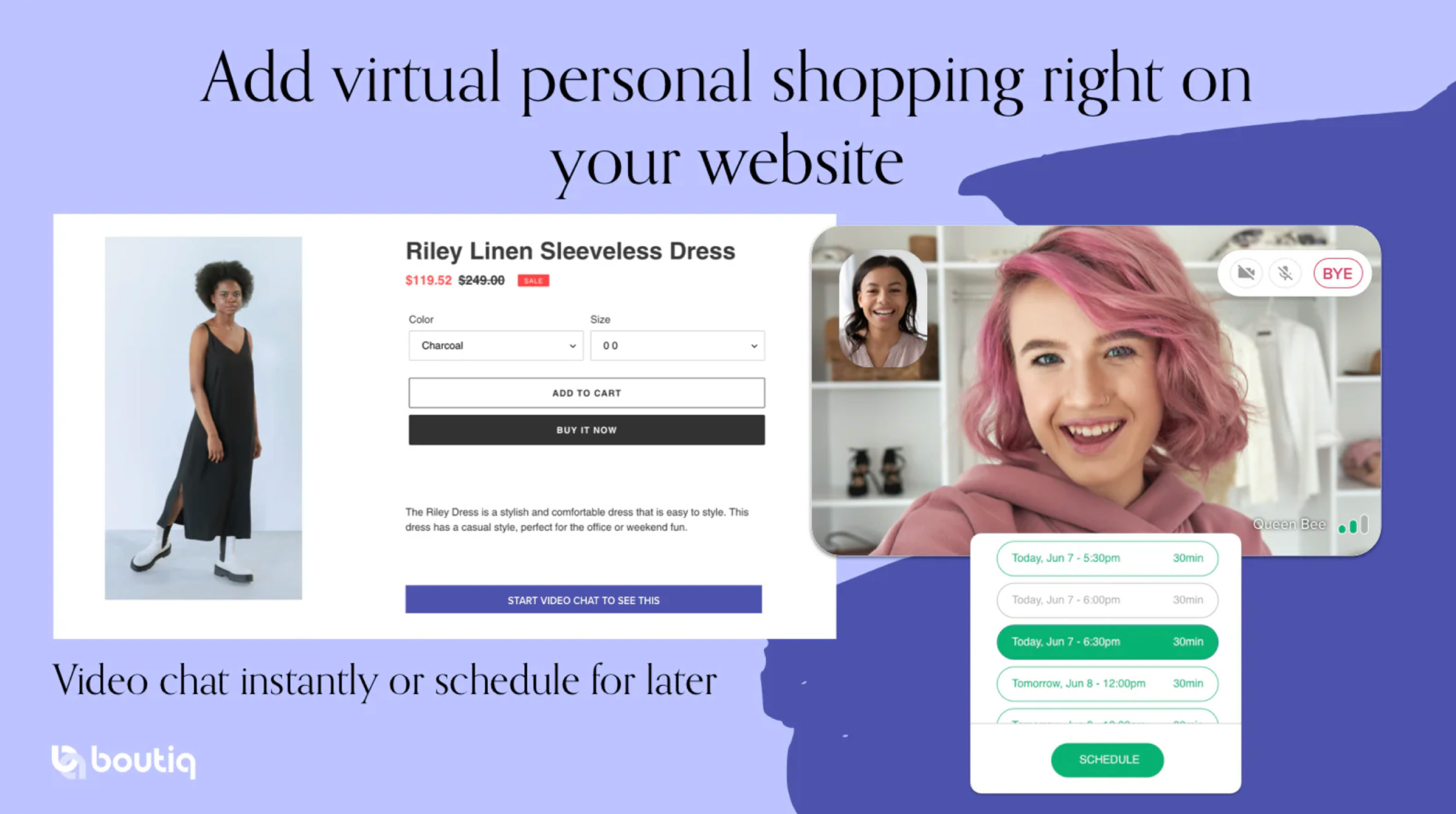

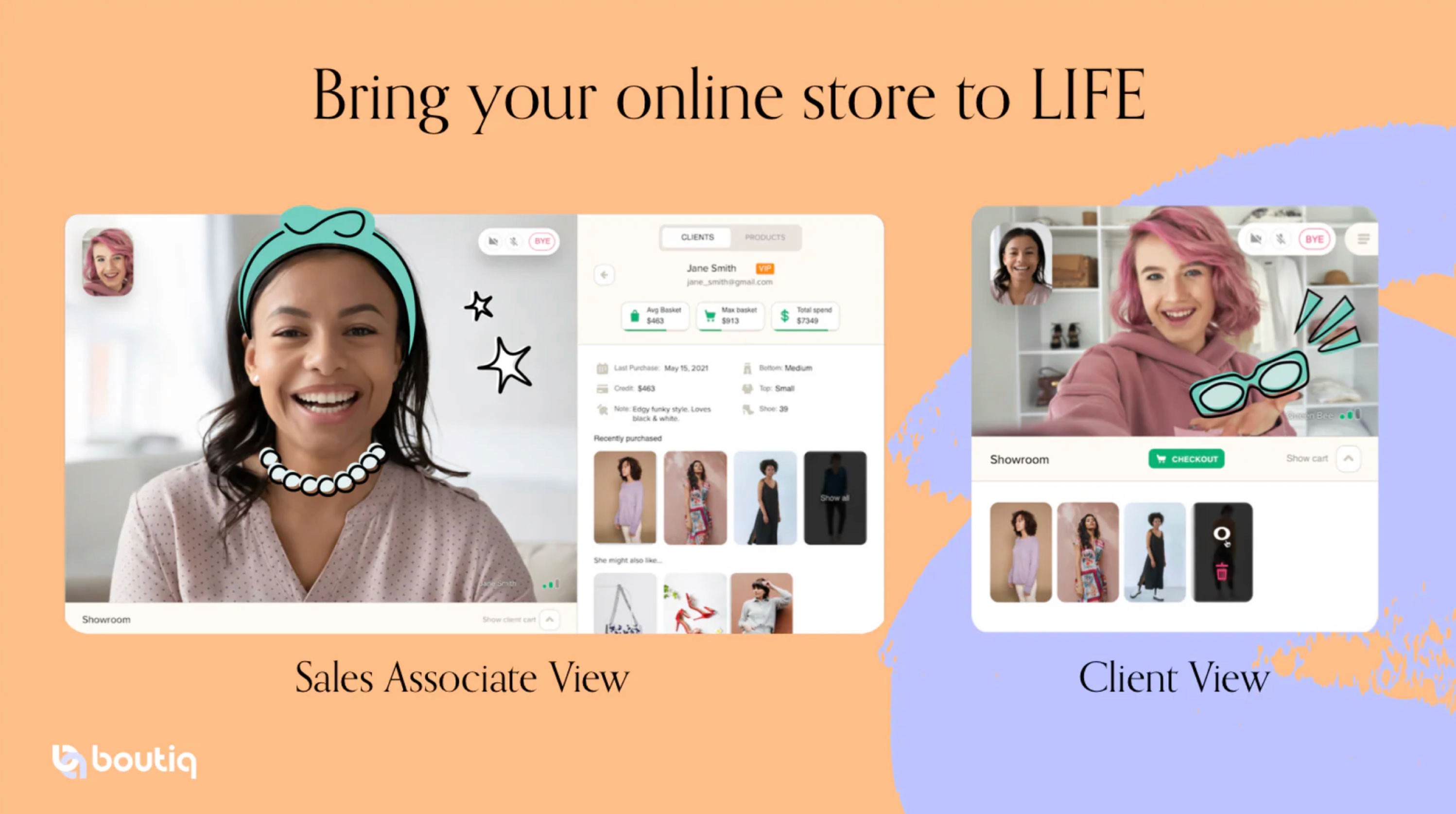

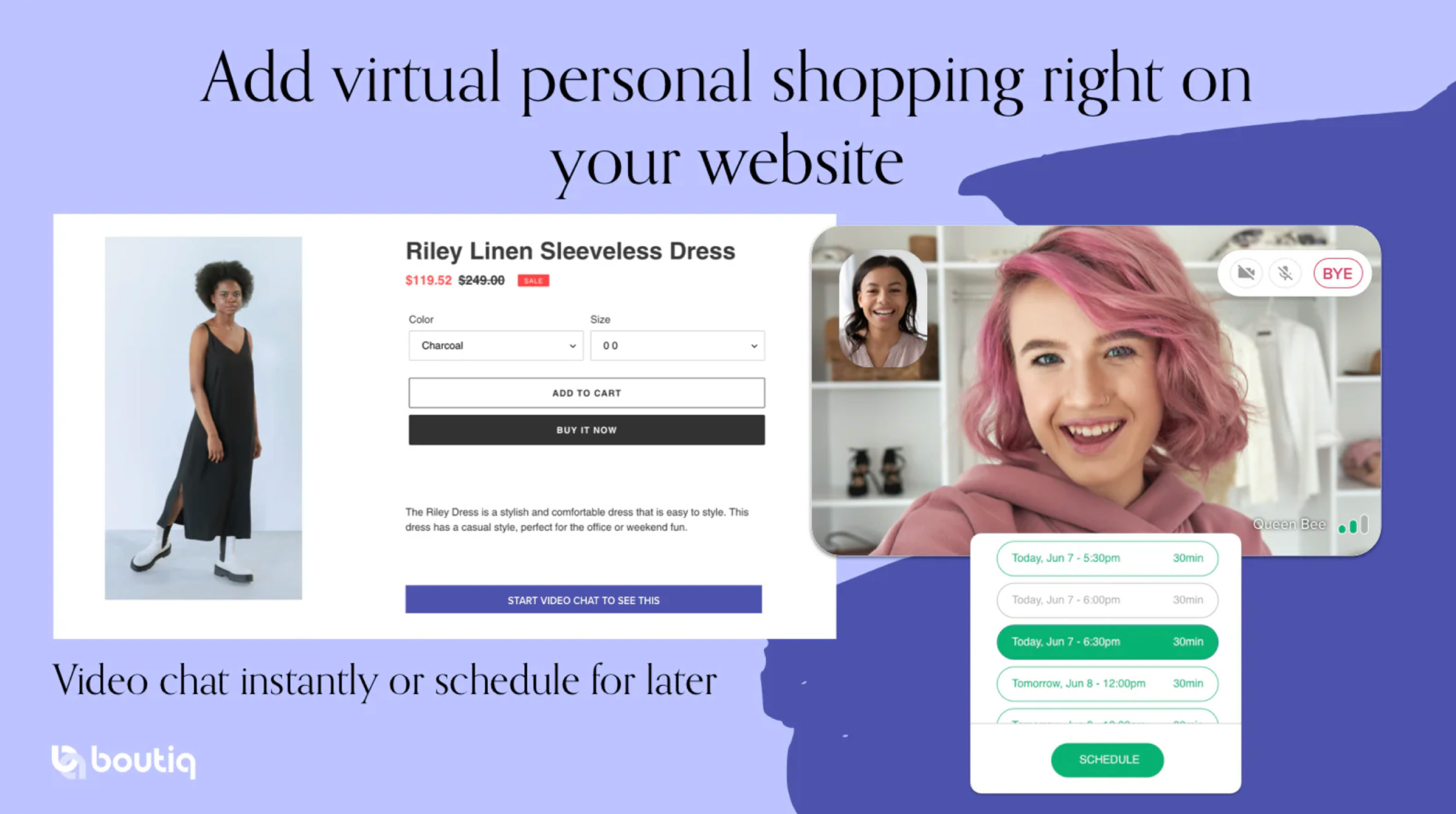

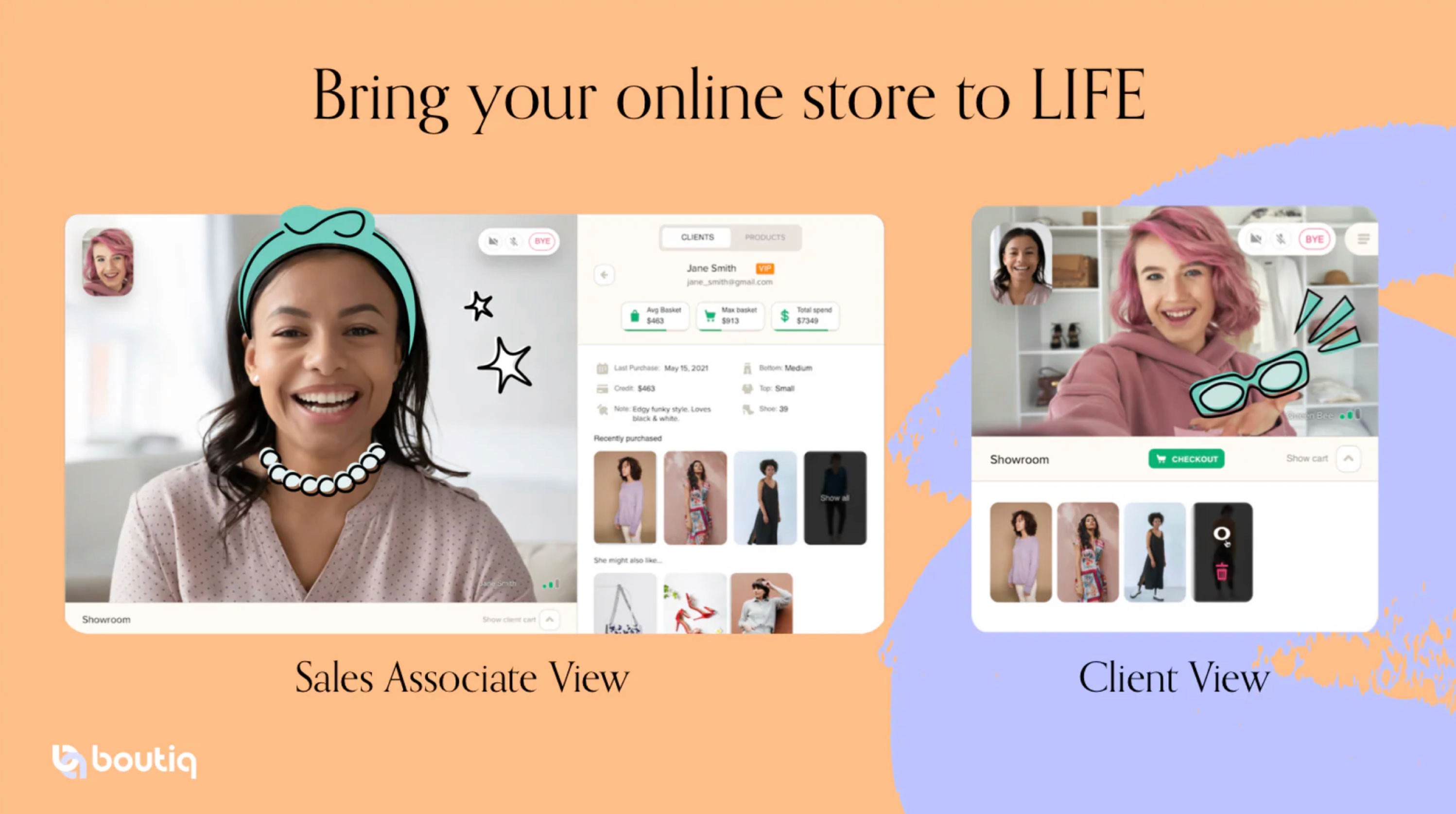

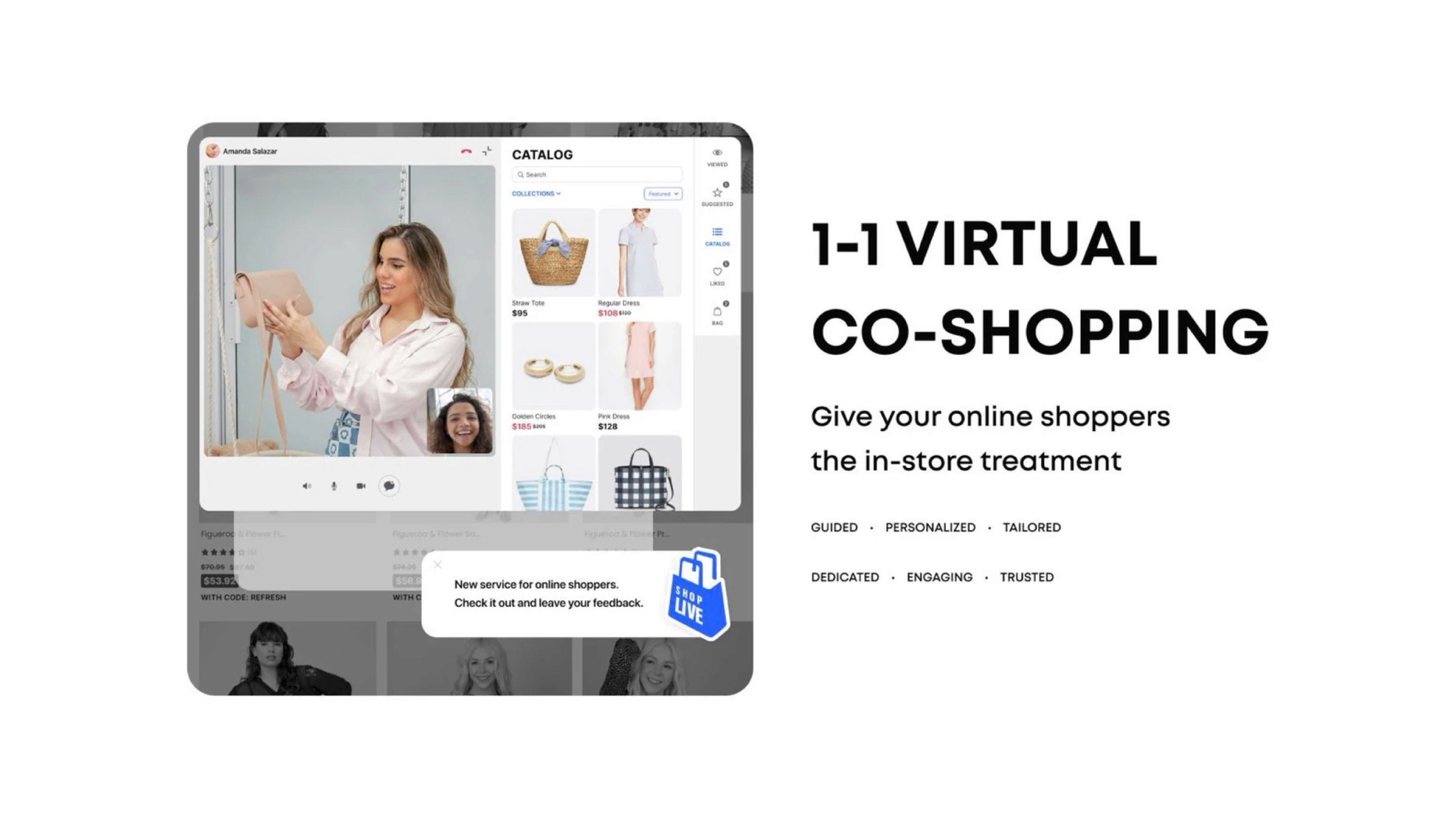

BOUTIQ PERSONAL VIDEO SHOPPING

Shopify App

1-to-1 personal video clienteling (instant or by appointment)

Yes - live video with real agents

Full Shopify sync (cart,

checkout, analytics)

Shoppable video, checkout sync, analytics, abandoned cart follow-up

From $90/month + usage fees

Sellers wanting personalized,

high-touch video shopping

Upselling fashion items via

live video sessionsAPPLICATION FEATURE

Category

Video Shopping Type

Human Element

Integration Level

Key Features

Pricing

Best For

Example Use Cases

BOUTIQ PERSONAL VIDEO SHOPPING

Shopify App

Autonomous or human-assisted

video commerceOptional (Al-driven or pre-recorded)

Shopify store embedded

videos and product display

Shoppable recorded/live

videos, product demos

Not listed, contact for pricing

Stores needing interactive shoppable

video without agents

DIY demonstrations or automated

product walkthroughs

APPLICATION FEATURE

Category

Video Shopping Type

Human Element

Integration Level

Key Features

Pricing

Best For

Example Use Cases

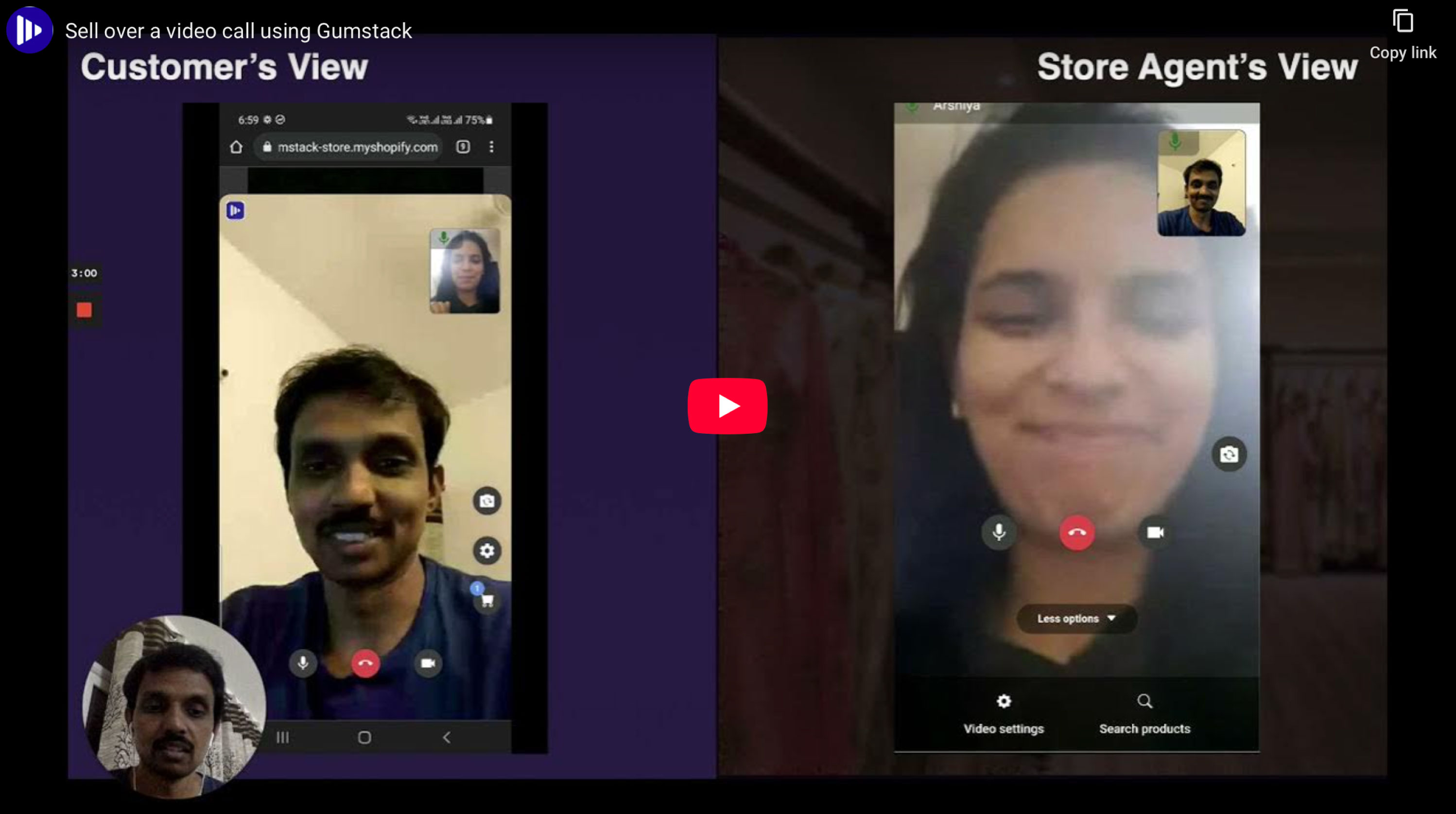

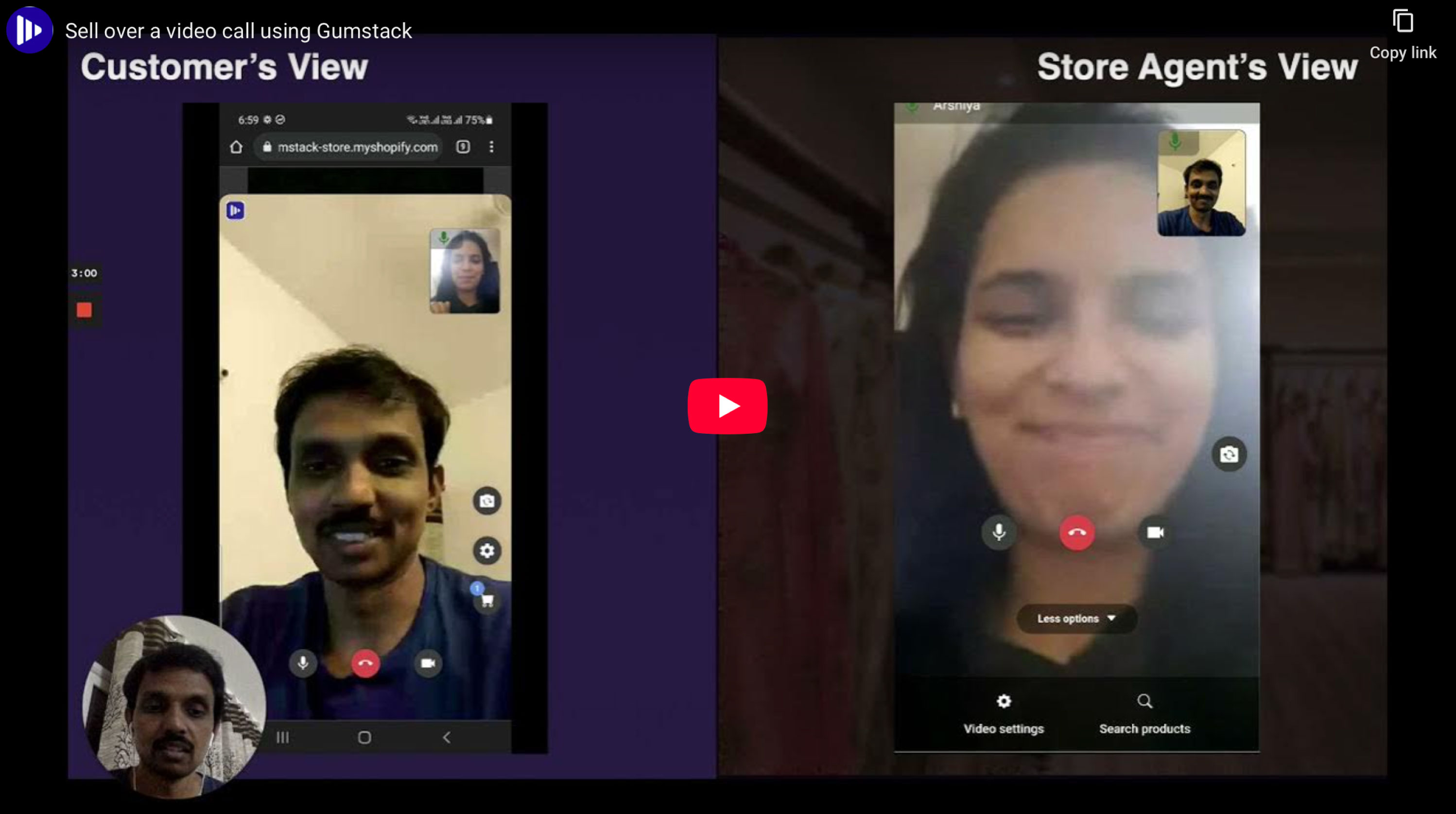

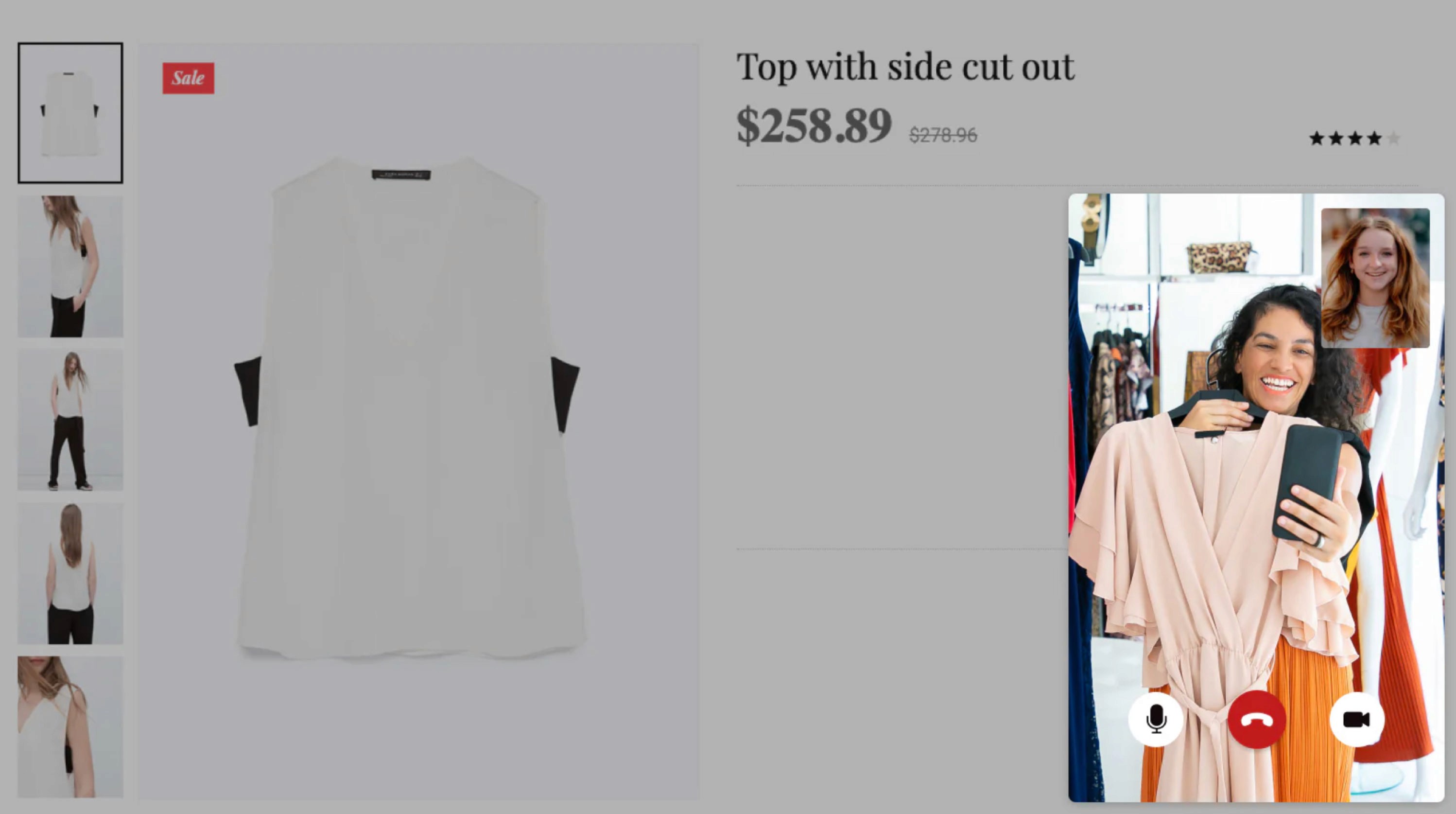

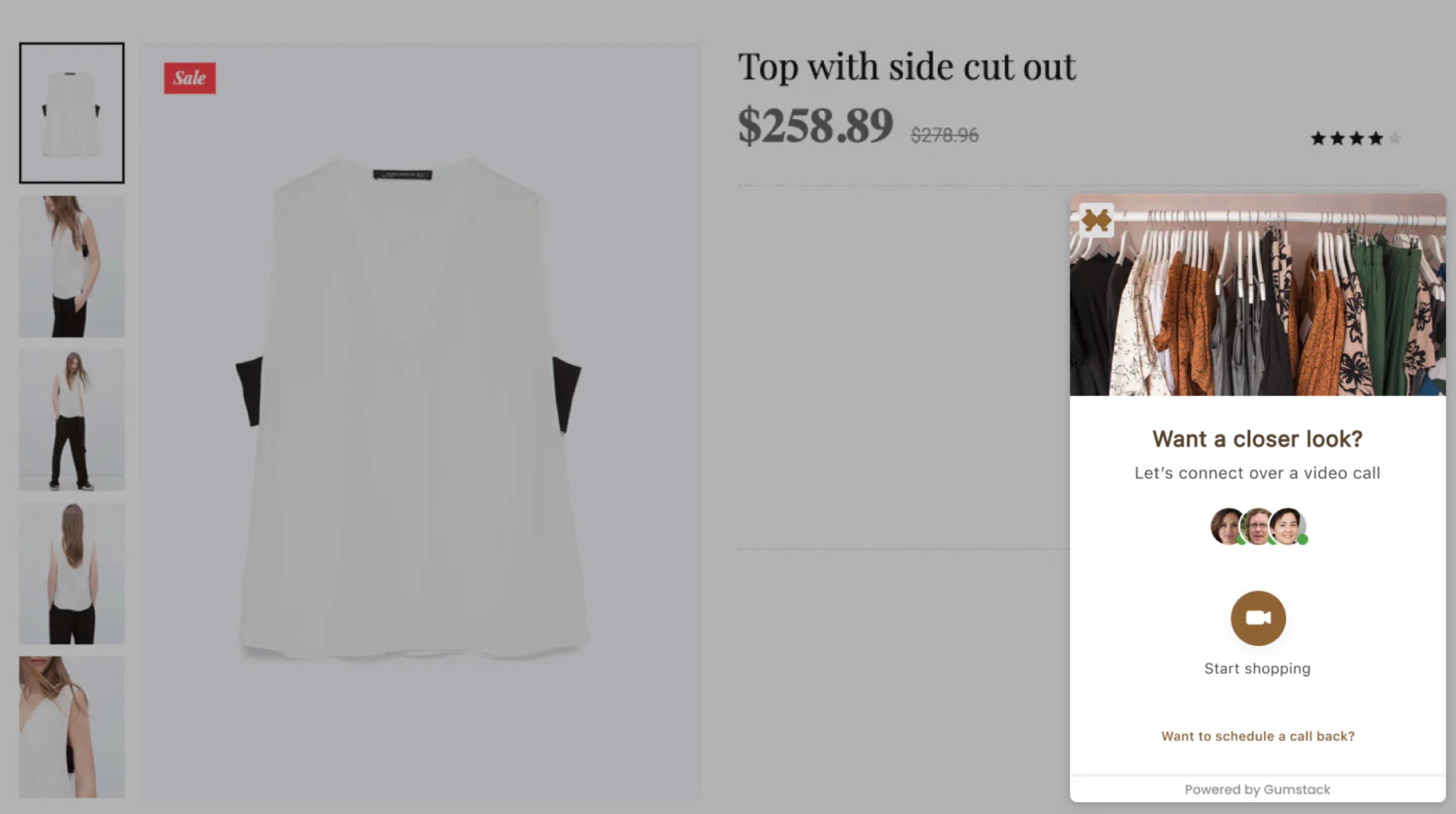

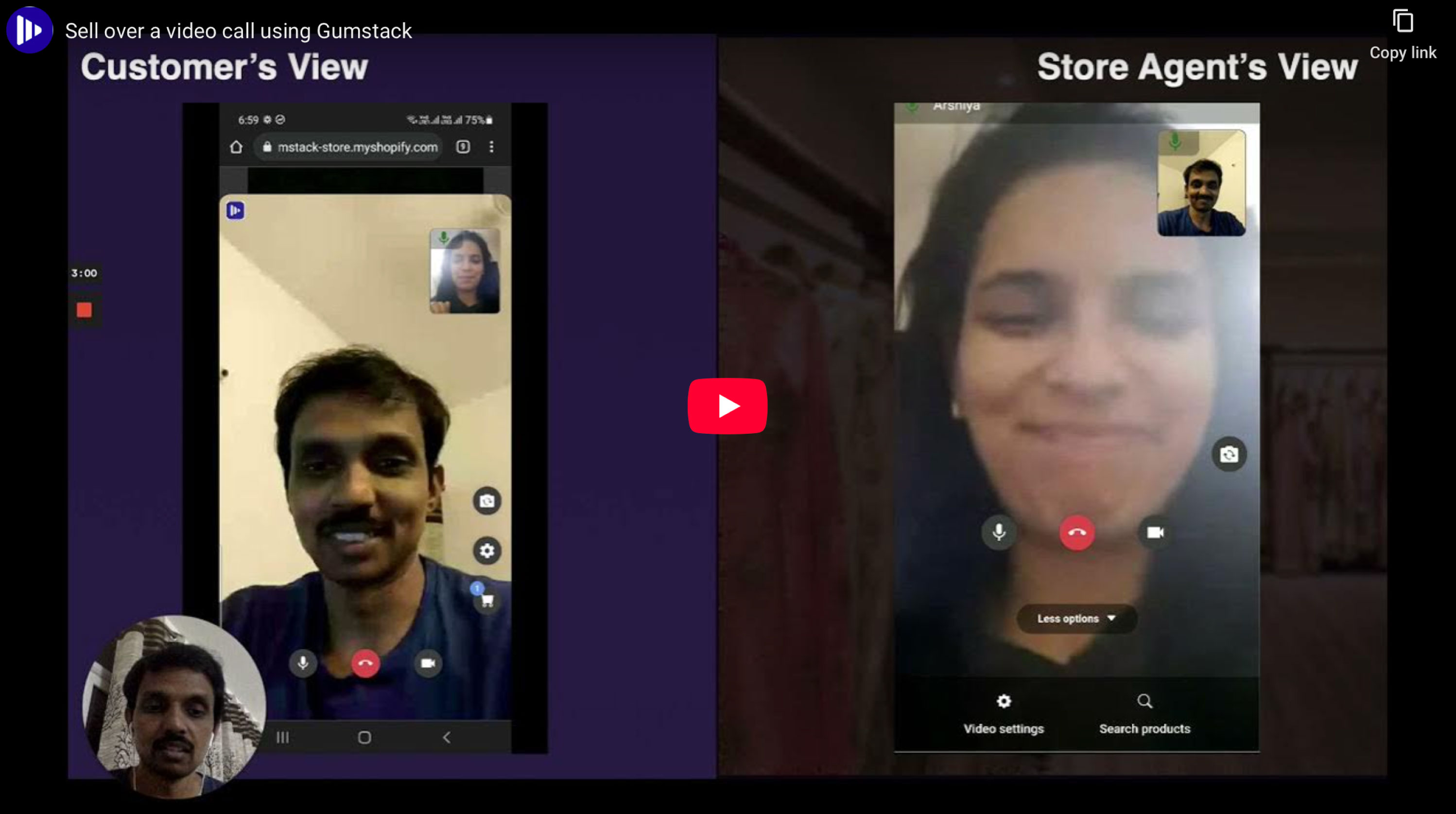

GUMSTACK

Service / Platform

1-to-1 live video shopping with brand

ambassadors

Yes - real brand ambassadors

providing shop support

Website integration with

shoppable video calls

Brand ambassador matching,

SAT/PS tracking, instant help

Custom packages

Brands offering expert-led

personal shopping experience

Appliance or complex product

consultations via video

APPLICATION FEATURE

Category

Video Shopping Type

Human Element

Integration Level

Key Features

Pricing

Best For

Example Use Cases

CONFERWITH

Service / Platform

Shoppable video, checkout sync,

analytics, abandoned cart follow-up

Yes - on-demand agent via video

Web/app integration for

live video calls

1-click video, mobile-first,

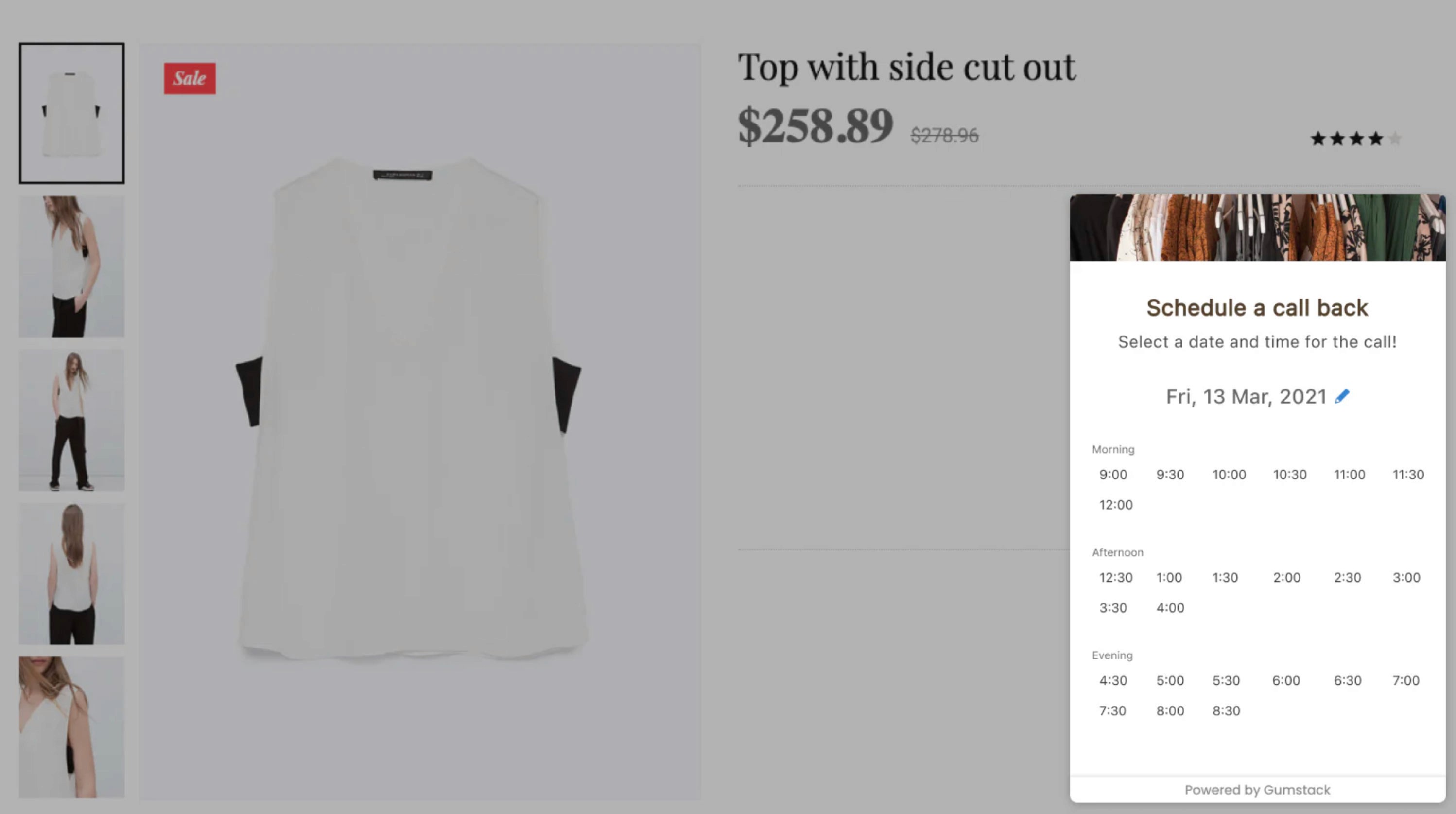

callback scheduling

Not listed, contact for pricing

Stores needing fast on-site video

customer support

Virtual store visits or real-time

visual assistance

COMPETITIVE LANDSCAPE / ANALYSIS —

Analyzing the competitive landscape I identified strengths & weakness of the other products currently or the market offering similar services. The primary feature of all products was the video chat feature, but each was paired with different complimentary features.

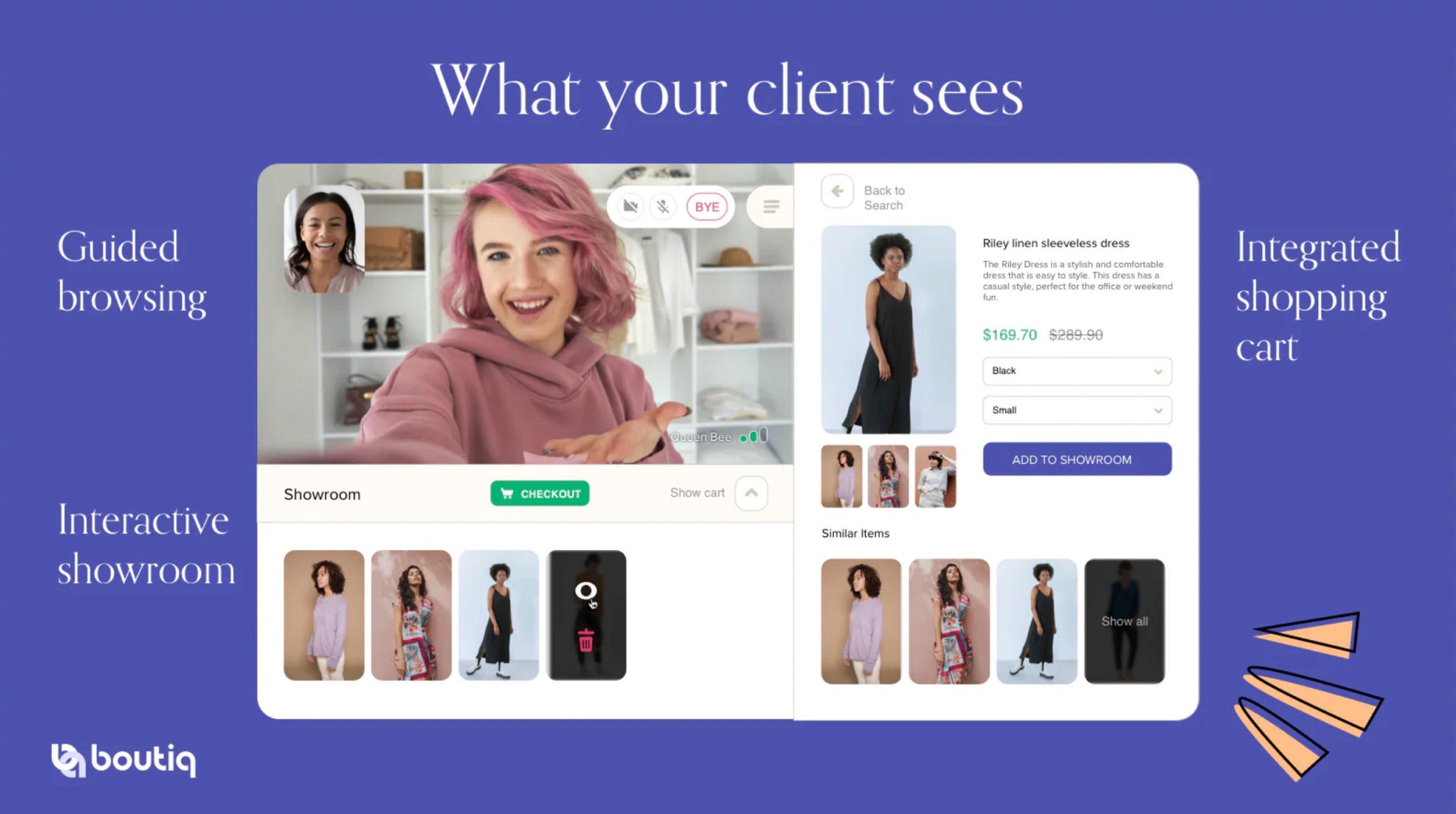

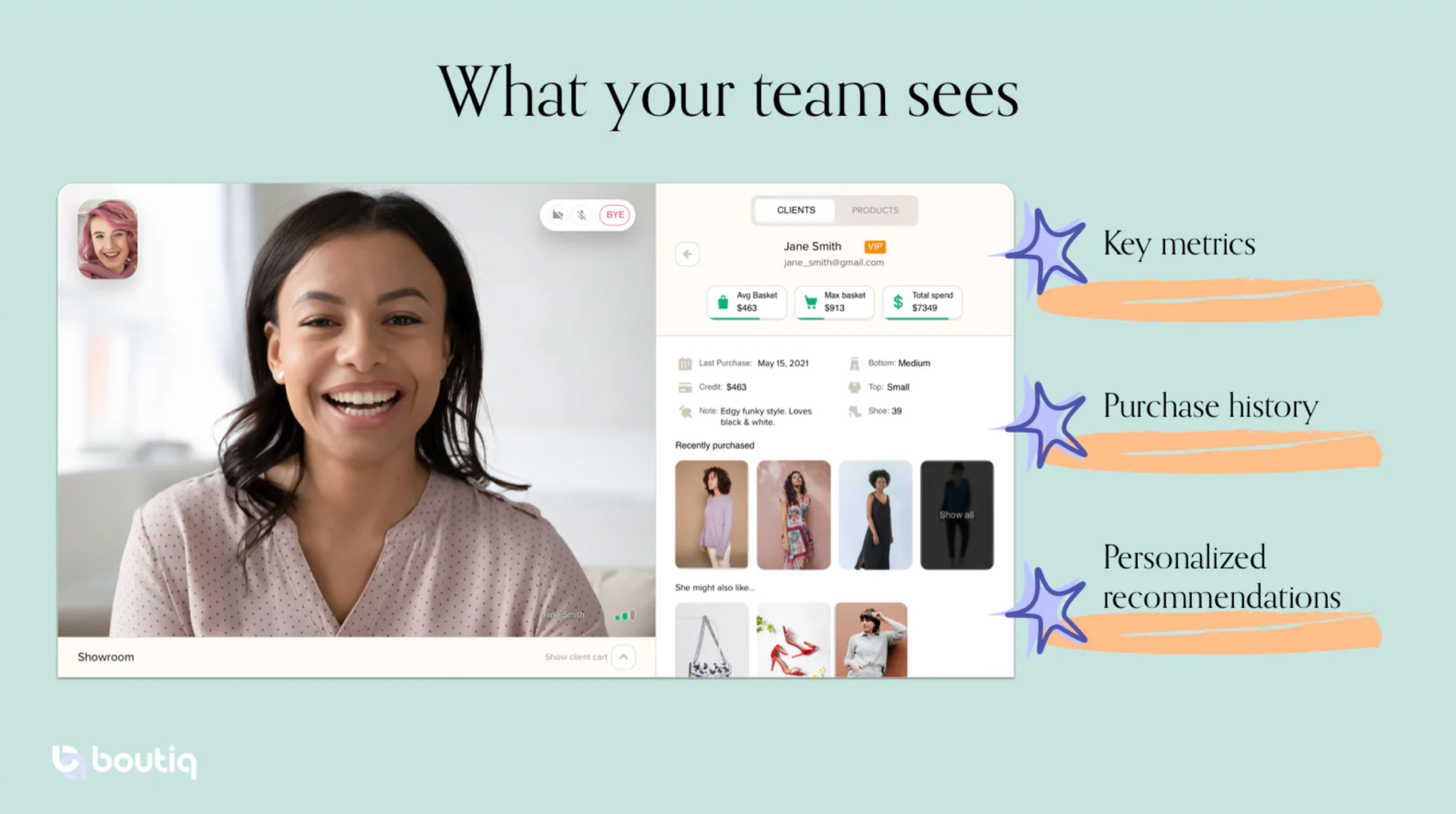

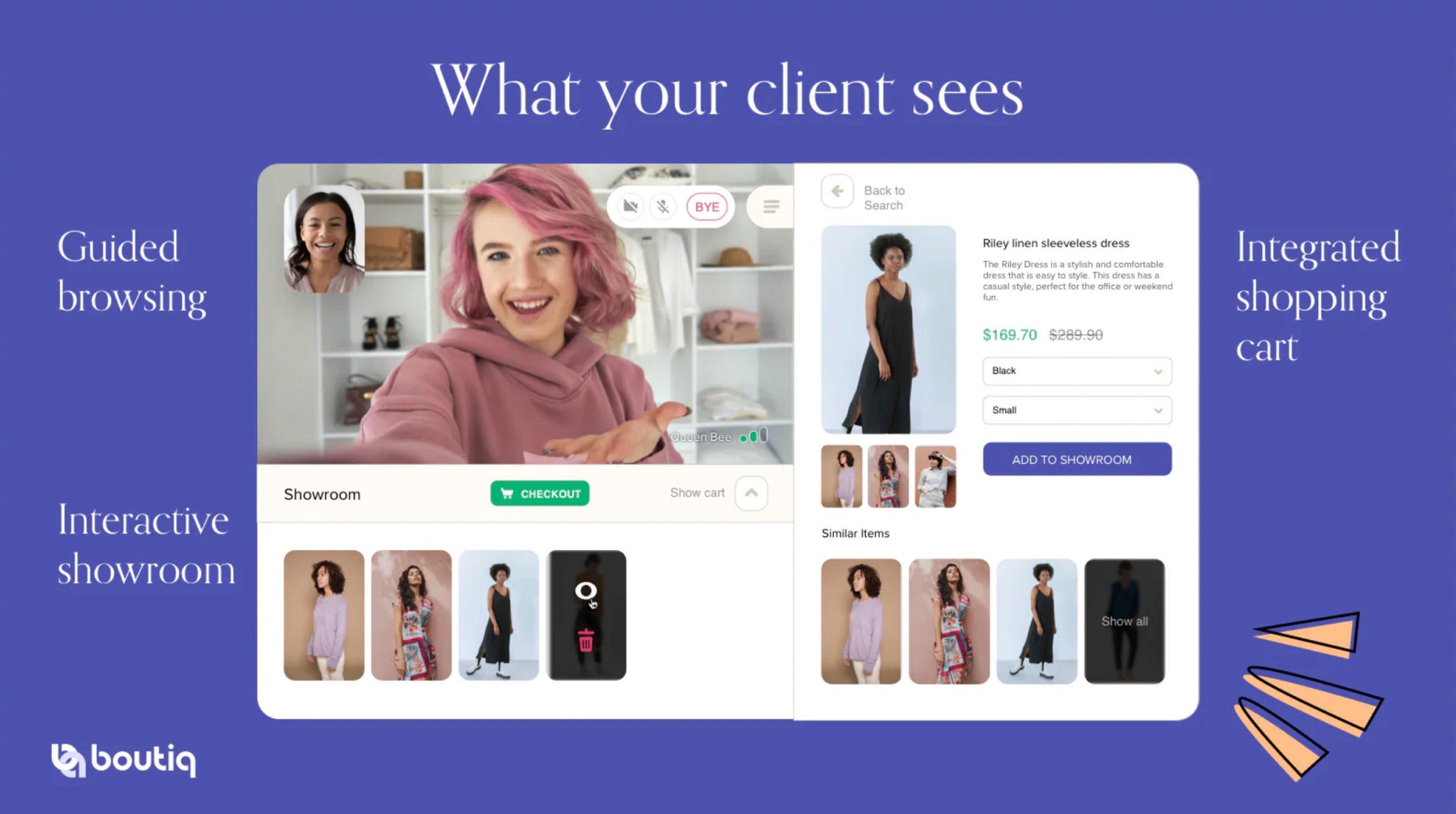

DECISION FATIGUE FROM TOO MANY CHOICES: Displays client video, purchase history, sizing, spending trends, style notes, and curated recommendation showroom.

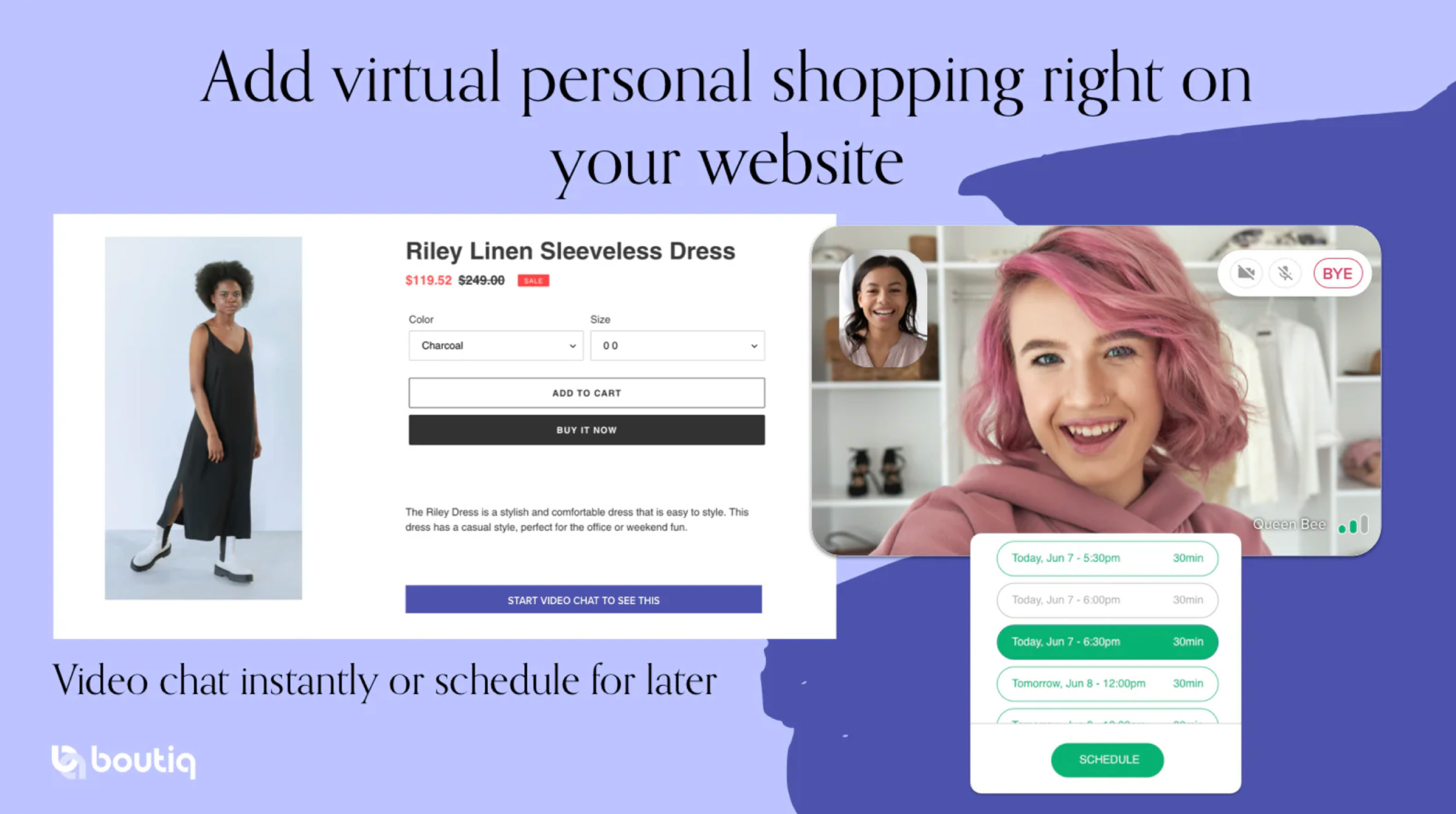

CLIENT EXPERIENCE: Half-screen video with cart access, checkout, and showroom recommendations.

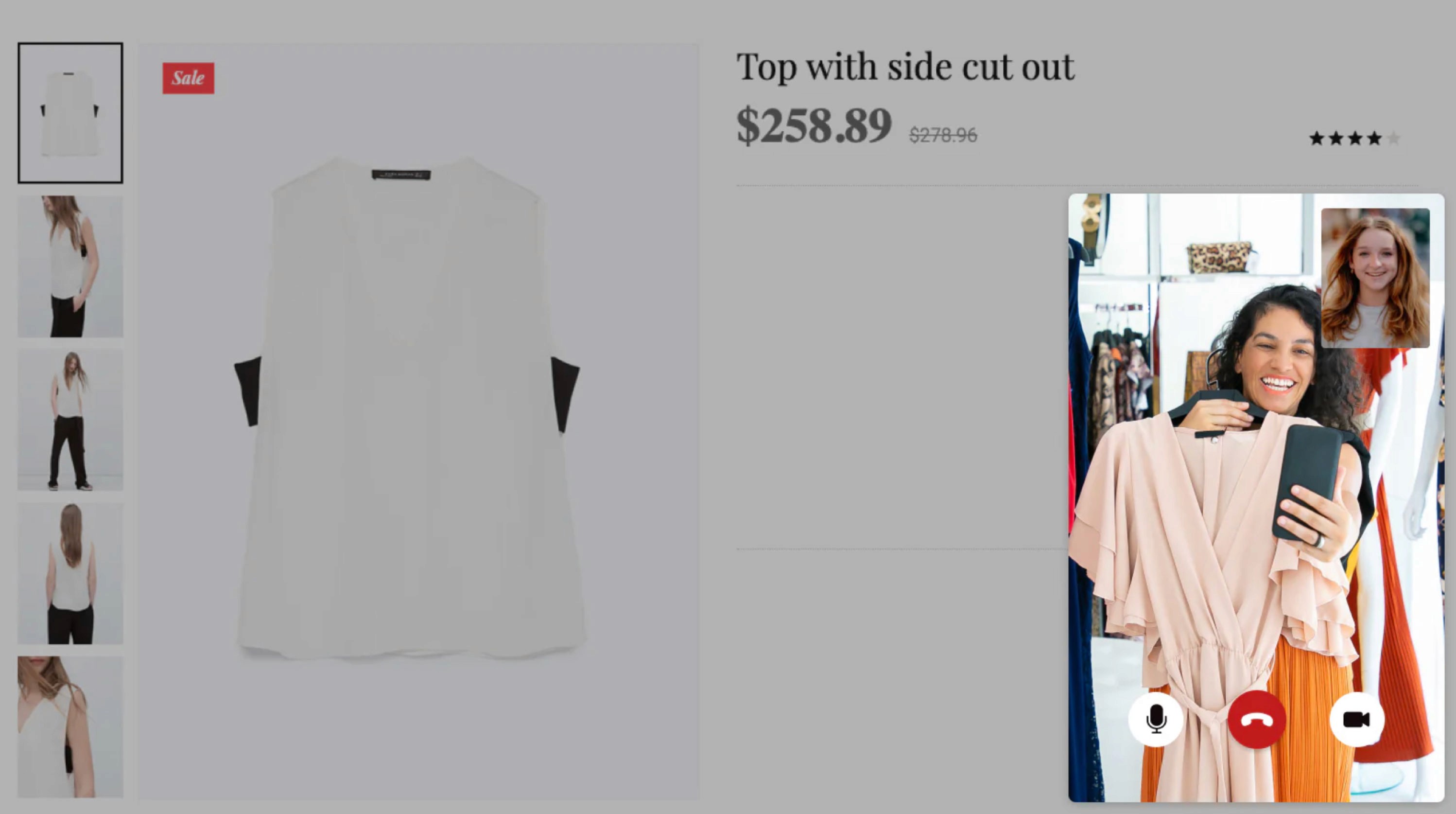

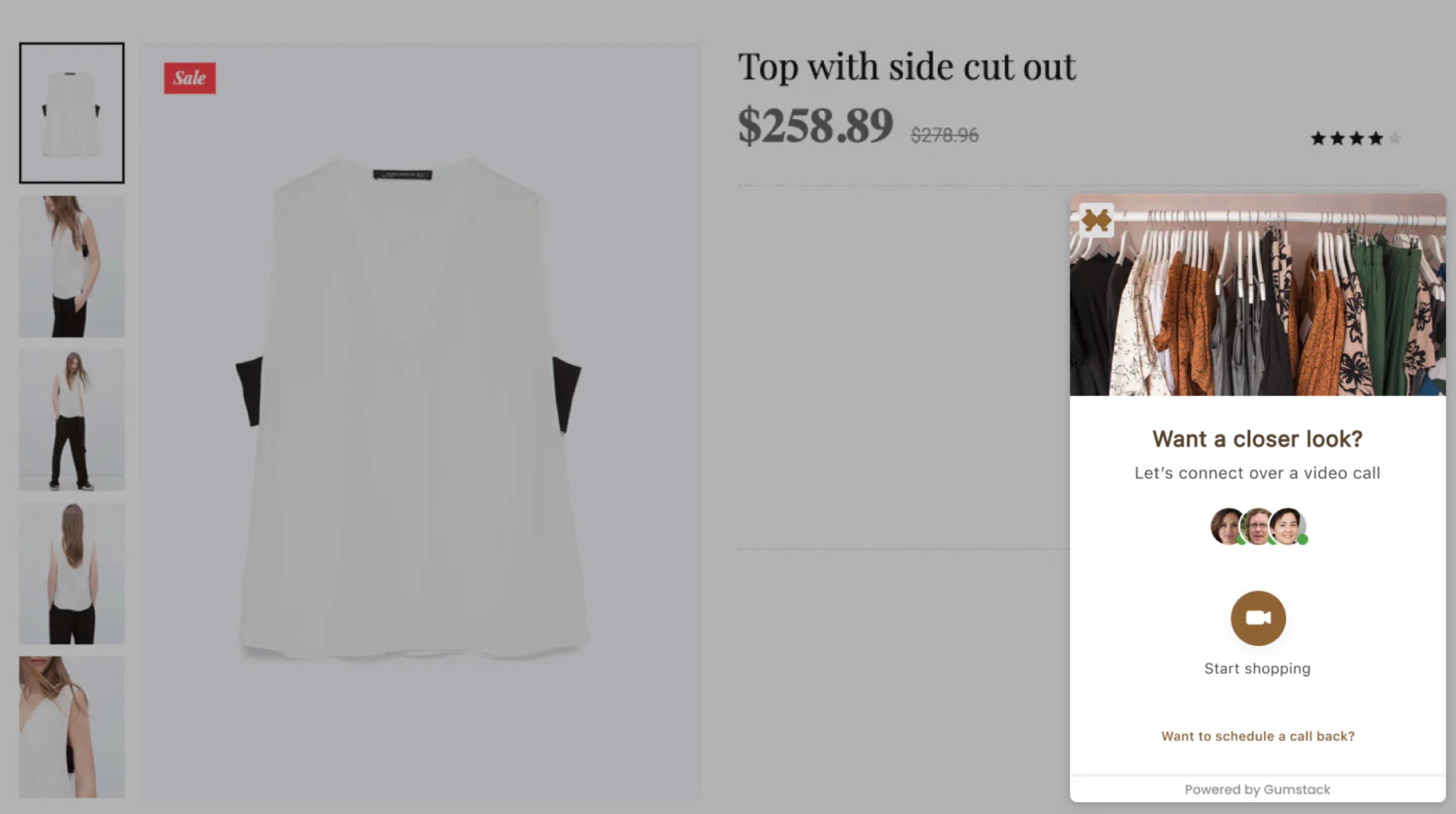

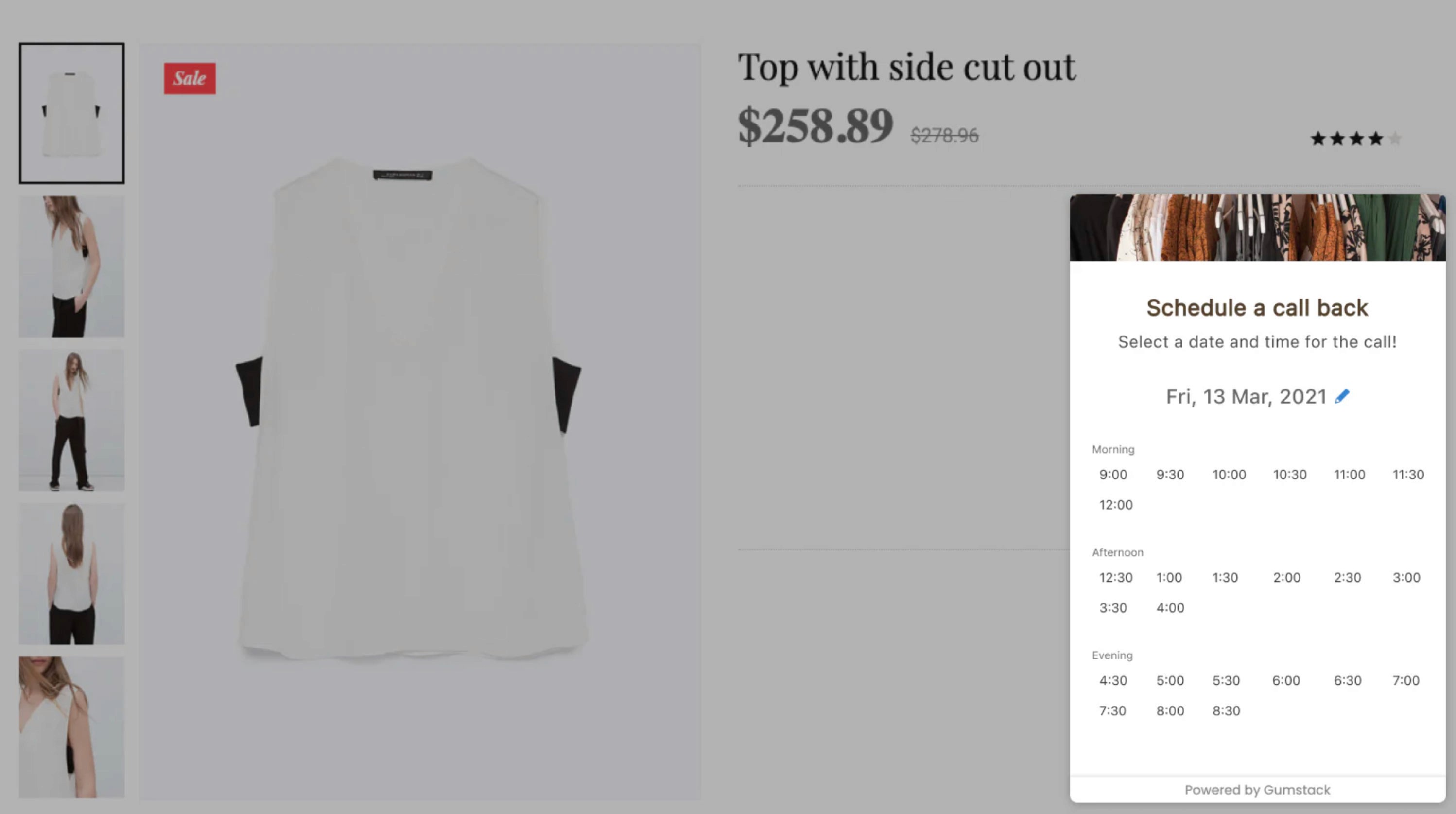

INSTANT OR SCHEDULED CALLS: Product pages include a "Start Video Chat To See This" CTA for immediate or scheduled consultations.

ANALYTICS & SALES INTELLIGENCE: Tracks calls, conversions, sales per call, AOV, and engagement metrics.

THIRD-PARTY INTEGRATIONS: Supports Klaviyo, Calendly, and Acuity for seamless workflow.

AI LIVE CHAT & VIDEO SHOPPING: Provides real-time product assistance and personalized recommendations.

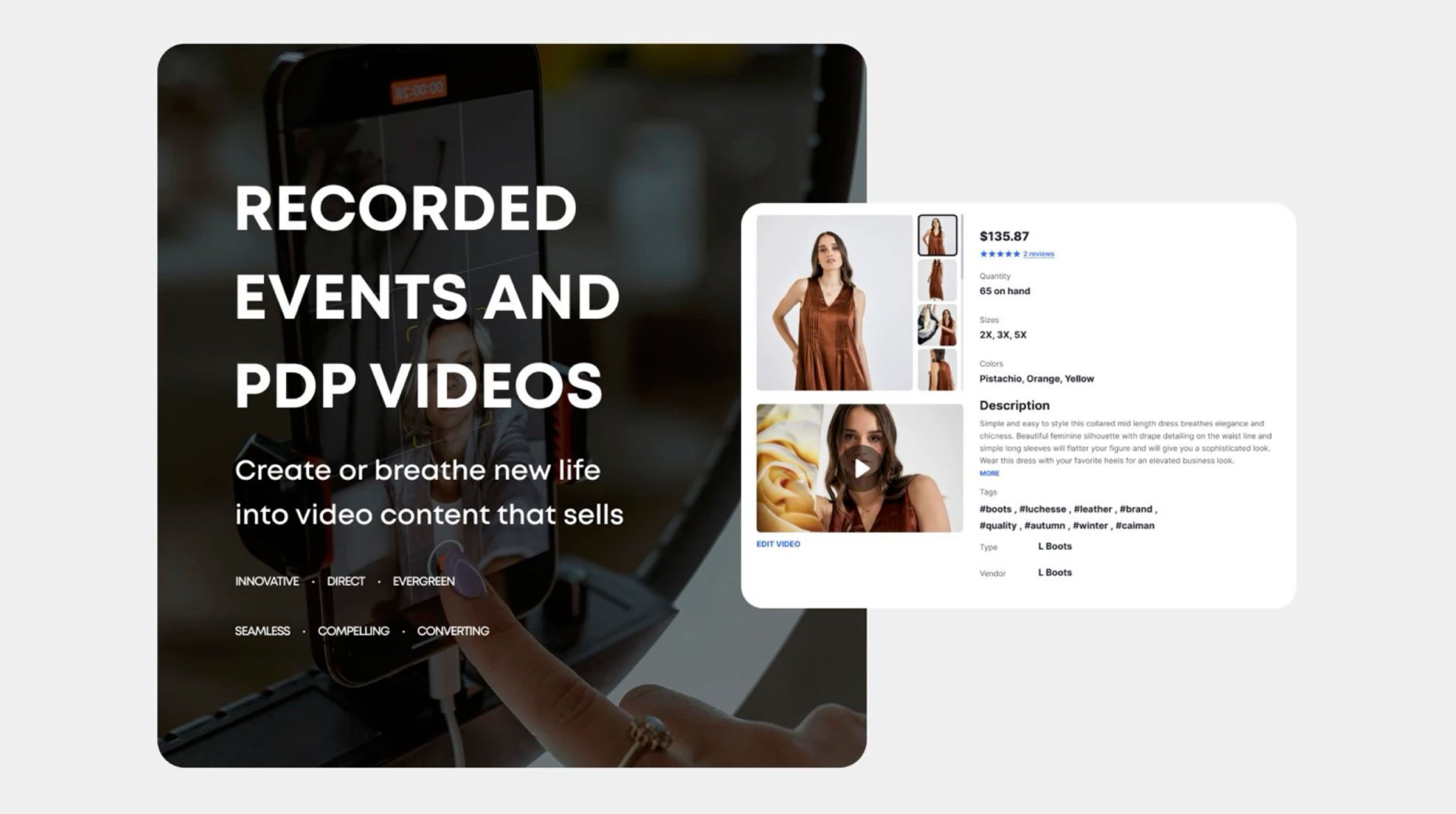

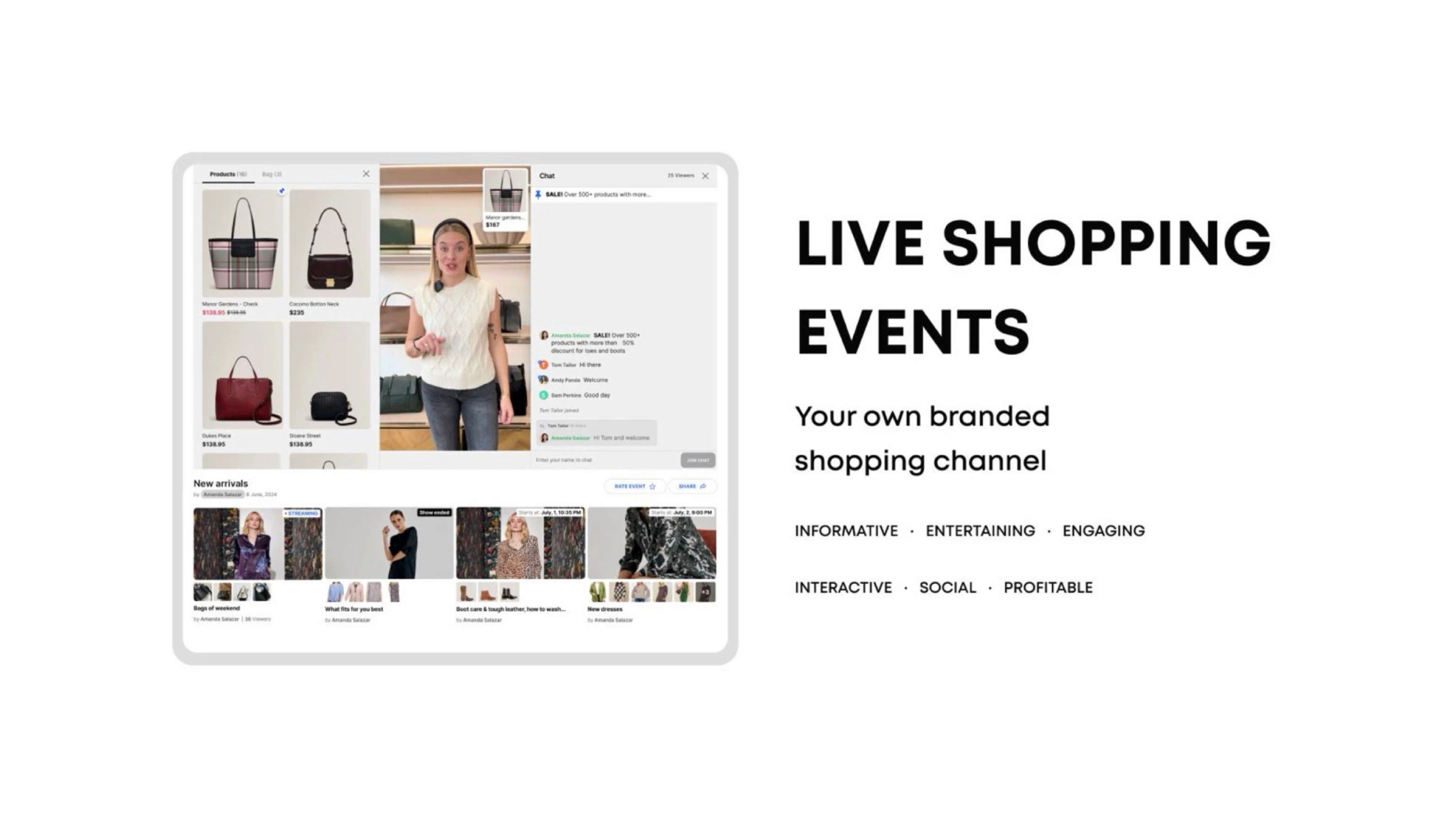

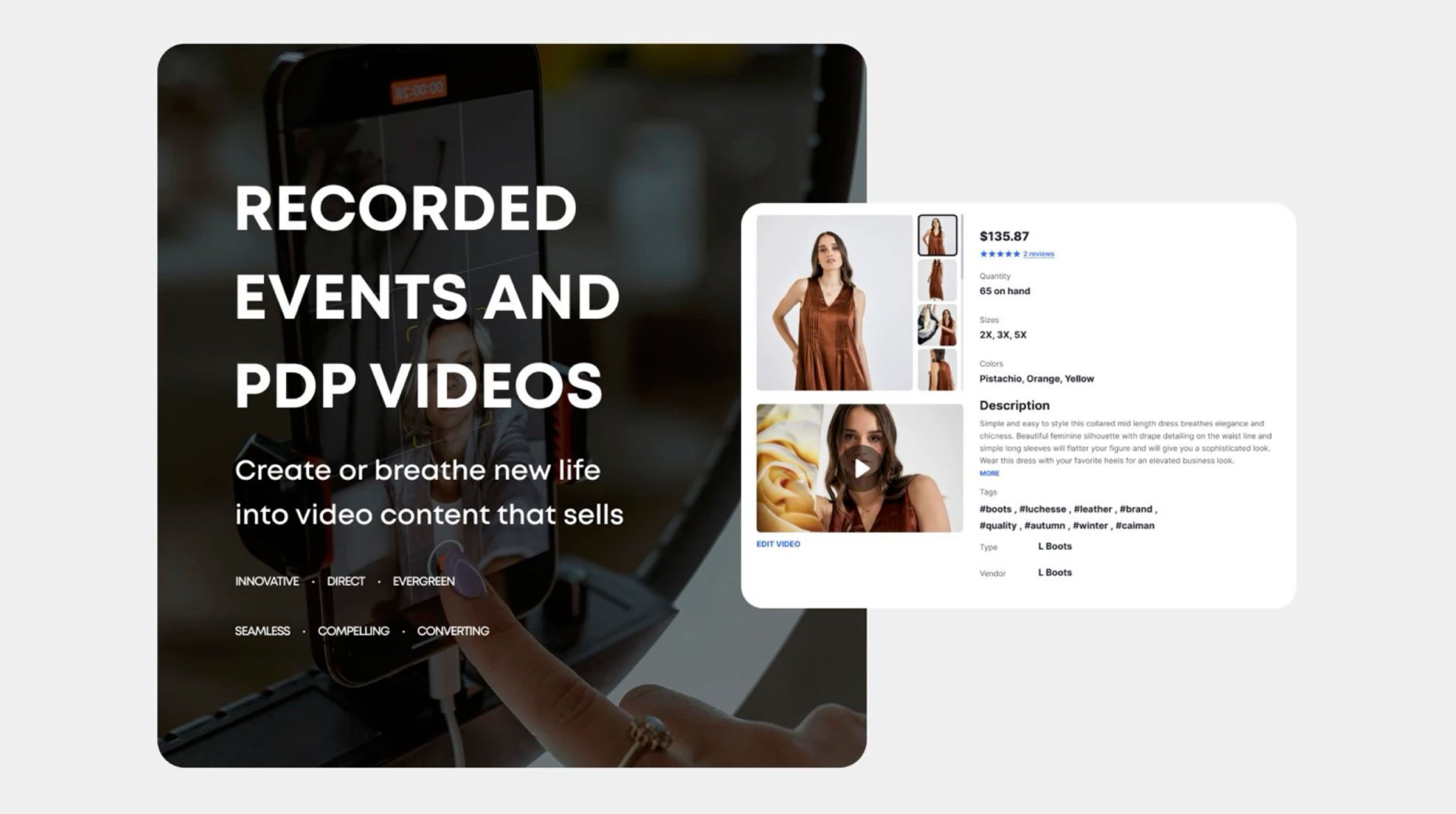

RECORDED & LIVE SHOPPING EVENTS: Group video sales, interactive product showcases, and PDP video integration.

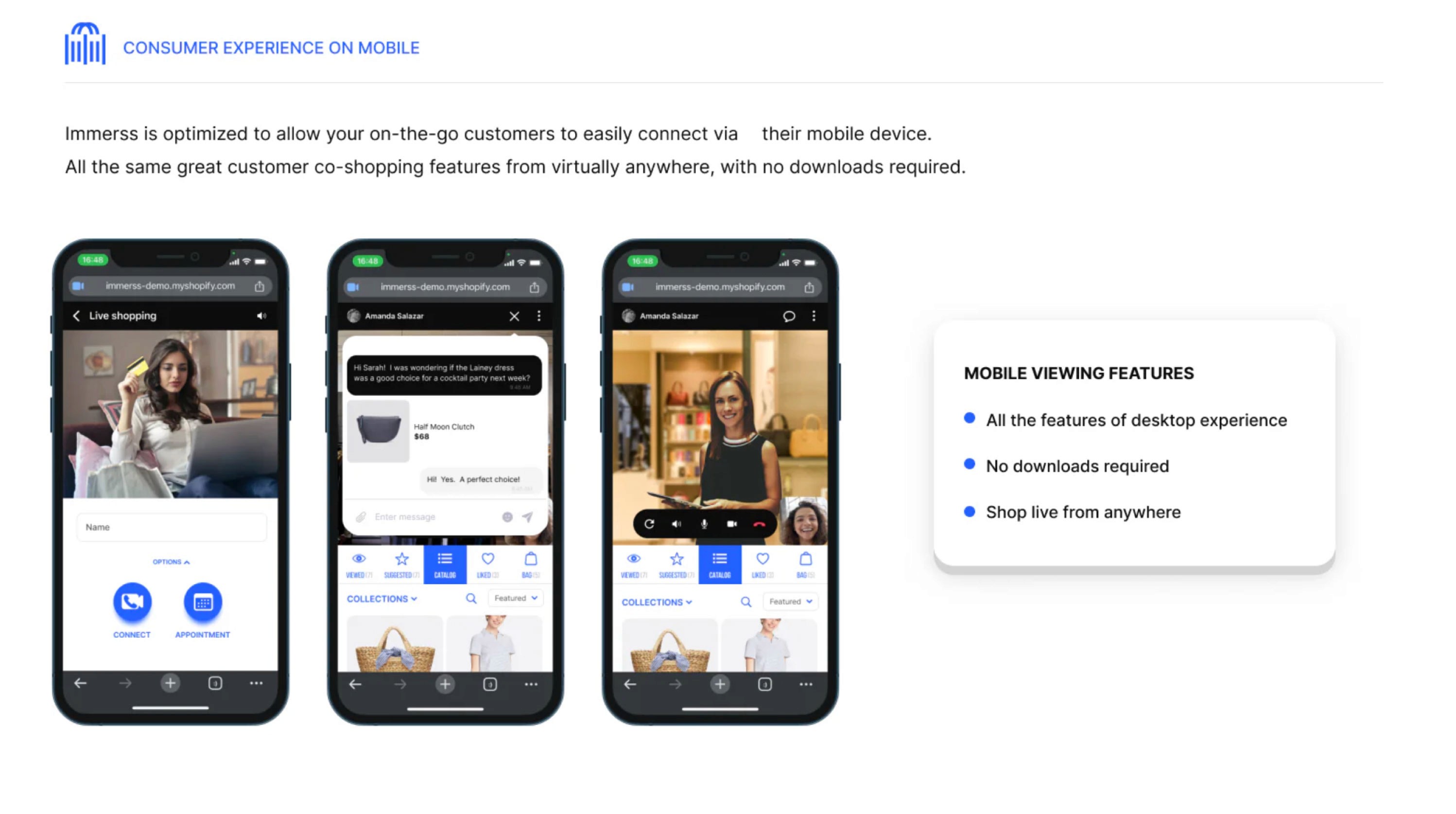

CLIENT EXPERIENCE: 60% VS screen area, product catalog browsing, and interactive tab navigation (Items Viewed, Suggested, Wishlist, Bag).

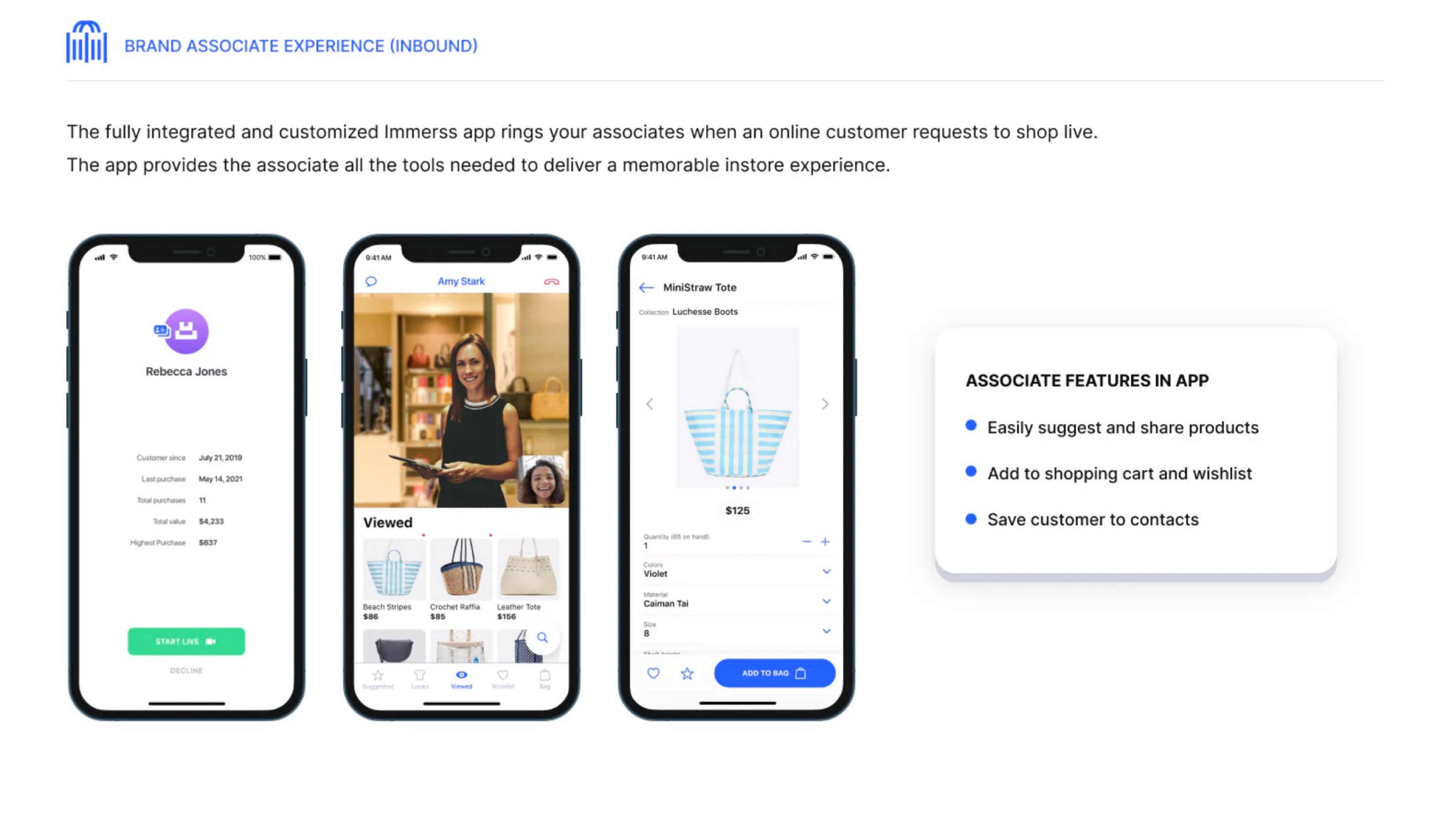

SALES ASSOCIATE DASHBOARD: Displays customer history, purchases, and engagement data with quick actions for live interactions.

PRODUCT DETAIL & EVENT PAGES: Carousel images, stock availability, material details, event thumbnails w/ reminders & sharing options.

SEAMLESS INTEGRATIONS: Connects with checkout systems, customer service tools (Gorgias, Zendesk, Olark, Intercom, Tidio, LiveChat).

CLIENT EXPERIENCE: A basic video call interface with a pop-up product preview (name, price, and image) and Add to Cart CTA. No browsing, account linking, or product details.

NO PRODUCT INTEGRATION: Products are showcased exclusively through live video, requiring direct communication for details.

STORE AGENT DASHBOARD: Minimal functionality with "Search Products" and "Video Options" buttons. After a call, only agent contact, order details, and call summary are available.

LIMITED POST-CALL INTERACTION: Clients can rate the sales agent, provide feedback, cannot revisit products / shopping history.

CLIENT EXPERIENCE: 60% VS screen area, shared shopping cart (top-right), and a VSA tab bar for video, chat, and screen expansion. Lower 40% screen area shared content when VSA minimized.

SALES ASSOCIATE DASHBOARD: Identical top-screen layout with host controls (Sharing Now, Demonstrate, Alternatives) and a detailed product display (image, price, size, color, description, and Add to Cart).

SEAMLESS PRODUCT INTEGRATION: Both parties can add products to the cart, ensuring a more engaging, guided shopping experience.

SECONDARY RESEARCH —

NAME: American Dream

LOCATION: East Rutherford, New Jersey, USA

OWNER: Triple Five Group

WEBSITE: americandream.com

American Dream s premier retail and entertainment

complex located within the Meadowlands Sports Complex in East Rutherford, New Jersey. Spanning approximately 3 million square feet, it stands as one of the largest malls in the United States.

MISSION & VISION: American Dream aims to redefine

the shopping and entertainment experience by combining diverse retail options with world-class attractions, creating a destination that appeals to both local residents and tourists.

PRODUCTS & SERVICE: The complex offers a blend of

retail and entertainment.

RETAIL: Over 350 retail establishments, featuring

high-end luxury stores and diverse shopping options.

DINING: More than 100 dining venues, ranging from

casual eateries to fine dining.

ENTERTAINMENT: Features a variety of attractions.

• Nickelodeon Universe: An indoor theme park with various

rides and attractions.• DreamWorks Water Park: An expansive indoor water park

featuring attractions themed around popular Dream Works

franchises.• Big Snow American Dream: Indoor ski & snowboard park.

• The Rink: An NHL-sized ice-skating rink.

• Legoland Discovery Center: An interactive experience

for families and children.

• Sea Life Aquarium: A marine life attraction.

MARKET & INDUSTRY ANALYSIS: Strategically located

near New York City, American Dream attracts both local

visitors and tourists. Its unique ombination of retail and

entertainment positions it competitively within the retail

and amusement industries.

BUSINESS MODEL & REVENUE STREAMS:

American Dream generates revenue through:

• Retail Leasing: Income from leasing space to various retail

tenants.NAME: American Dream

LOCATION: East Rutherford, New Jersey, USA

OWNER: Triple Five Group

WEBSITE: americandream.com

American Dream s premier retail and entertainment

complex located within the Meadowlands Sports Complex in East Rutherford, New Jersey. Spanning approximately 3 million square feet, it stands as one of the largest malls in the United States.

MISSION & VISION: American Dream aims to redefine

the shopping and entertainment experience by combining diverse retail options with world-class attractions, creating a destination that appeals to both local residents and tourists.

PRODUCTS & SERVICE: The complex offers a blend of

retail and entertainment.

RETAIL: Over 350 retail establishments, featuring

high-end luxury stores and diverse shopping options.

DINING: More than 100 dining venues, ranging from

casual eateries to fine dining.

ENTERTAINMENT: Features a variety of attractions.

• Nickelodeon Universe: An indoor theme park with various

rides and attractions.• DreamWorks Water Park: An expansive indoor water park

featuring attractions themed around popular Dream Works

franchises.• Big Snow American Dream: Indoor ski & snowboard park.

• The Rink: An NHL-sized ice-skating rink.

• Legoland Discovery Center: An interactive experience

for families and children.

• Sea Life Aquarium: A marine life attraction.

MARKET & INDUSTRY ANALYSIS: Strategically located

near New York City, American Dream attracts both local

visitors and tourists. Its unique ombination of retail and

entertainment positions it competitively within the retail

and amusement industries.

BUSINESS MODEL & REVENUE STREAMS:

American Dream generates revenue through:

• Retail Leasing: Income from leasing space to various retail

tenants.• Ticket Sales: Revenue from admissions to entertainment

attractions.• Dining: Proceeds from a wide array of dining options.

• Special Events: Hosting events and performances in

dedicated spaces.

FINANCIAL OVERVIEW: In 2022. American Dream reported losses of $254.4 million. In November 2022, JPMorgan Chase extended a four-year extension on over $1.7 billion in con-

struction borrowings. American Dream Mall has faced signif-

icant financial challenges since its opening in October 2019.FINANCIAL LOSSES:

• 2021: The mall reported losses of nearly $60 million.

• 2022: Losses escalated to approximately $245 million, a

substantial increase from the previous year.DEBT AND LOANS:

• Construction Financing: Triple Five Group, the mall's

developer, secured about $1.1 billion in municipal bonds to

finance the $5 billion project.•Loan Extension: In November 2022, JPMorgan Chase

granted a four-year extension on repaying over $1.7

BOND PAYMENT ISSUES:

• August 2024: The mall made overdue interest payments on

$287 million of municipal bonds after more than two years

of delays.• February 2025: Bondholders did not receive expected

interest payments, indicating ongoing difficulties.

MARKETING & GROWTH STRATEGY: American Dream

focuses on offering a unique blend of shopping and entertain-

ment to differentiate itself from traditional malls. Marketing efforts target families, tourists, and shoppers seeking diverse experiences.CHALLENGES & RISKS: The complex has faced financial

challenges, including significant losses and reliance on

substantial financing. Additionally, the COVID-19 pandemic impacted operations and visitor numbers.

RECENT DEVELOPMENTS & ACHIEVEMENTS:

Complex opened in phases, initial debuting in October 2019

Secured a four-year extension on significant construction

loans in November 2022.

NAME: TheAddress

FOUNDED: February 2022

LOCATION: East Rutherford, New Jersey, USA

WEBSITE: theaddressad.com

A specialty department store curated for modest fashion

women of religious faith.

MISSION & VISION: TheAddress aims to provide an elevated shopping experience for the modest fashion community by offering a curated selection of sought-after brands and styles, catering to women, teens, and children.

PRODUCTS & SERVICES: The store offers a diverse range

of products, including:

• Women's Apparel: Dresses, tops, skirts, activewear,

swimwear, and outerwear.• Teens' and Kids' Clothing: Age-appropriate modest fashion

options.• Accessories: Makeup, hair accessories, jewelry & more.

• Home Goods: Various home-related products.

Featured brands include Adee, Adina Las Vegas, Adonis,

Aish Tamid Hat Boxes, A.I Stone, Apparalel, Artscroll, B7ac-

tive, Bliss, BNJR Teen Collection, Byrd, By Tess, and more.

MARKET & INDUSTRY ANALYSIS: As the first depart-

ment store in the U.S. specifically designed for the modest fashion consumer, TheAddress fills a unique niche in the retail in market. The modest fashion industry has seen significant growth, with increasing demand for stylish yet conservative clothing options. By offering a wide range of products and brands under one roof, heAddress appeals to a diverse clientele seeking quality and variety in modest fashion.BUSINESS MODEL & REVENUE STREAMS: Operating

both an online platform and a physical store located within

the American Dream mall, heAddress generates revenue

through:

• Retail Sales: In-store and online purchases of clothing, of

accessories, and home goods.

• Brand Partnerships: Collaborations with various brands

to offer exclusive collections.MARKETING & GROWTH STRATEGY:

TheAddress focuses on community engagement and brand awareness through:

• Social Media Presence: Active engagement on platforms

like Instagram.

• In-Store Events: Hosting events to attract /retain

customers.• Expansion Plans: Phased rollouts of new departments,

including bridalwear and giftware, to continually enhance

the shopping experience.CHALLENGES & RISKS: As a relatively new entrant in the

retail market, TheAddress faces challenges such as:

• Market Competition: Competing with established

retailers and online platforms.• Economic Factors: Navigating economic downturns

that may affect consumer spending.RECENT DEVELOPMENTS & ACHIEVEMENTS:

• Store Launch: Opened in phases, starting with women's

clothing, followed by teens' and kids' departments, and

plans for bridalwear and giftware.

Location: Situated within the American Dream mall, offering extended store hours to accommodate diverse schedules.

1) Upsy Shopping. "Virtual Shopping Assistants vs. Chatbots - What's the Difference?" Upsy Shopping, upsyshopping.com/virtual-shopping-assistants-vs-chatbots/. Accessed 26 Feb. 2025.

2) Scoop Market Research. "Virtual Assistant Statistics." Scoop Market Research, scoop. market.us/virtual-assistant-statistics/. Accessed 26 Feb. 2025.

3) Barron'. "Black Friday Shopping & Cyber Monday Trends." Barron's, 2024, www.barrons.com/articles/black-friday-shopping-cyber-monday-d31144da. Accessed 26 Feb. 2025.

4) Credence Research. "Virtual Shopping Assistant Market Report." Credence Research, 2024, www.credenceresearch.com/report/virtual-shopping-assistant-market. Accessed 26 Feb. 2025.

5) CrossML. "AI Virtual Assistants in Retail." CrossML, 2023, www.crossml.com/ai-virtual-assistants-in-retail/. Accessed 26 Feb. 2025.

6) Reuters. "Al-Influenced Shopping Boosts Online Holiday Sales, Salesforce Data Shows." Reuters, 6 Jan. 2025, www.reuters.com/business/retail-consumer/ai-influenced-shop-

ping-boosts-online-holiday-sales-salesforce-data-shows-2025-01-06/. Accessed 26 Feb. 2025.

PRELIMINARY RESEARCH —

COMPETITIVE LANDSCAPE / COMPARISON —

APPLICATION FEATURE

Category

Video Shopping Type

Human Element

Integration Level

Key Features

Pricing

Best For

Example Use Cases

BOUTIQ PERSONAL VIDEO SHOPPING

Shopify App

1-to-1 personal video clienteling (instant or by appointment)

Yes - live video with real agents

Full Shopify sync (cart,

checkout, analytics)

Shoppable video, checkout sync, analytics, abandoned cart follow-up

From $90/month + usage fees

Sellers wanting personalized,

high-touch video shopping

Upselling fashion items via

live video sessionsAPPLICATION FEATURE

Category

Video Shopping Type

Human Element

Integration Level

Key Features

Pricing

Best For

Example Use Cases

BOUTIQ PERSONAL VIDEO SHOPPING

Shopify App

Autonomous or human-assisted

video commerceOptional (Al-driven or pre-recorded)

Shopify store embedded

videos and product display

Shoppable recorded/live

videos, product demos

Not listed, contact for pricing

Stores needing interactive shoppable

video without agents

DIY demonstrations or automated

product walkthroughs

APPLICATION FEATURE

Category

Video Shopping Type

Human Element

Integration Level

Key Features

Pricing

Best For

Example Use Cases

GUMSTACK

Service / Platform

1-to-1 live video shopping with brand

ambassadors

Yes - real brand ambassadors

providing shop support

Website integration with

shoppable video calls

Brand ambassador matching,

SAT/PS tracking, instant help

Custom packages

Brands offering expert-led

personal shopping experience

Appliance or complex product

consultations via video

APPLICATION FEATURE

Category

Video Shopping Type

Human Element

Integration Level

Key Features

Pricing

Best For

Example Use Cases

CONFERWITH

Service / Platform

Shoppable video, checkout sync,

analytics, abandoned cart follow-up

Yes - on-demand agent via video

Web/app integration for

live video calls

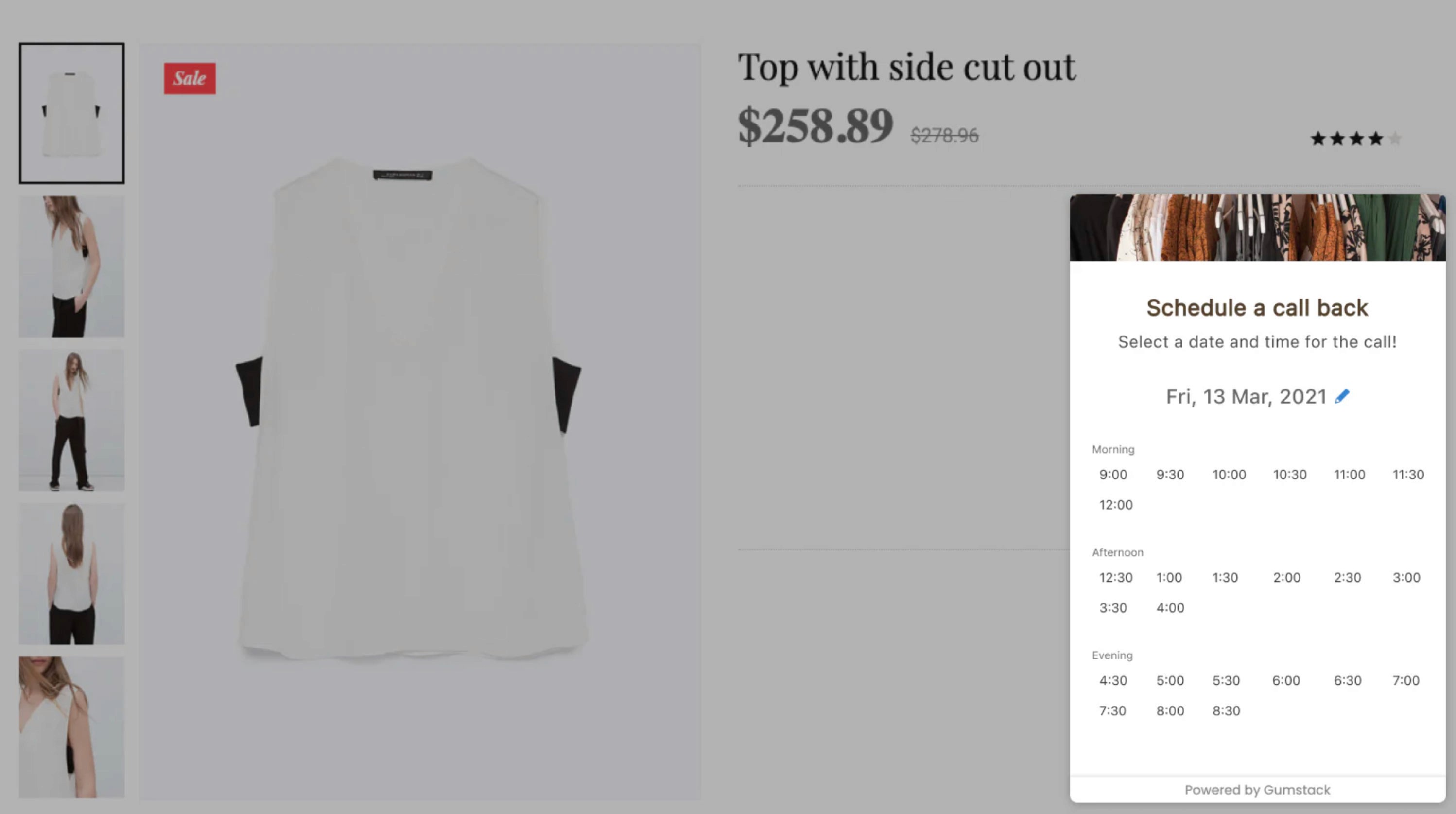

1-click video, mobile-first,

callback scheduling

Not listed, contact for pricing

Stores needing fast on-site video

customer support

Virtual store visits or real-time

visual assistance

COMPETITIVE LANDSCAPE / ANALYSIS —

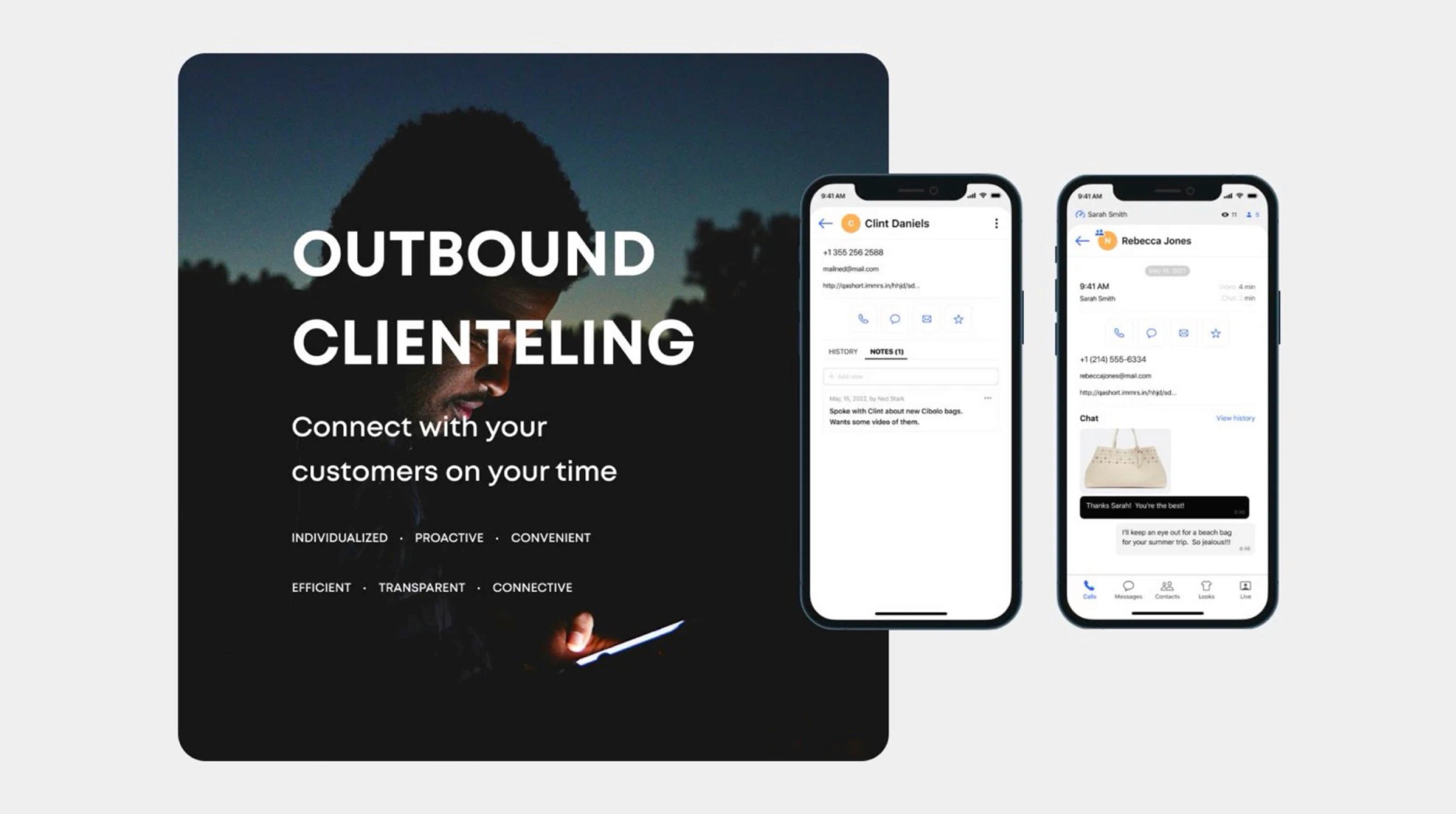

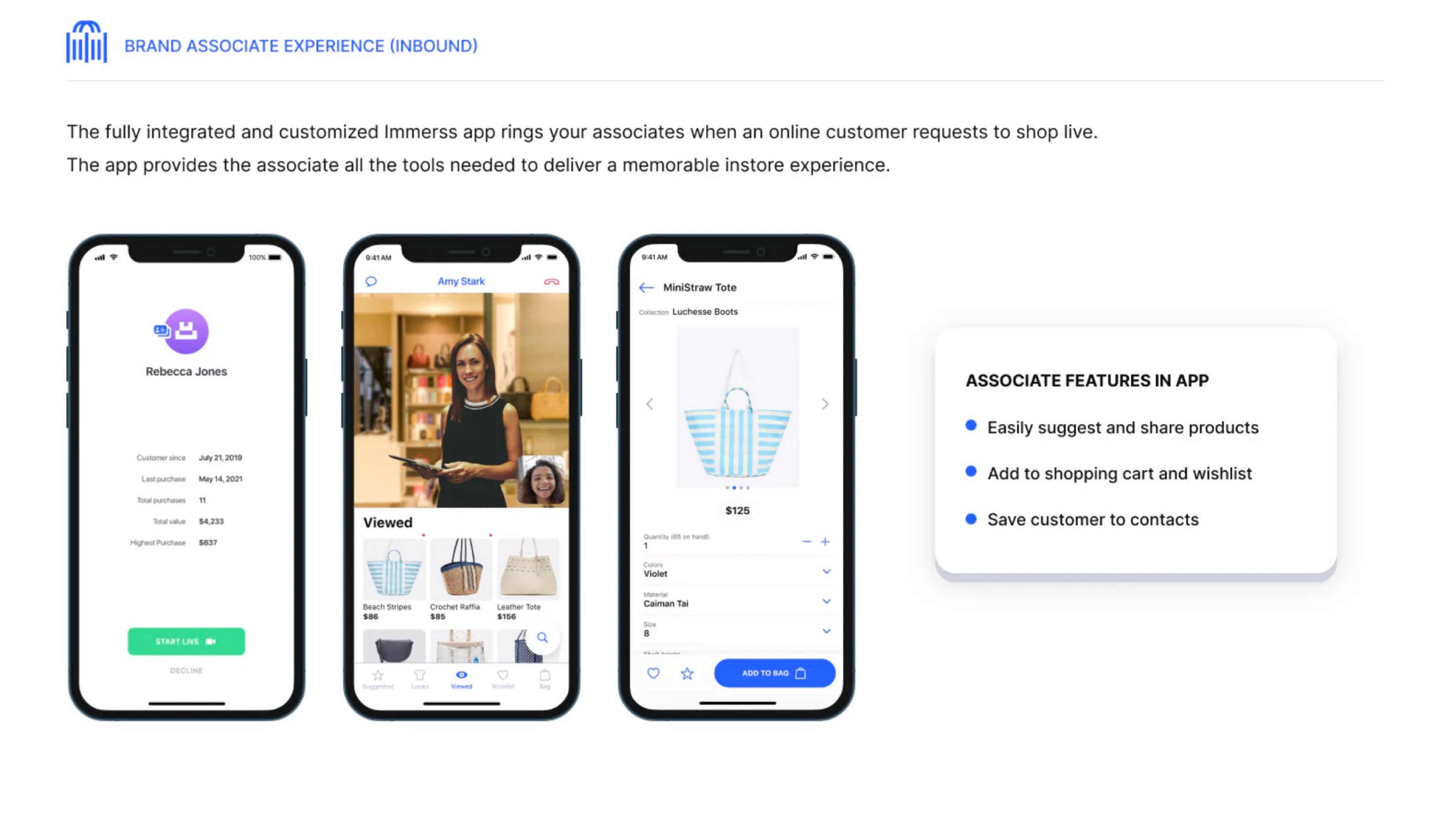

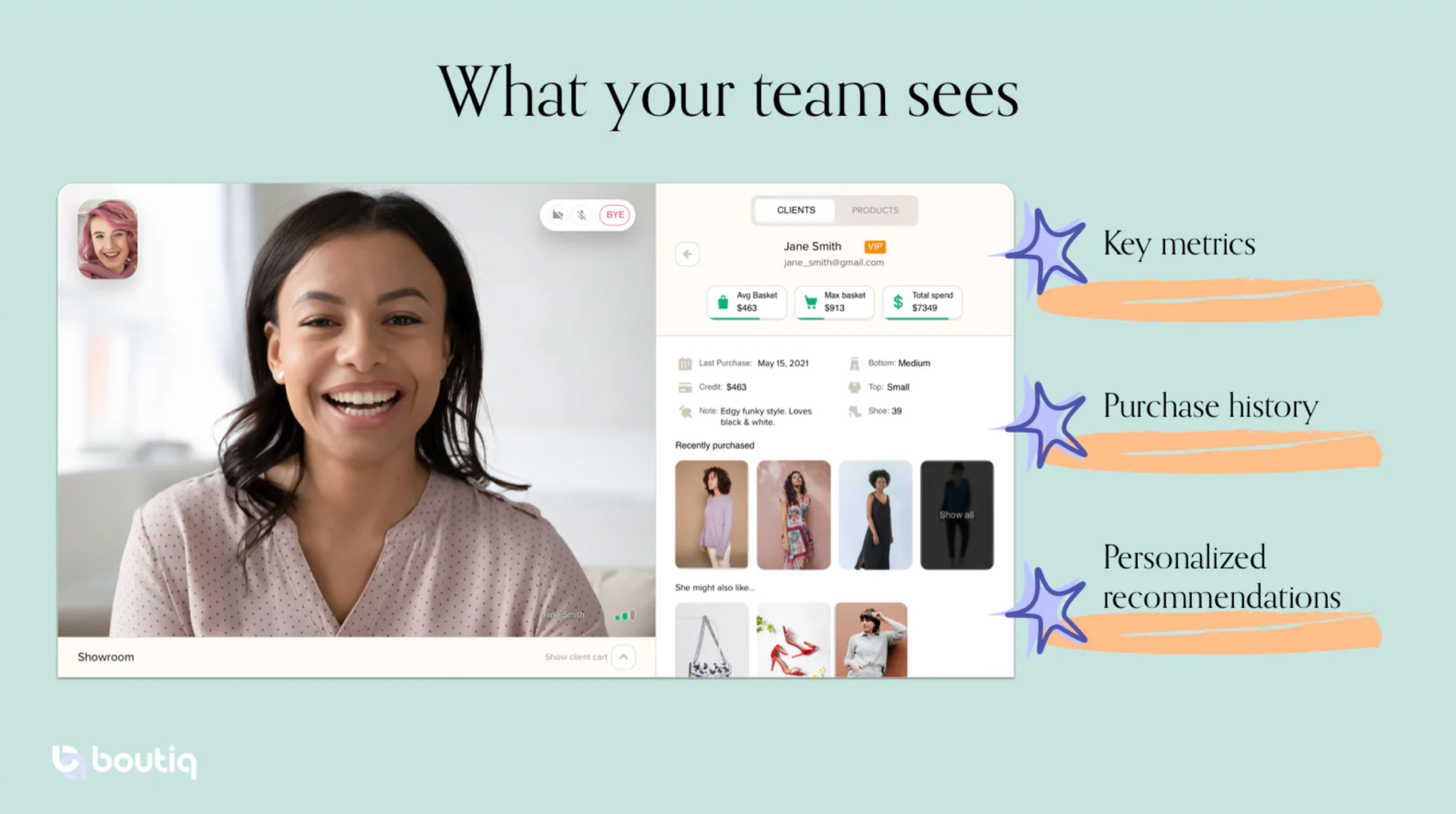

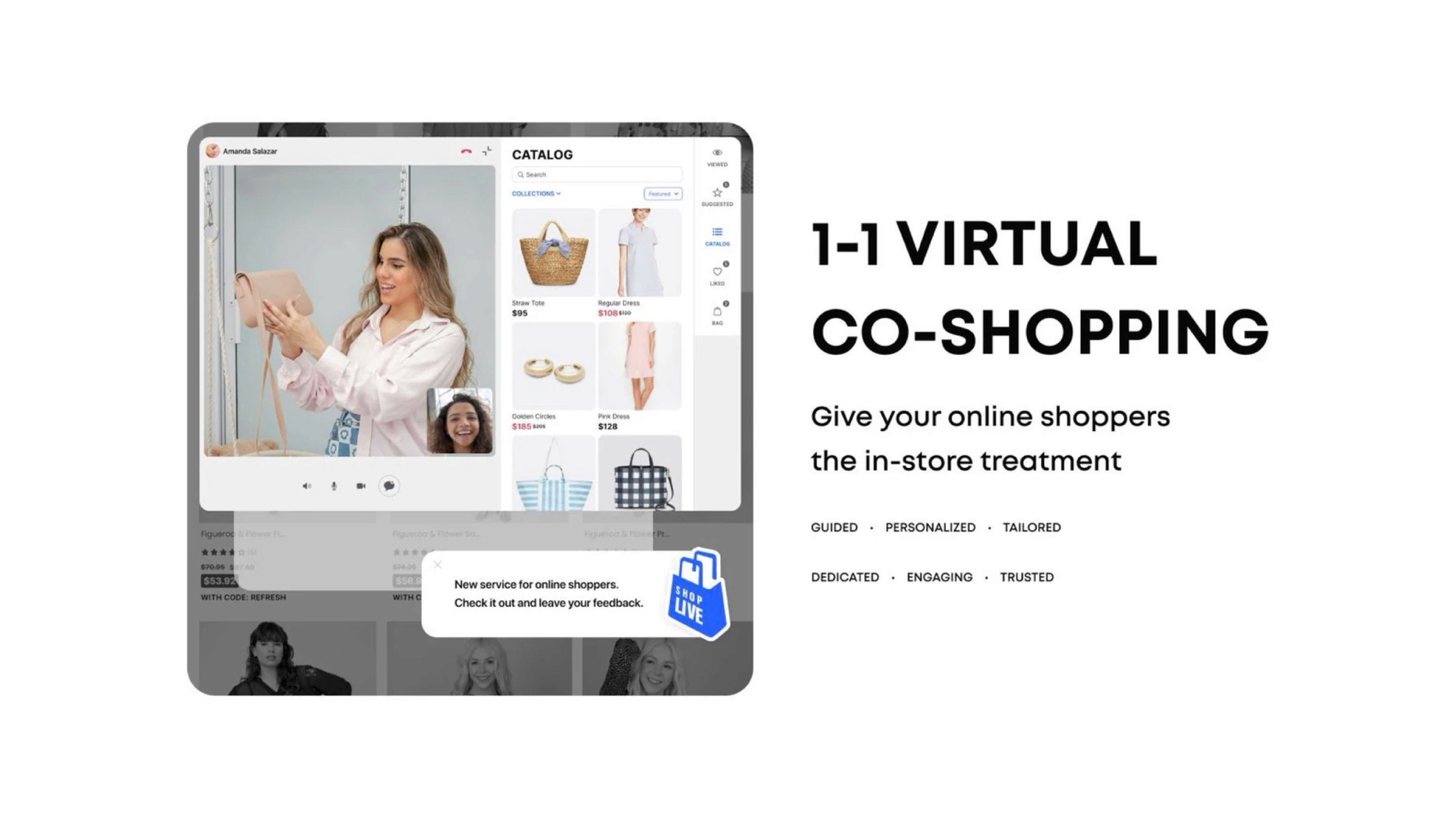

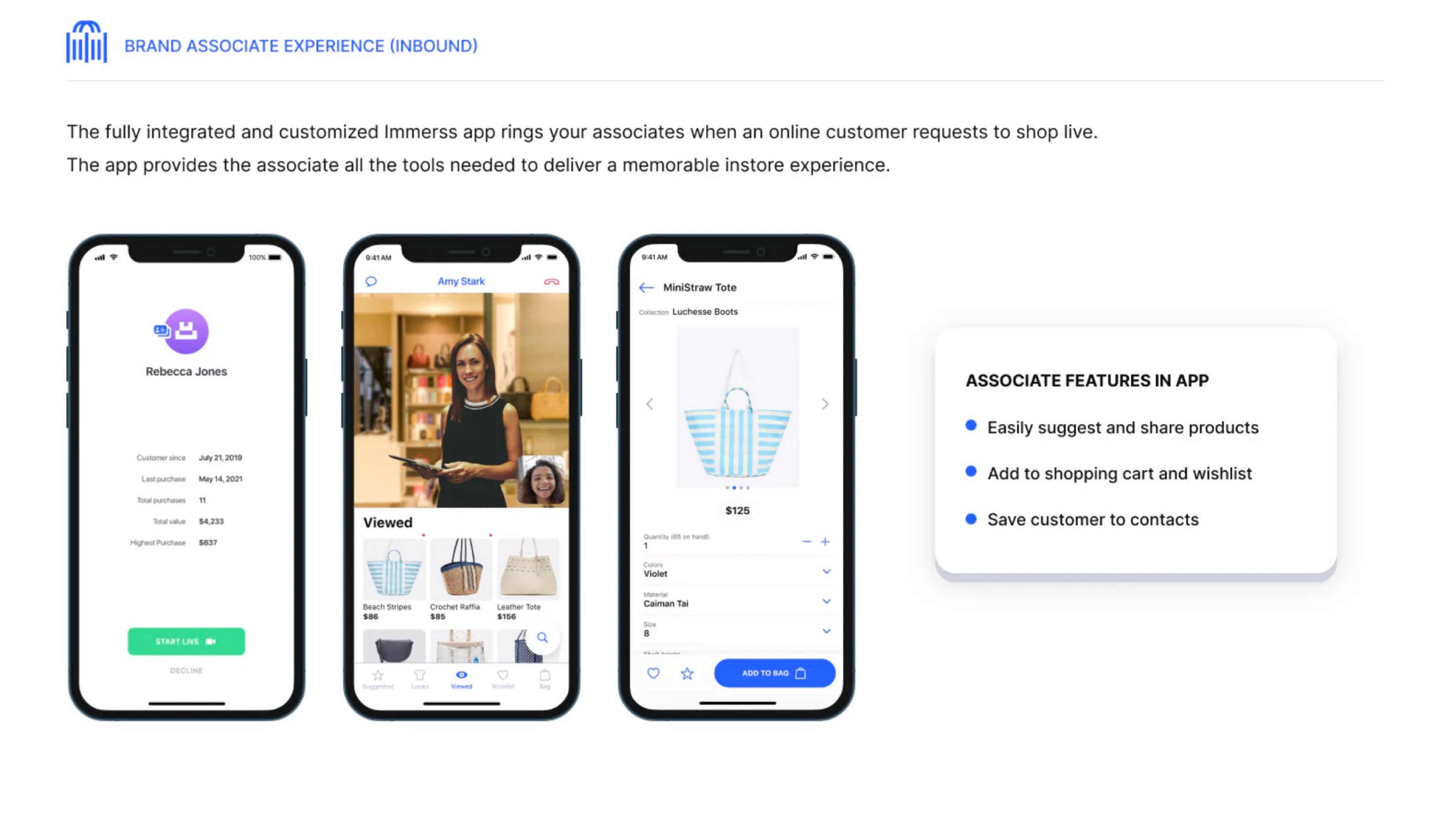

Analyzing the competitive landscape I identified strengths & weakness of the other products currently or the market offering similar services. The primary feature of all products was the video chat feature, but each was paired with different complimentary features.

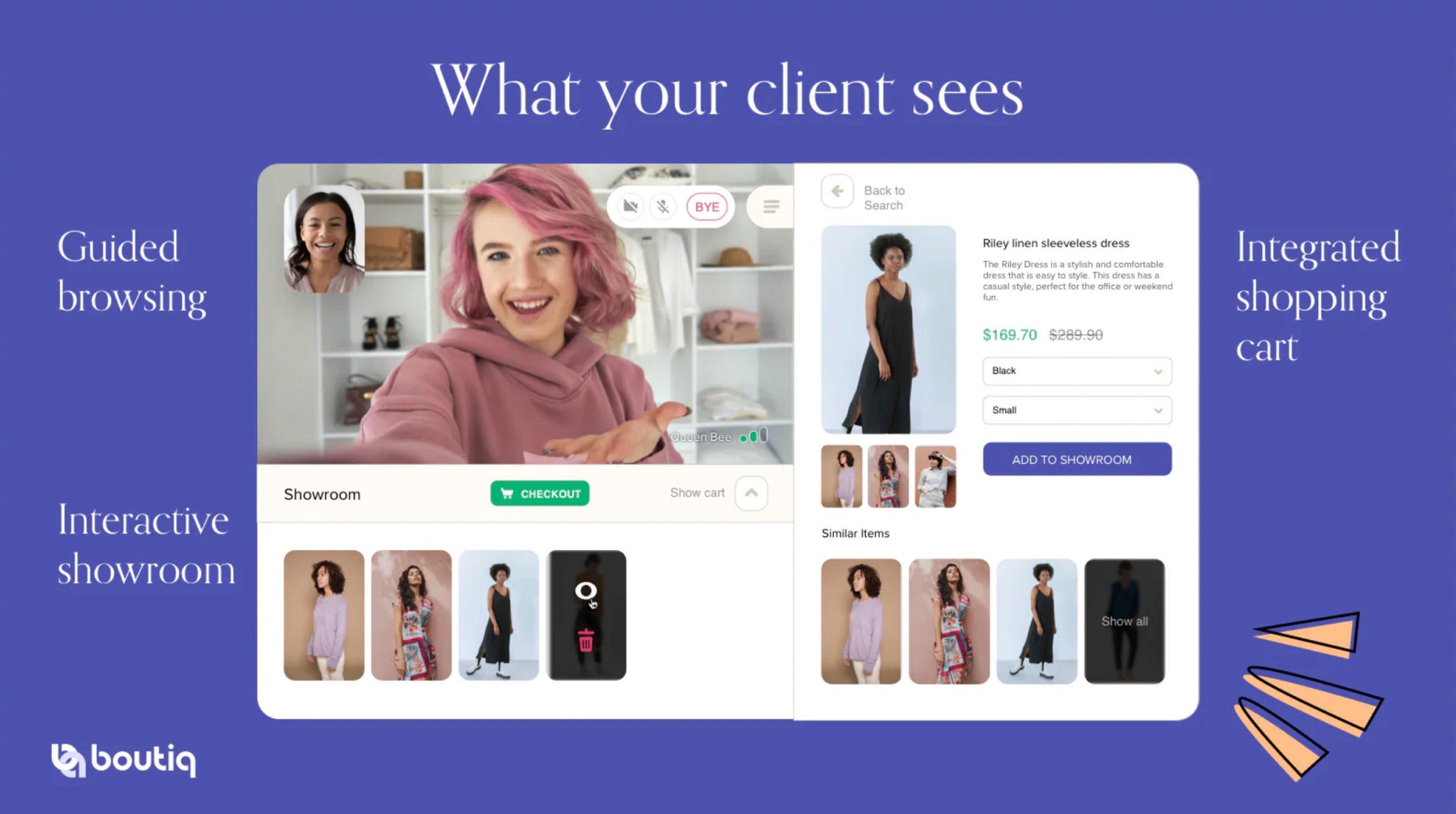

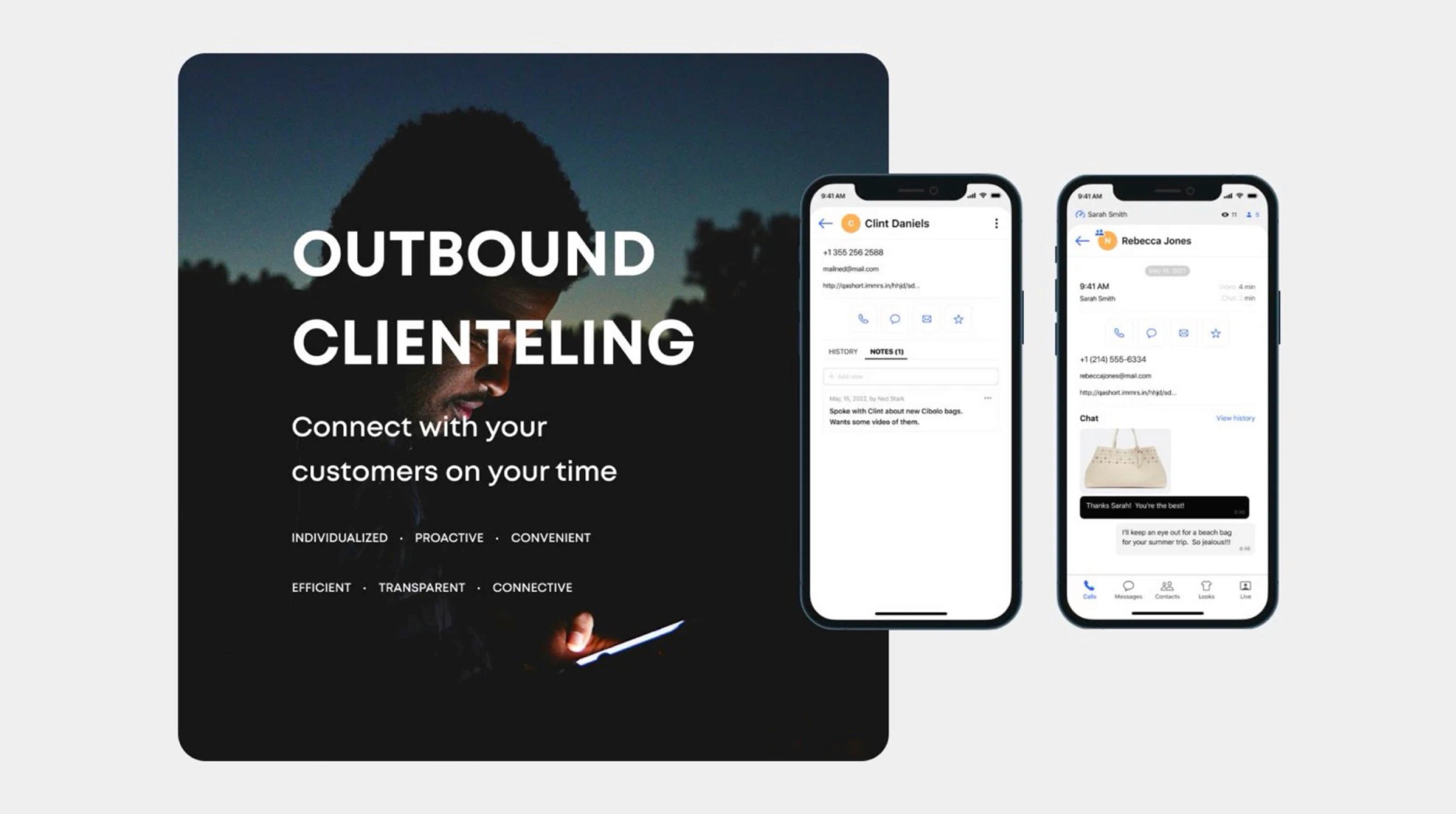

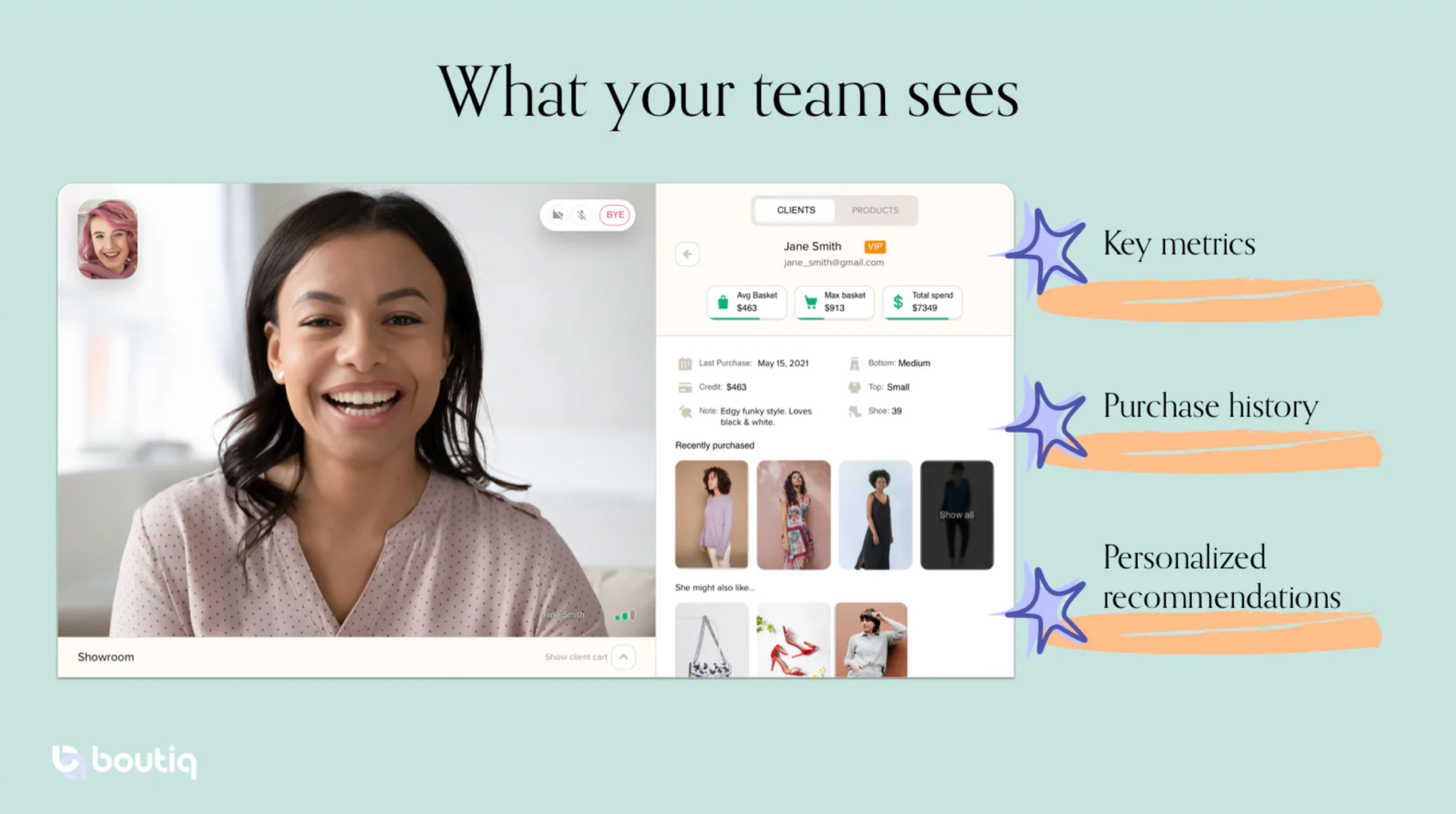

DECISION FATIGUE FROM TOO MANY CHOICES: Displays client video, purchase history, sizing, spending trends, style notes, and curated recommendation showroom.

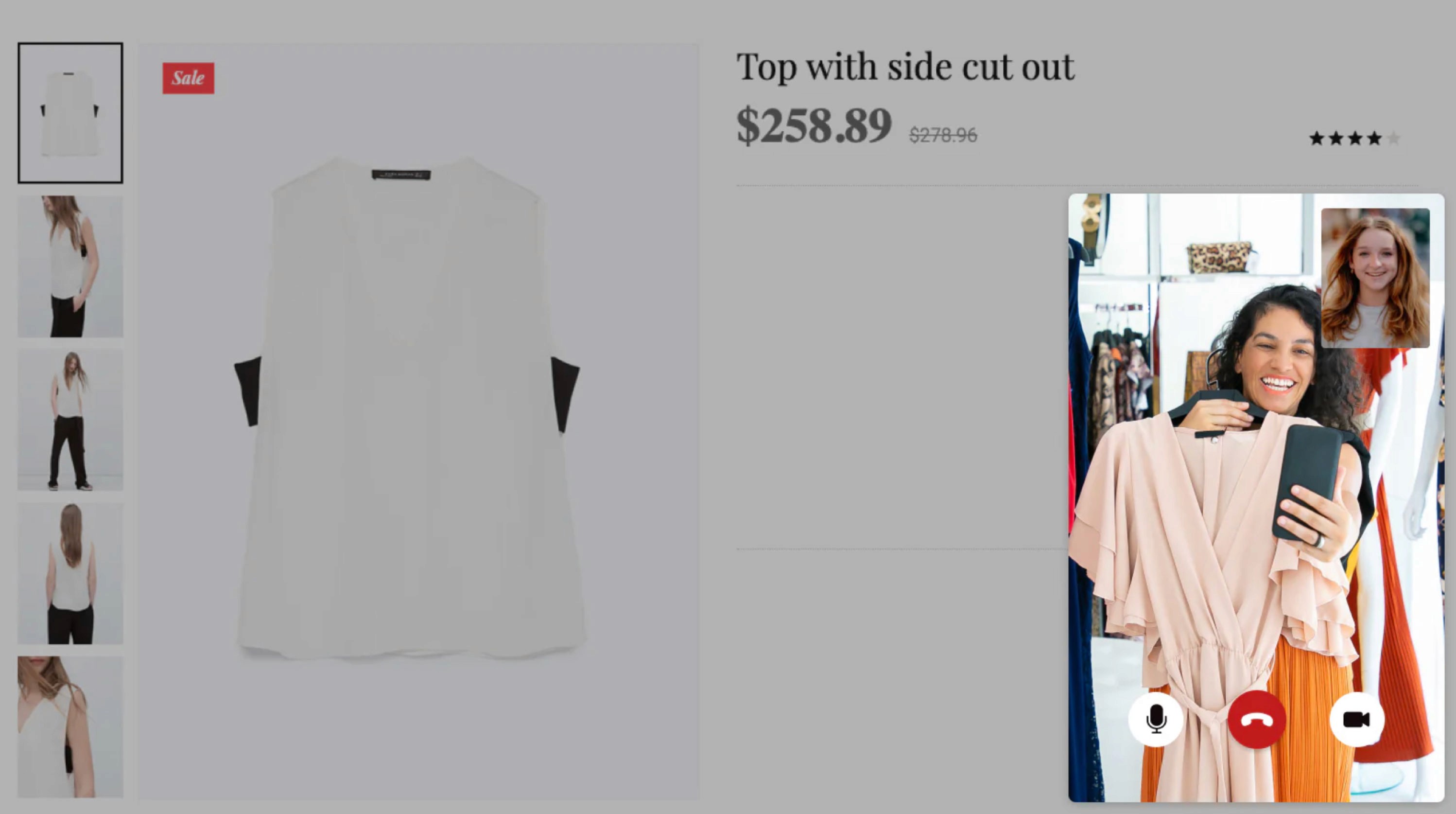

CLIENT EXPERIENCE: Half-screen video with cart access, checkout, and showroom recommendations.

INSTANT OR SCHEDULED CALLS: Product pages include a "Start Video Chat To See This" CTA for immediate or scheduled consultations.

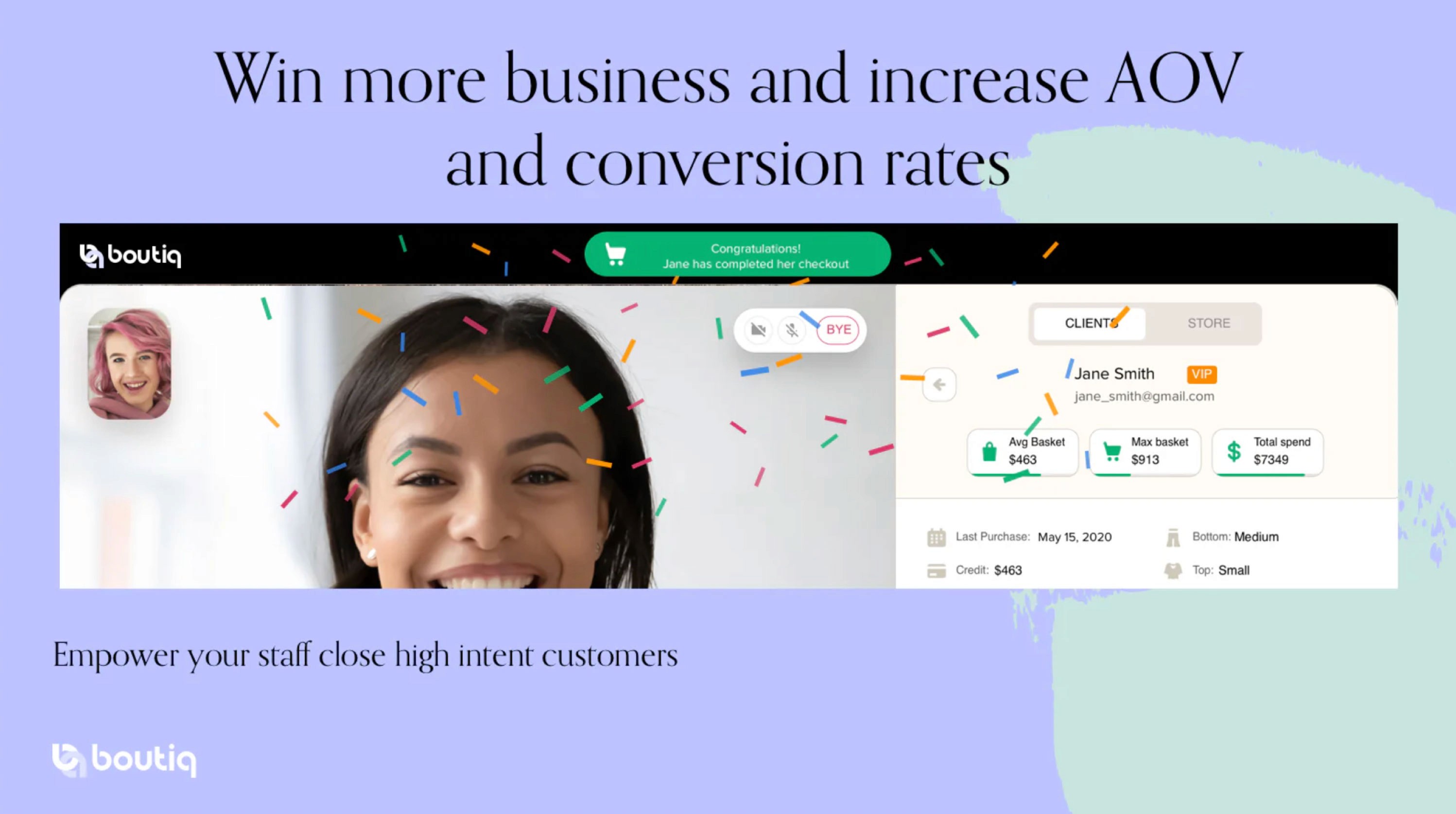

ANALYTICS & SALES INTELLIGENCE: Tracks calls, conversions, sales per call, AOV, and engagement metrics.

THIRD-PARTY INTEGRATIONS: Supports Klaviyo, Calendly, and Acuity for seamless workflow.

AI LIVE CHAT & VIDEO SHOPPING: Provides real-time product assistance and personalized recommendations.

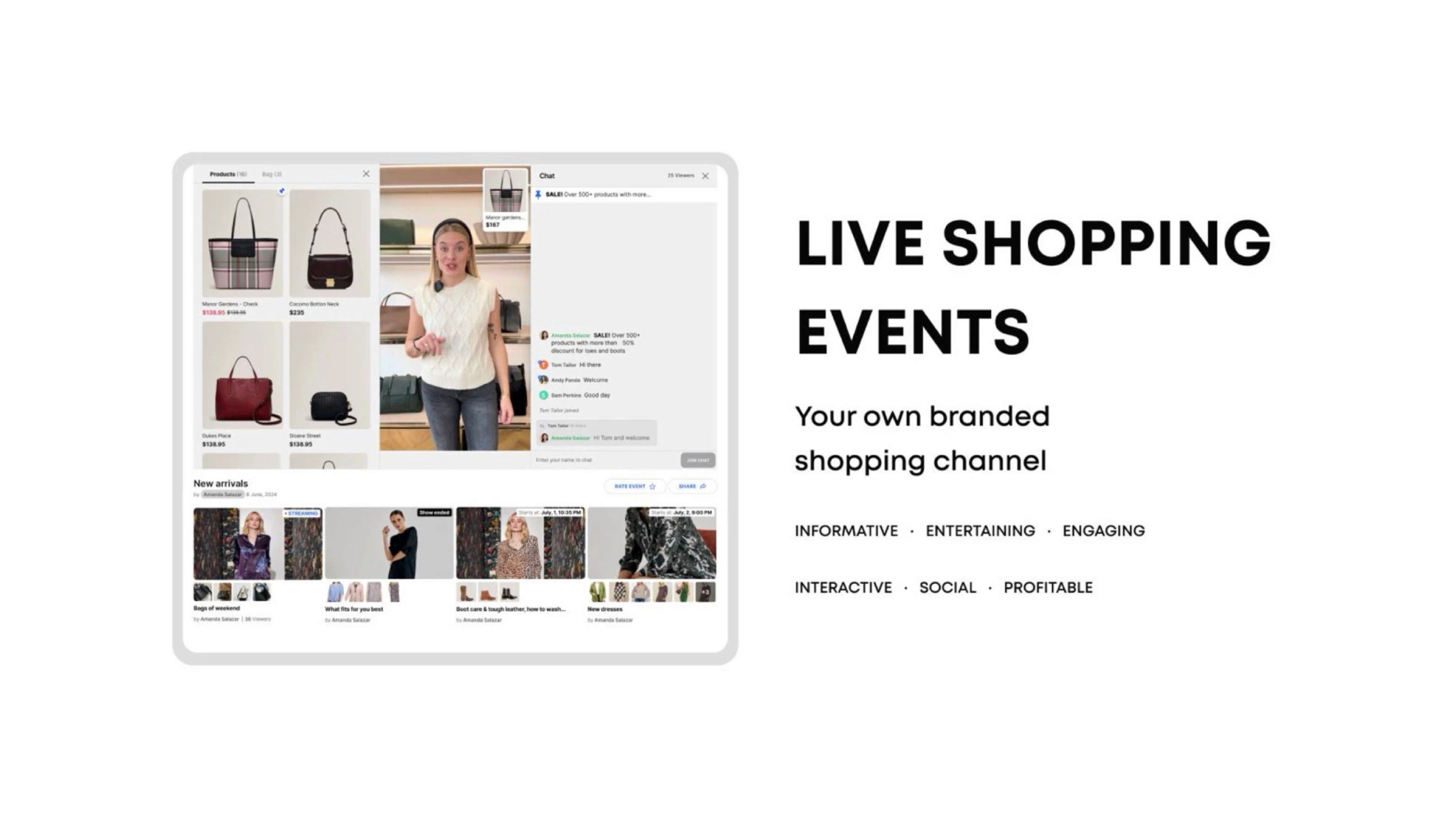

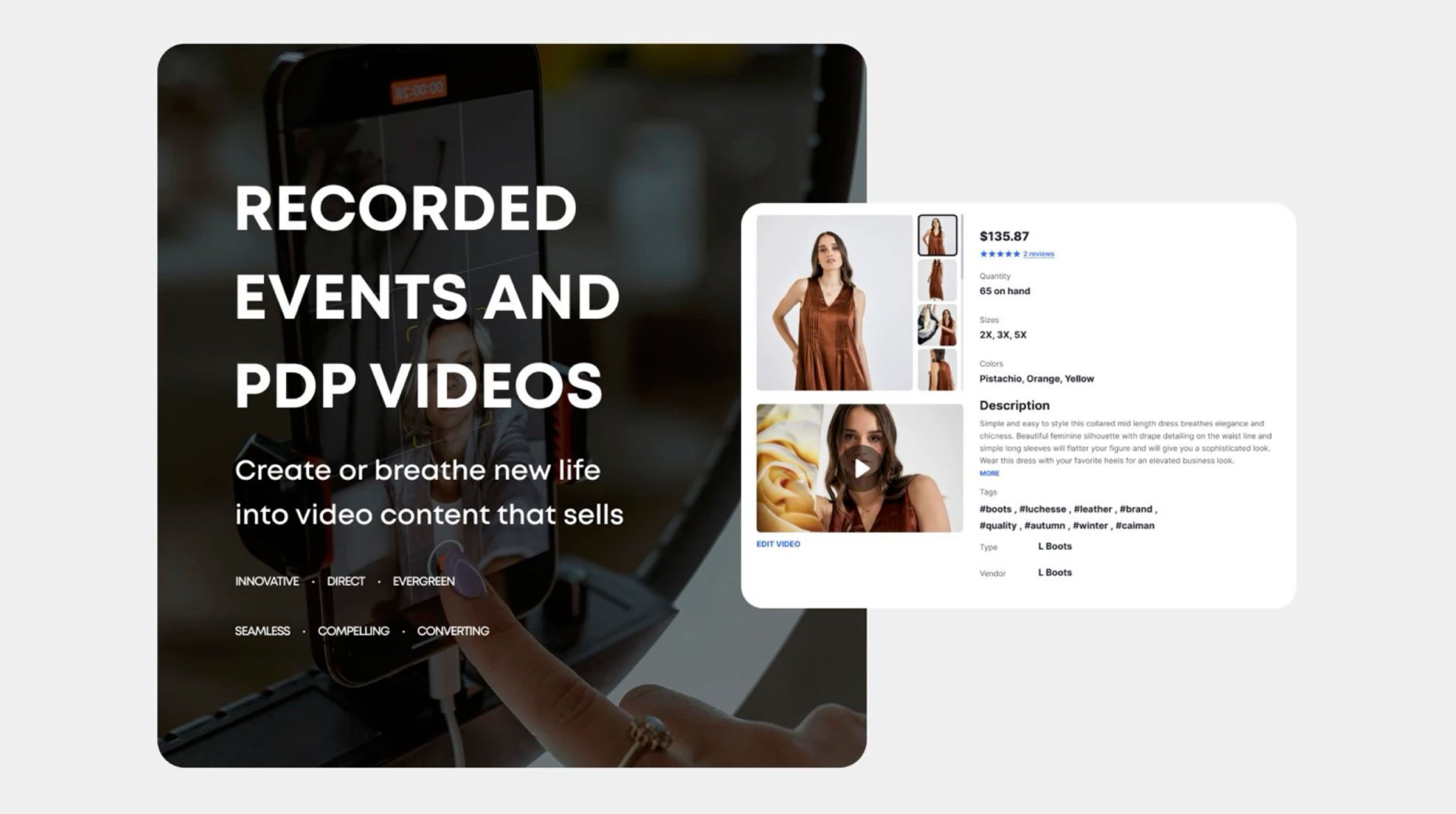

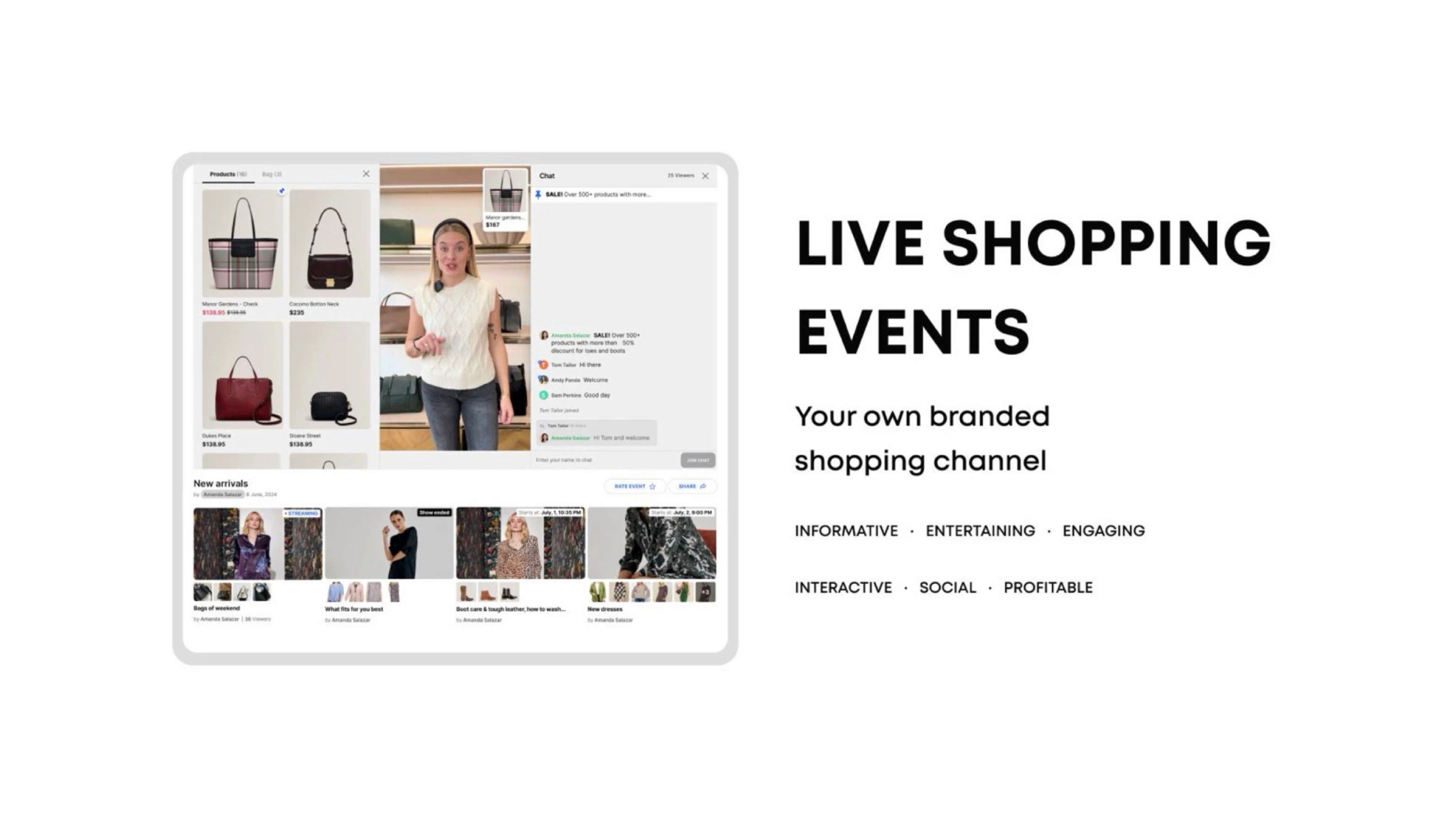

RECORDED & LIVE SHOPPING EVENTS: Group video sales, interactive product showcases, and PDP video integration.

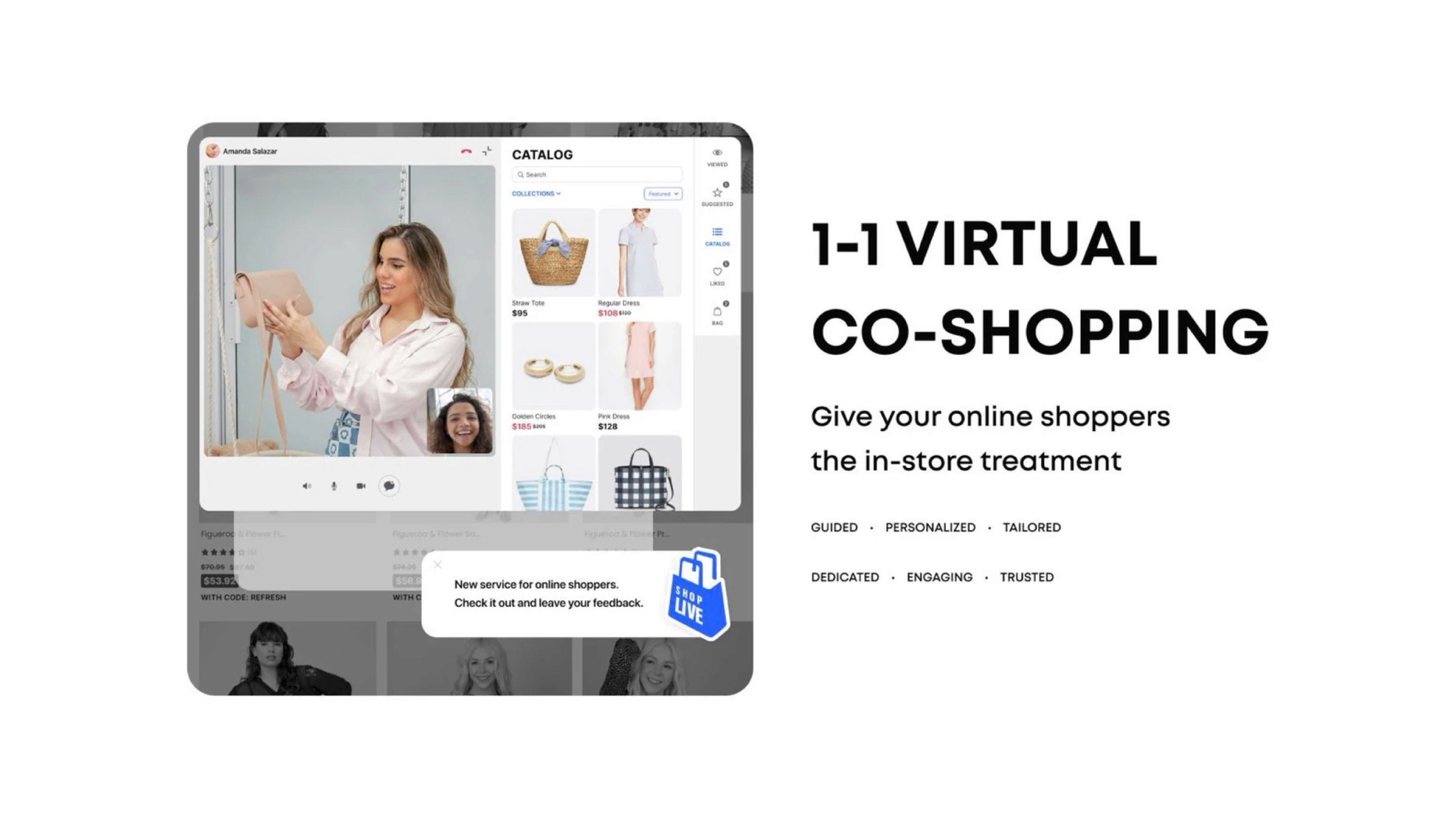

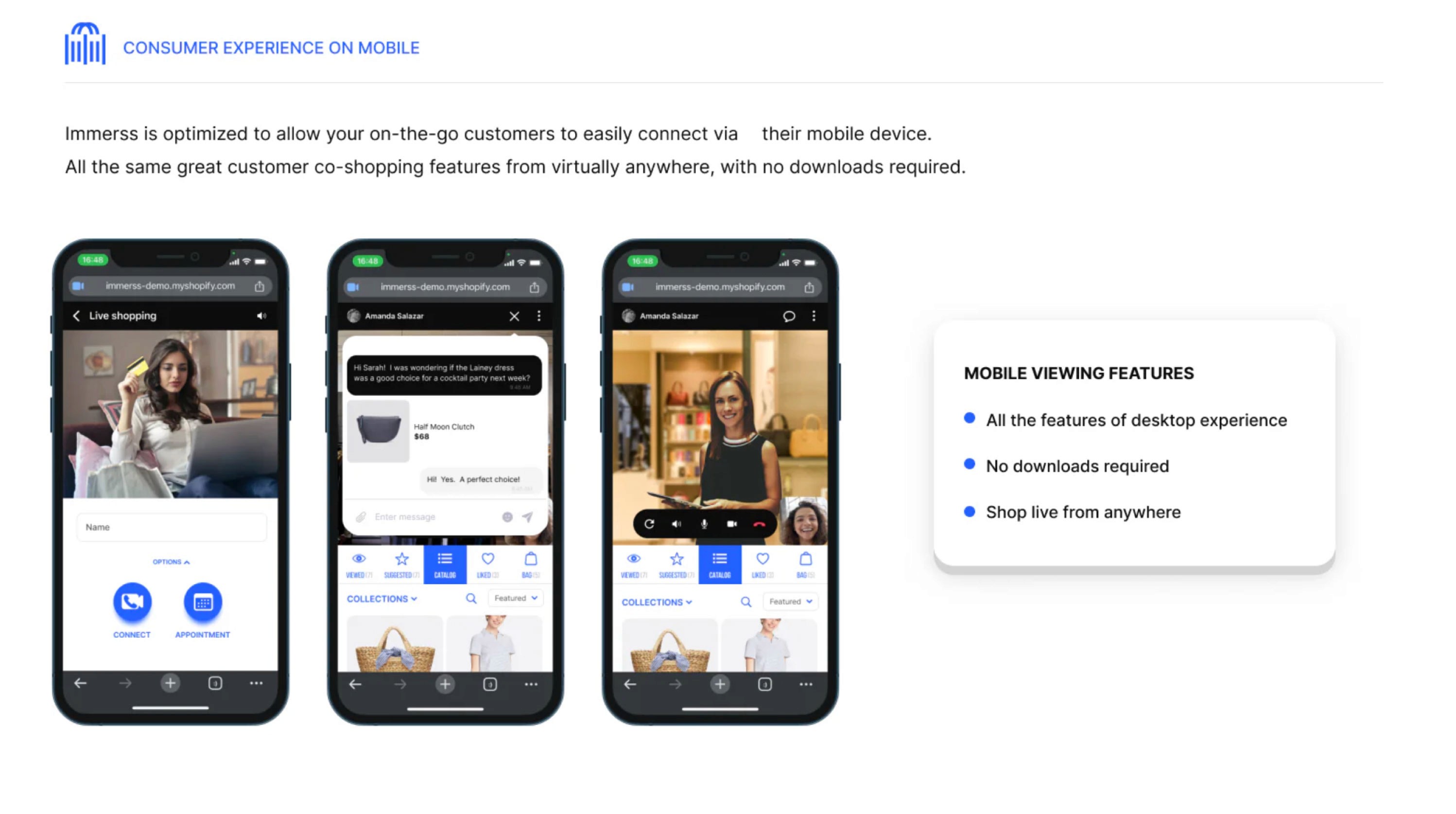

CLIENT EXPERIENCE: 60% VS screen area, product catalog browsing, and interactive tab navigation (Items Viewed, Suggested, Wishlist, Bag).

SALES ASSOCIATE DASHBOARD: Displays customer history, purchases, and engagement data with quick actions for live interactions.

PRODUCT DETAIL & EVENT PAGES: Carousel images, stock availability, material details, event thumbnails w/ reminders & sharing options.

SEAMLESS INTEGRATIONS: Connects with checkout systems, customer service tools (Gorgias, Zendesk, Olark, Intercom, Tidio, LiveChat).

CLIENT EXPERIENCE: A basic video call interface with a pop-up product preview (name, price, and image) and Add to Cart CTA. No browsing, account linking, or product details.

NO PRODUCT INTEGRATION: Products are showcased exclusively through live video, requiring direct communication for details.

STORE AGENT DASHBOARD: Minimal functionality with "Search Products" and "Video Options" buttons. After a call, only agent contact, order details, and call summary are available.

LIMITED POST-CALL INTERACTION: Clients can rate the sales agent, provide feedback, cannot revisit products / shopping history.

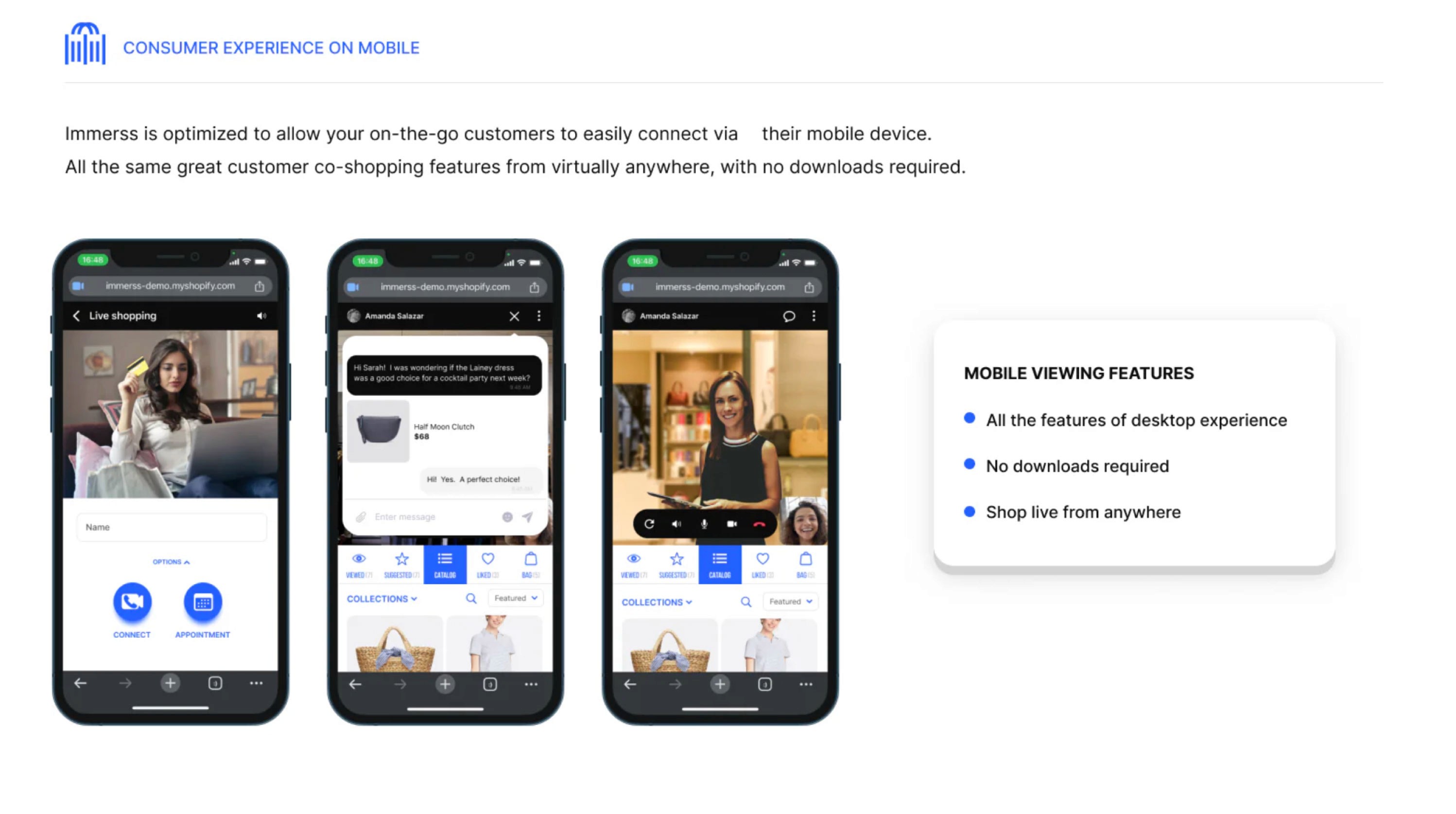

CLIENT EXPERIENCE: 60% VS screen area, shared shopping cart (top-right), and a VSA tab bar for video, chat, and screen expansion. Lower 40% screen area shared content when VSA minimized.

SALES ASSOCIATE DASHBOARD: Identical top-screen layout with host controls (Sharing Now, Demonstrate, Alternatives) and a detailed product display (image, price, size, color, description, and Add to Cart).

SEAMLESS PRODUCT INTEGRATION: Both parties can add products to the cart, ensuring a more engaging, guided shopping experience.

SECONDARY RESEARCH —

NAME: American Dream

LOCATION: East Rutherford, New Jersey, USA

OWNER: Triple Five Group

WEBSITE: americandream.com

American Dream s premier retail and entertainment

complex located within the Meadowlands Sports Complex in East Rutherford, New Jersey. Spanning approximately 3 million square feet, it stands as one of the largest malls in the United States.

MISSION & VISION: American Dream aims to redefine

the shopping and entertainment experience by combining diverse retail options with world-class attractions, creating a destination that appeals to both local residents and tourists.

PRODUCTS & SERVICE: The complex offers a blend of

retail and entertainment.

RETAIL: Over 350 retail establishments, featuring

high-end luxury stores and diverse shopping options.

DINING: More than 100 dining venues, ranging from

casual eateries to fine dining.

ENTERTAINMENT: Features a variety of attractions.

• Nickelodeon Universe: An indoor theme park with various

rides and attractions.• DreamWorks Water Park: An expansive indoor water park

featuring attractions themed around popular Dream Works

franchises.• Big Snow American Dream: Indoor ski & snowboard park.

• The Rink: An NHL-sized ice-skating rink.

• Legoland Discovery Center: An interactive experience

for families and children.

• Sea Life Aquarium: A marine life attraction.

MARKET & INDUSTRY ANALYSIS: Strategically located

near New York City, American Dream attracts both local

visitors and tourists. Its unique ombination of retail and

entertainment positions it competitively within the retail

and amusement industries.

BUSINESS MODEL & REVENUE STREAMS:

American Dream generates revenue through:

• Retail Leasing: Income from leasing space to various retail

tenants.NAME: American Dream

LOCATION: East Rutherford, New Jersey, USA

OWNER: Triple Five Group

WEBSITE: americandream.com

American Dream s premier retail and entertainment

complex located within the Meadowlands Sports Complex in East Rutherford, New Jersey. Spanning approximately 3 million square feet, it stands as one of the largest malls in the United States.

MISSION & VISION: American Dream aims to redefine

the shopping and entertainment experience by combining diverse retail options with world-class attractions, creating a destination that appeals to both local residents and tourists.

PRODUCTS & SERVICE: The complex offers a blend of

retail and entertainment.

RETAIL: Over 350 retail establishments, featuring

high-end luxury stores and diverse shopping options.

DINING: More than 100 dining venues, ranging from

casual eateries to fine dining.

ENTERTAINMENT: Features a variety of attractions.

• Nickelodeon Universe: An indoor theme park with various

rides and attractions.• DreamWorks Water Park: An expansive indoor water park

featuring attractions themed around popular Dream Works

franchises.• Big Snow American Dream: Indoor ski & snowboard park.

• The Rink: An NHL-sized ice-skating rink.

• Legoland Discovery Center: An interactive experience

for families and children.

• Sea Life Aquarium: A marine life attraction.

MARKET & INDUSTRY ANALYSIS: Strategically located

near New York City, American Dream attracts both local

visitors and tourists. Its unique ombination of retail and

entertainment positions it competitively within the retail

and amusement industries.

BUSINESS MODEL & REVENUE STREAMS:

American Dream generates revenue through:

• Retail Leasing: Income from leasing space to various retail

tenants.• Ticket Sales: Revenue from admissions to entertainment

attractions.• Dining: Proceeds from a wide array of dining options.

• Special Events: Hosting events and performances in

dedicated spaces.

FINANCIAL OVERVIEW: In 2022. American Dream reported losses of $254.4 million. In November 2022, JPMorgan Chase extended a four-year extension on over $1.7 billion in con-

struction borrowings. American Dream Mall has faced signif-

icant financial challenges since its opening in October 2019.FINANCIAL LOSSES:

• 2021: The mall reported losses of nearly $60 million.

• 2022: Losses escalated to approximately $245 million, a

substantial increase from the previous year.DEBT AND LOANS:

• Construction Financing: Triple Five Group, the mall's

developer, secured about $1.1 billion in municipal bonds to

finance the $5 billion project.•Loan Extension: In November 2022, JPMorgan Chase

granted a four-year extension on repaying over $1.7

BOND PAYMENT ISSUES:

• August 2024: The mall made overdue interest payments on

$287 million of municipal bonds after more than two years

of delays.• February 2025: Bondholders did not receive expected

interest payments, indicating ongoing difficulties.

MARKETING & GROWTH STRATEGY: American Dream

focuses on offering a unique blend of shopping and entertain-

ment to differentiate itself from traditional malls. Marketing efforts target families, tourists, and shoppers seeking diverse experiences.CHALLENGES & RISKS: The complex has faced financial

challenges, including significant losses and reliance on

substantial financing. Additionally, the COVID-19 pandemic impacted operations and visitor numbers.

RECENT DEVELOPMENTS & ACHIEVEMENTS:

Complex opened in phases, initial debuting in October 2019

Secured a four-year extension on significant construction

loans in November 2022.

NAME: TheAddress

FOUNDED: February 2022

LOCATION: East Rutherford, New Jersey, USA

WEBSITE: theaddressad.com

A specialty department store curated for modest fashion

women of religious faith.

MISSION & VISION: TheAddress aims to provide an elevated shopping experience for the modest fashion community by offering a curated selection of sought-after brands and styles, catering to women, teens, and children.

PRODUCTS & SERVICES: The store offers a diverse range

of products, including:

• Women's Apparel: Dresses, tops, skirts, activewear,

swimwear, and outerwear.• Teens' and Kids' Clothing: Age-appropriate modest fashion

options.• Accessories: Makeup, hair accessories, jewelry & more.

• Home Goods: Various home-related products.

Featured brands include Adee, Adina Las Vegas, Adonis,

Aish Tamid Hat Boxes, A.I Stone, Apparalel, Artscroll, B7ac-

tive, Bliss, BNJR Teen Collection, Byrd, By Tess, and more.

MARKET & INDUSTRY ANALYSIS: As the first depart-

ment store in the U.S. specifically designed for the modest fashion consumer, TheAddress fills a unique niche in the retail in market. The modest fashion industry has seen significant growth, with increasing demand for stylish yet conservative clothing options. By offering a wide range of products and brands under one roof, heAddress appeals to a diverse clientele seeking quality and variety in modest fashion.BUSINESS MODEL & REVENUE STREAMS: Operating

both an online platform and a physical store located within

the American Dream mall, heAddress generates revenue

through:

• Retail Sales: In-store and online purchases of clothing, of

accessories, and home goods.

• Brand Partnerships: Collaborations with various brands

to offer exclusive collections.MARKETING & GROWTH STRATEGY:

TheAddress focuses on community engagement and brand awareness through:

• Social Media Presence: Active engagement on platforms

like Instagram.

• In-Store Events: Hosting events to attract /retain

customers.• Expansion Plans: Phased rollouts of new departments,

including bridalwear and giftware, to continually enhance

the shopping experience.CHALLENGES & RISKS: As a relatively new entrant in the

retail market, TheAddress faces challenges such as:

• Market Competition: Competing with established

retailers and online platforms.• Economic Factors: Navigating economic downturns

that may affect consumer spending.RECENT DEVELOPMENTS & ACHIEVEMENTS:

• Store Launch: Opened in phases, starting with women's

clothing, followed by teens' and kids' departments, and

plans for bridalwear and giftware.

Location: Situated within the American Dream mall, offering extended store hours to accommodate diverse schedules.

1) Upsy Shopping. "Virtual Shopping Assistants vs. Chatbots - What's the Difference?" Upsy Shopping, upsyshopping.com/virtual-shopping-assistants-vs-chatbots/. Accessed 26 Feb. 2025.

2) Scoop Market Research. "Virtual Assistant Statistics." Scoop Market Research, scoop. market.us/virtual-assistant-statistics/. Accessed 26 Feb. 2025.

3) Barron'. "Black Friday Shopping & Cyber Monday Trends." Barron's, 2024, www.barrons.com/articles/black-friday-shopping-cyber-monday-d31144da. Accessed 26 Feb. 2025.

4) Credence Research. "Virtual Shopping Assistant Market Report." Credence Research, 2024, www.credenceresearch.com/report/virtual-shopping-assistant-market. Accessed 26 Feb. 2025.

5) CrossML. "AI Virtual Assistants in Retail." CrossML, 2023, www.crossml.com/ai-virtual-assistants-in-retail/. Accessed 26 Feb. 2025.

6) Reuters. "Al-Influenced Shopping Boosts Online Holiday Sales, Salesforce Data Shows." Reuters, 6 Jan. 2025, www.reuters.com/business/retail-consumer/ai-influenced-shop-

ping-boosts-online-holiday-sales-salesforce-data-shows-2025-01-06/. Accessed 26 Feb. 2025.

RESEARCH SYNTHESIS —

PERSONAS —

Generating personas helped to keep the user's needs central during the design process & improved decision making by filtering the choices through the target user's perspective.

NAME & AGE: MIRIAM / 28

OCCUPATION: HOMEMAKER

EDUCATION: BACHELOR OF ARTS

SHOPPING FREQ: WEEKLY

MARITAL STATUS: MARRIED

CHILDREN: 2 BOYS / 2 GIRLS

INCOME: $120,000/YEAR

"I need a one-stop shop for

stylish, modest fashion for

my entire family.'

PSYCHOGRAPHICS

• Values faith-based living &

prioritizes modesty in fashion

choices for herself & her

daughters.• Enjoys quality, stylish clothing

that aligns with religious

principles.• Prefers shopping at stores that

provide a welcoming, commu-

nity oriented environment.BEHAVIORS

• Shops frequently for family

clothing, especially for Shabbat

and holidays.• Seeks durable and comfortable

clothing for daily wear and spe-

cial occasions.

• Engages with brands that align

with her values, often discover-

ing them through social media.

PAIN POINTS

• Difficulty finding modest

clothing that is both fashion-

able and high-quality.• Struggles with inconsistent

sizing across different brands.

• Prefers in-store shopping but

has limited time due to family

responsibilities.GOALS & MOTIVATIONS

• Wants a single destination

where she can shop for herself

and her children.• Looks for brands that balance

style, comfort, and faith-based

modesty.

• Appreciates a shopping experi-

ence that feels tailored to her

needs as a busy mother.

NAME & AGE: SARAH / 27

OCCUPATION: HR DIRECTOR

EDUCATION: MA BUS ADMIN

SHOPPING FREQ: BI-MONTHLY

MARITAL STATUS: ENGAGED

CHILDREN: NONE

INCOME: $85,000/YEAR

"Elegant, modest fashion should

be effortless and perfect for both the office and social events.'PSYCHOGRAPHICS

• Values modern modest fashion

that fits both professional andsocial settings.

• Interested in ethically sourced

and sustainable fashion.• Prefers shopping at high-end,

faith-conscious brands.BEHAVIORS

• Shops primarily online but

visits stores for special events

and sales.• Invests in high-quality, timeless

pieces rather than fast fashion.

• Prefers minimal, elegant styles

that transition from work to

social occasions.

PAIN POINTS

• Struggles to find modest busi-

ness attire that is trendy yet

professional.• Limited access to in-store

shopping due to a demanding

work schedule.• Finds it difficult to locate high-

quality modest brands in main-

stream department stores.GOALS & MOTIVATIONS

• Seeks a shopping experience

that offers both convenience

and exclusivity.• Values curated collections that

align with her personal style.

• Wants access to exclusive

modest fashion brands in one

location.

NAME & AGE: RIVKA / 23

OCCUPATION: STUDENT

EDUCATION: BA FASHION

SHOPPING FREQ: MONTHLY

MARITAL STATUS: SINGLE

CHILDREN: NONE

INCOME: $20,000/YEAR

"Modest fashion can be trendy too, I want stylish options that reflect

my personality."

PSYCHOGRAPHICS

• Enjoys experimenting w/ mod-

est fashion trends while main-

taining religious guidelines.• Highly engaged in social media,

following modest influencers

and fashion brands.• Prefers shopping experiences

that feel fresh, youthful, and

community-driven.

BEHAVIORS

• Frequently shops tor casual

and social -event outfits.• Engages in online shopping but

prefers in-person experiences

for inspiration.• Shares her fashion finds on

social media, influencing her

peers.

PAIN POINTS

• Limited budget for premium

modest brands.

• Finds some modest styles out-

dated or not aligned with youth-

ful trends.

• Struggles to find modest

activewear and swimwear

options.GOALS & MOTIVATIONS

• Wants affordable, stylish

modest fashion that reflects

her personality.• Seeks an inclusive and trendy

shopping environment catering

to younger women.

• Enjoys community-driven

events, such as modest fashion

shows or influencer meetups.

NAME & AGE: CHAYA / 50

OCCUPATION: COUNSELOR

EDUCATION: BA SOCIAL WORK

SHOPPING FREQ: MONTHLY

MARITAL STATUS: MARRIED

CHILDREN: 2 GROWN

INCOME: $60,000/YEAR

"I invest in timeless, high-end modest fashion that aligns with my values and lifestyle.'

PSYCHOGRAPHICS

• Invests in high-end, timeless

modest fashion for professional

and social settings.

• Strong advocate for supporting

faith-based businesses and de-

signers.

• Prefers classic styles over fast

fashion trends.

BEHAVIORS

• Shops for sophisticated,

elegant attire for events and

community engagements.• Prefers boutique-style

customer service with person-

alized shopping assistance.• Attends in-store events, such

as fashion launches and charitygalas.

PAIN POINTS

• Limited access to high-end

modest designers in main-

stream department stores.• Struggles to find occasion wear

that aligns with her religious

standards.

• Prefers in-person shopping ex-

periences but needs efficient

service due to a busy schedule.

GOALS & MOTIVATIONS

• Wants a refined shopping

experience with exclusive mod-

est brands.• Seeks elegant styles that

reflect both her faith and

professional standing.• Enjoys supporting businesses

that align with her values

NAME & AGE: DEVORAH / 30

OCCUPATION: HOMEMAKER

EDUCATION: AA ECE

SHOPPING FREQ: BI-WEEKLY

MARITAL STATUS: MARRIED

CHILDREN: EXPECTING

INCOME: $90,000/YEAR HI

"I need fashionable yet practical modest clothing for motherhood, from maternity to everyday wear."

PSYCHOGRAPHICS

• Values practical yet stylish

modest clothing for herself and

her growing family.

• Focuses on high-quality, long -

lasting pieces.• Enjoys shopping as part of self-

care & community engagementBEHAVIORS

• Regularly shops for both

maternity and postpartum-

friendly modest fashion.• Engages with faith-based influ-

encers for modest fashion

inspiration.• Prefers shopping in stores

where she can touch and feel

fabrics before purchasing.PAIN POINTS

• Limited options for stylish

maternity and nursing-friendly

modest clothing.• Difficulty finding affordable,

high-quality modest fashion for

different life stages.

• Navigating modest activewear

options that balance function

and faith-based values.GOALS & MOTIVATIONS

•Wants convenient, all-in-one

shopping for herself and her

child.

• Seeks fashionable yet comfort-

able modest options.

• Enjoys a welcoming, family

friendly shopping environment.

EMPATHY MAPPING —

Creating empathy mapping helped in understanding the users emotions, perspectives, and motivations far beyond what the secondary research established.

THINK AND FEEL

• Shops for family clothing, especially for Shabbat &

holidays.• Buys in bulk when finding a reliable modest fashion

brand.• Seeks inspiration religious & social media

communities.HEAR

• Friends discussing where to find the best modest

clothing.• Faith-based influencers promoting brands w/

religious values.• Children requesting comfortable yet stylish outfits for

school and events.

SEE

• Limited stylish modest fashion in mainstream stores.

• Inconsistent sizing across different brands.

• Other mothers also struggling to find fashionable,

faith-aligned clothing.

THINK AND FEEL

• Shopping should be convenient/efficient for busy

mothers.• Quality and durability are just as important as

aesthetics.• Modest fashion should be stylish, comfortable, &

reflective of my faith.GAIN

• A one-stop shop with stylish, modest clothing for herself & her kids.

• Brands that consistently offer modest, comfortable & durable fashion.

• A welcoming shopping experience catering to busy mothers.

PAIN

• Difficulty finding modest clothing that is both high-quality & fashionable.

• Struggles with inconsistent sizing across different brands.

• Prefers in-store shopping but limited time due to family responsibilities.

THINK AND FEEL

• Shops online - convenience / visits stores - exclusive

for special events.• Follows faith-conscious & sustainable fashion brands.

• Invests in timeless, high-quality pieces, not fast

fashion.HEAR

• Colleagues complimenting her elegant, modest outfits.

• Influencers covering sustainable & high-end modest

brands.• Peers recommending exclusive shopping events

SEE

• Online stores with inconsistent quality and fit.

• Luxury brands lacking modest yet fashionable work

attire.• Limited professional modest fashion options in main

stream stores.

THINK AND FEEL

• Modest fashion should be professional, stylish, &

versatile.• Ethical & sustainable fashion is a priority in my

purchases.• Convenience and exclusivity matter when shopping

for high-end fashion.GAIN

• A curated shopping experience offering exclusivity and convenience.

• Access to high-quality, faith-conscious fashion in one location.

• Stylish, modest clothing that transitions from work to social settings.

PAIN

• Hard to find trendy yet professional modest businesswear.

• Limited time for in-store shopping due to a demanding schedule.

• Few mainstream retailers offer high-end modest fashion options.

THINK AND FEEL

• Frequently shops for casual and social -event outfits.

• Posts fashion finds on social media, influencing her

peers.• Prefers in-store shopping for inspiration but buys

online for the best deals.HEAR

• Peers talking about trendy but modest outfit

inspirations.• Brands promoting fast fashion over modest

alternatives.• Online communities sharing shopping hacks for

modest apparel styles.SEE

• Social media influencers showcasing stylish modest

outfits.• Limited affordable modest fashion options in most

stores.• Friends experimenting with modest fashion but strug-

gling to find trendy styles. a with Shon butTHINK AND FEEL

• Modest fashion should be trendy, youthful, and

expressive.• Shopping should be fun, inclusive, and community-

driven.• Staying within budget while keeping up with fashion

trends is challenging.

GAIN

• Affordable, stylish modest fashion that reflects her personality.

• A trendy shopping environment catering to young women.

• Access to community-driven fashion events and influencer meetups.

PAIN

• Limited budget for high-end modest brands.

• Struggles to find activewear and swimwear that align with her faith.

• Many modest styles feel outdated for young shoppers.

THINK AND FEEL

• Shops monthly for sophisticated, occasion-appropriate

attire.• Attends fashion launches, charity events & social

gatherings.• Prefers boutique-style customer service and

personalized shopping experiences.HEAR

• Boutique owners discussing exclusive fashion

collections.• Community members admiring her refined fashion

choices.• Fashion consultants recommending timeless modest

styles.SEE

• Limited availability of luxury modest fashion in stores.

• Exclusive in-store events showcasing elegant designs.

• Faith-based stores promoting modest, high-end

fashion.THINK AND FEEL

• Fashion should reflect both professionalism and

faith.• High-end modest designers should be more

accessible.• Shopping should be efficient yet enjoyable.

GAIN

• An exclusive shopping experience tailored to her refined taste.

• Elegant styles that align with her faith and professional standing.

• A seamless, personalized service that enhances shopping efficiency.

PAIN

• Limited access to luxury modest brands in mainstream retail.

• Struggles to find high-quality occasion wear meeting religious standards.

• Needs efficient in-person shopping due to a demanding schedule.

THINK AND FEEL

• Shops bi-weekly for maternity, nursing & baby apparel.

• Prefers in-store shopping to assess fabric quality & fit.

• Engages w/modest fashion influencers for

recommendations.HEAR

• Friends discussing challange finding modest maternity

wear.• Influencers recommending modest brands for

mothers.• Sales associates suggesting fabrics & fits for

postpartumSEE

• Limited stylish maternity & nursing-friendly modest

options.• Mothers struggling to find faith-aligned, practical

clothing.

• Faith-based influencers promoting modest fashion

brands.THINK AND FEEL

• Shopping should be convenient & efficient for a busy

mother.• Clothing should be high-quality, long-lasting &

comfortable.• Modest maternity / postpartum clothing should be

stylish and functional. u clothing should be stylishGAIN

• A one-stop shop for herself and her child's modest fashion needs.

• Comfortable yet stylish clothing for different life stages.

• A welcoming, family-friendly shopping environment.

PAIN

• Few maternity and nursing-friendly modest clothing options.

• Struggles to find affordable yet high-quality modest fashion.

• Limited activewear options that balance function and modesty.

MOOD BOARD —

A mood board was created to help with the ideation process by beginning to organize and communicate a particular aesthetic and serve as a source of inspiration Creating this visual representation of desired goals or tasks the product would accomplish is an invaluable resource during the initial steps of the design process.

RESEARCH SYNTHESIS —

PERSONAS —

Generating personas helped to keep the user's needs central during the design process & improved decision making by filtering the choices through the target user's perspective.

NAME & AGE: MIRIAM / 28

OCCUPATION: HOMEMAKER

EDUCATION: BACHELOR OF ARTS

SHOPPING FREQ: WEEKLY

MARITAL STATUS: MARRIED

CHILDREN: 2 BOYS / 2 GIRLS

INCOME: $120,000/YEAR

"I need a one-stop shop for

stylish, modest fashion for

my entire family.'

PSYCHOGRAPHICS

• Values faith-based living &

prioritizes modesty in fashion

choices for herself & her

daughters.• Enjoys quality, stylish clothing

that aligns with religious

principles.• Prefers shopping at stores that

provide a welcoming, commu-

nity oriented environment.BEHAVIORS

• Shops frequently for family

clothing, especially for Shabbat

and holidays.• Seeks durable and comfortable

clothing for daily wear and spe-

cial occasions.

• Engages with brands that align

with her values, often discover-

ing them through social media.

PAIN POINTS

• Difficulty finding modest

clothing that is both fashion-

able and high-quality.• Struggles with inconsistent

sizing across different brands.

• Prefers in-store shopping but

has limited time due to family

responsibilities.GOALS & MOTIVATIONS

• Wants a single destination

where she can shop for herself

and her children.• Looks for brands that balance

style, comfort, and faith-based

modesty.

• Appreciates a shopping experi-

ence that feels tailored to her

needs as a busy mother.

NAME & AGE: SARAH / 27

OCCUPATION: HR DIRECTOR

EDUCATION: MA BUS ADMIN

SHOPPING FREQ: BI-MONTHLY

MARITAL STATUS: ENGAGED

CHILDREN: NONE

INCOME: $85,000/YEAR

"Elegant, modest fashion should

be effortless and perfect for both the office and social events.'PSYCHOGRAPHICS

• Values modern modest fashion

that fits both professional andsocial settings.

• Interested in ethically sourced

and sustainable fashion.• Prefers shopping at high-end,

faith-conscious brands.BEHAVIORS

• Shops primarily online but

visits stores for special events

and sales.• Invests in high-quality, timeless

pieces rather than fast fashion.

• Prefers minimal, elegant styles

that transition from work to

social occasions.

PAIN POINTS

• Struggles to find modest busi-

ness attire that is trendy yet

professional.• Limited access to in-store

shopping due to a demanding

work schedule.• Finds it difficult to locate high-

quality modest brands in main-

stream department stores.GOALS & MOTIVATIONS

• Seeks a shopping experience

that offers both convenience

and exclusivity.• Values curated collections that

align with her personal style.

• Wants access to exclusive

modest fashion brands in one

location.

NAME & AGE: RIVKA / 23

OCCUPATION: STUDENT

EDUCATION: BA FASHION

SHOPPING FREQ: MONTHLY

MARITAL STATUS: SINGLE

CHILDREN: NONE

INCOME: $20,000/YEAR

"Modest fashion can be trendy too, I want stylish options that reflect

my personality."

PSYCHOGRAPHICS

• Enjoys experimenting w/ mod-

est fashion trends while main-

taining religious guidelines.• Highly engaged in social media,

following modest influencers

and fashion brands.• Prefers shopping experiences

that feel fresh, youthful, and

community-driven.

BEHAVIORS

• Frequently shops tor casual

and social -event outfits.• Engages in online shopping but

prefers in-person experiences

for inspiration.• Shares her fashion finds on

social media, influencing her

peers.

PAIN POINTS

• Limited budget for premium

modest brands.

• Finds some modest styles out-

dated or not aligned with youth-

ful trends.

• Struggles to find modest

activewear and swimwear

options.GOALS & MOTIVATIONS

• Wants affordable, stylish

modest fashion that reflects

her personality.• Seeks an inclusive and trendy

shopping environment catering

to younger women.

• Enjoys community-driven

events, such as modest fashion

shows or influencer meetups.

NAME & AGE: CHAYA / 50

OCCUPATION: COUNSELOR

EDUCATION: BA SOCIAL WORK

SHOPPING FREQ: MONTHLY

MARITAL STATUS: MARRIED

CHILDREN: 2 GROWN

INCOME: $60,000/YEAR

"I invest in timeless, high-end modest fashion that aligns with my values and lifestyle.'

PSYCHOGRAPHICS

• Invests in high-end, timeless

modest fashion for professional

and social settings.

• Strong advocate for supporting

faith-based businesses and de-

signers.

• Prefers classic styles over fast

fashion trends.

BEHAVIORS

• Shops for sophisticated,

elegant attire for events and

community engagements.• Prefers boutique-style

customer service with person-

alized shopping assistance.• Attends in-store events, such

as fashion launches and charitygalas.

PAIN POINTS

• Limited access to high-end

modest designers in main-

stream department stores.• Struggles to find occasion wear

that aligns with her religious

standards.

• Prefers in-person shopping ex-

periences but needs efficient

service due to a busy schedule.

GOALS & MOTIVATIONS

• Wants a refined shopping

experience with exclusive mod-

est brands.• Seeks elegant styles that

reflect both her faith and

professional standing.• Enjoys supporting businesses

that align with her values

NAME & AGE: DEVORAH / 30

OCCUPATION: HOMEMAKER

EDUCATION: AA ECE

SHOPPING FREQ: BI-WEEKLY

MARITAL STATUS: MARRIED

CHILDREN: EXPECTING

INCOME: $90,000/YEAR HI

"I need fashionable yet practical modest clothing for motherhood, from maternity to everyday wear."

PSYCHOGRAPHICS

• Values practical yet stylish

modest clothing for herself and

her growing family.

• Focuses on high-quality, long -

lasting pieces.• Enjoys shopping as part of self-

care & community engagementBEHAVIORS

• Regularly shops for both

maternity and postpartum-

friendly modest fashion.• Engages with faith-based influ-

encers for modest fashion

inspiration.• Prefers shopping in stores

where she can touch and feel

fabrics before purchasing.PAIN POINTS

• Limited options for stylish

maternity and nursing-friendly

modest clothing.• Difficulty finding affordable,

high-quality modest fashion for

different life stages.

• Navigating modest activewear

options that balance function

and faith-based values.GOALS & MOTIVATIONS

•Wants convenient, all-in-one

shopping for herself and her

child.

• Seeks fashionable yet comfort-

able modest options.

• Enjoys a welcoming, family

friendly shopping environment.

EMPATHY MAPPING —

Creating empathy mapping helped in understanding the users emotions, perspectives, and motivations far beyond what the secondary research established.

THINK AND FEEL

• Shops for family clothing, especially for Shabbat &

holidays.• Buys in bulk when finding a reliable modest fashion

brand.• Seeks inspiration religious & social media

communities.HEAR

• Friends discussing where to find the best modest

clothing.• Faith-based influencers promoting brands w/

religious values.• Children requesting comfortable yet stylish outfits for

school and events.

SEE

• Limited stylish modest fashion in mainstream stores.

• Inconsistent sizing across different brands.

• Other mothers also struggling to find fashionable,

faith-aligned clothing.

THINK AND FEEL

• Shopping should be convenient/efficient for busy

mothers.• Quality and durability are just as important as

aesthetics.• Modest fashion should be stylish, comfortable, &

reflective of my faith.GAIN

• A one-stop shop with stylish, modest clothing for herself & her kids.

• Brands that consistently offer modest, comfortable & durable fashion.

• A welcoming shopping experience catering to busy mothers.

PAIN

• Difficulty finding modest clothing that is both high-quality & fashionable.

• Struggles with inconsistent sizing across different brands.

• Prefers in-store shopping but limited time due to family responsibilities.

THINK AND FEEL

• Shops online - convenience / visits stores - exclusive

for special events.• Follows faith-conscious & sustainable fashion brands.

• Invests in timeless, high-quality pieces, not fast

fashion.HEAR

• Colleagues complimenting her elegant, modest outfits.

• Influencers covering sustainable & high-end modest

brands.• Peers recommending exclusive shopping events

SEE

• Online stores with inconsistent quality and fit.

• Luxury brands lacking modest yet fashionable work

attire.• Limited professional modest fashion options in main

stream stores.

THINK AND FEEL

• Modest fashion should be professional, stylish, &

versatile.• Ethical & sustainable fashion is a priority in my

purchases.• Convenience and exclusivity matter when shopping

for high-end fashion.GAIN

• A curated shopping experience offering exclusivity and convenience.

• Access to high-quality, faith-conscious fashion in one location.

• Stylish, modest clothing that transitions from work to social settings.

PAIN

• Hard to find trendy yet professional modest businesswear.

• Limited time for in-store shopping due to a demanding schedule.

• Few mainstream retailers offer high-end modest fashion options.

THINK AND FEEL

• Frequently shops for casual and social -event outfits.

• Posts fashion finds on social media, influencing her

peers.• Prefers in-store shopping for inspiration but buys

online for the best deals.HEAR

• Peers talking about trendy but modest outfit

inspirations.• Brands promoting fast fashion over modest

alternatives.• Online communities sharing shopping hacks for

modest apparel styles.SEE

• Social media influencers showcasing stylish modest

outfits.• Limited affordable modest fashion options in most

stores.• Friends experimenting with modest fashion but strug-

gling to find trendy styles. a with Shon butTHINK AND FEEL

• Modest fashion should be trendy, youthful, and

expressive.• Shopping should be fun, inclusive, and community-

driven.• Staying within budget while keeping up with fashion

trends is challenging.

GAIN

• Affordable, stylish modest fashion that reflects her personality.

• A trendy shopping environment catering to young women.

• Access to community-driven fashion events and influencer meetups.

PAIN

• Limited budget for high-end modest brands.

• Struggles to find activewear and swimwear that align with her faith.

• Many modest styles feel outdated for young shoppers.

THINK AND FEEL

• Shops monthly for sophisticated, occasion-appropriate

attire.• Attends fashion launches, charity events & social

gatherings.• Prefers boutique-style customer service and

personalized shopping experiences.HEAR

• Boutique owners discussing exclusive fashion

collections.• Community members admiring her refined fashion

choices.• Fashion consultants recommending timeless modest

styles.SEE

• Limited availability of luxury modest fashion in stores.

• Exclusive in-store events showcasing elegant designs.

• Faith-based stores promoting modest, high-end

fashion.THINK AND FEEL

• Fashion should reflect both professionalism and

faith.• High-end modest designers should be more

accessible.• Shopping should be efficient yet enjoyable.

GAIN

• An exclusive shopping experience tailored to her refined taste.

• Elegant styles that align with her faith and professional standing.

• A seamless, personalized service that enhances shopping efficiency.

PAIN

• Limited access to luxury modest brands in mainstream retail.

• Struggles to find high-quality occasion wear meeting religious standards.

• Needs efficient in-person shopping due to a demanding schedule.

THINK AND FEEL

• Shops bi-weekly for maternity, nursing & baby apparel.

• Prefers in-store shopping to assess fabric quality & fit.

• Engages w/modest fashion influencers for

recommendations.HEAR

• Friends discussing challange finding modest maternity

wear.• Influencers recommending modest brands for

mothers.• Sales associates suggesting fabrics & fits for

postpartumSEE

• Limited stylish maternity & nursing-friendly modest

options.• Mothers struggling to find faith-aligned, practical

clothing.

• Faith-based influencers promoting modest fashion

brands.THINK AND FEEL

• Shopping should be convenient & efficient for a busy

mother.• Clothing should be high-quality, long-lasting &

comfortable.• Modest maternity / postpartum clothing should be

stylish and functional. u clothing should be stylishGAIN

• A one-stop shop for herself and her child's modest fashion needs.

• Comfortable yet stylish clothing for different life stages.

• A welcoming, family-friendly shopping environment.

PAIN

• Few maternity and nursing-friendly modest clothing options.

• Struggles to find affordable yet high-quality modest fashion.

• Limited activewear options that balance function and modesty.

MOOD BOARD —

A mood board was created to help with the ideation process by beginning to organize and communicate a particular aesthetic and serve as a source of inspiration Creating this visual representation of desired goals or tasks the product would accomplish is an invaluable resource during the initial steps of the design process.

"Personal video

shopping consultations

would allow me to shop more

frequently given my busy

work schedule." — Sarah

"Personal video

shopping consultations

would allow me to shop more

frequently given my busy

work schedule." — Sarah

INFORMATION ARCHITECTURE —

USER FLOW RED ROUTES —

Creating empathy mapping helped in understanding the users emotions, perspectives, and motivations far beyond what the secondary research established.

INFORMATION ARCHITECTURE —

USER FLOW RED ROUTES —

Creating empathy mapping helped in understanding the users emotions, perspectives, and motivations far beyond what the secondary research established.

LOW FIDELITY DESIGNS —

WIREFRAMES —

Designing wireframes based on the user flow blueprints helped to maintain focus on the structure, layout, and functionality. Wireframes are the first visual culmination of the preliminary research phase of the design process, and help to maintain focus on the structure over visual aesthetics.

LOW FIDELITY DESIGNS —

WIREFRAMES —

Designing wireframes based on the user flow blueprints helped to maintain focus on the structure, layout, and functionality. Wireframes are the first visual culmination of the preliminary research phase of the design process, and help to maintain focus on the structure over visual aesthetics.

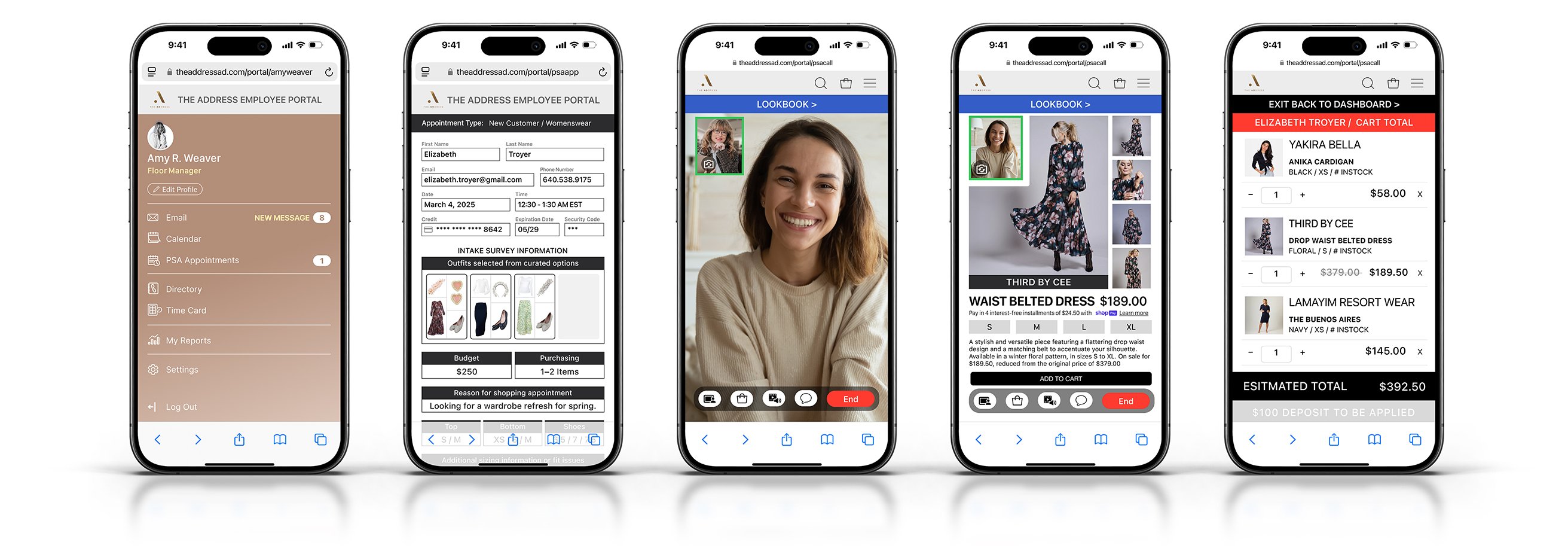

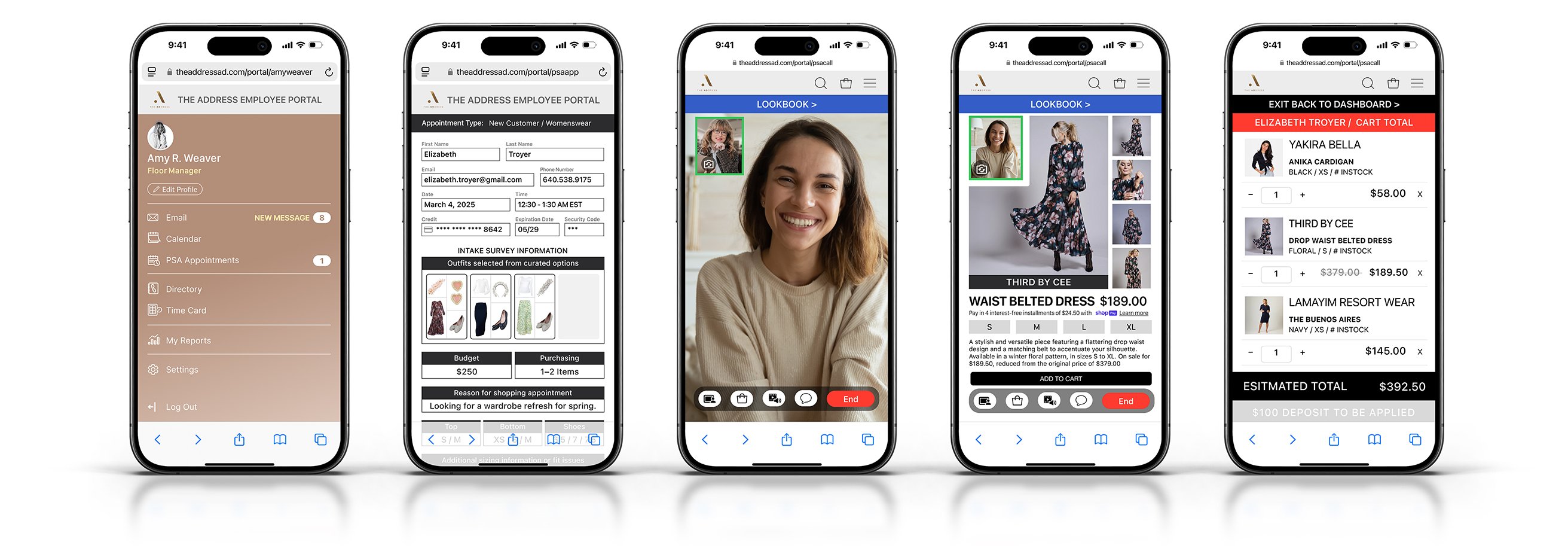

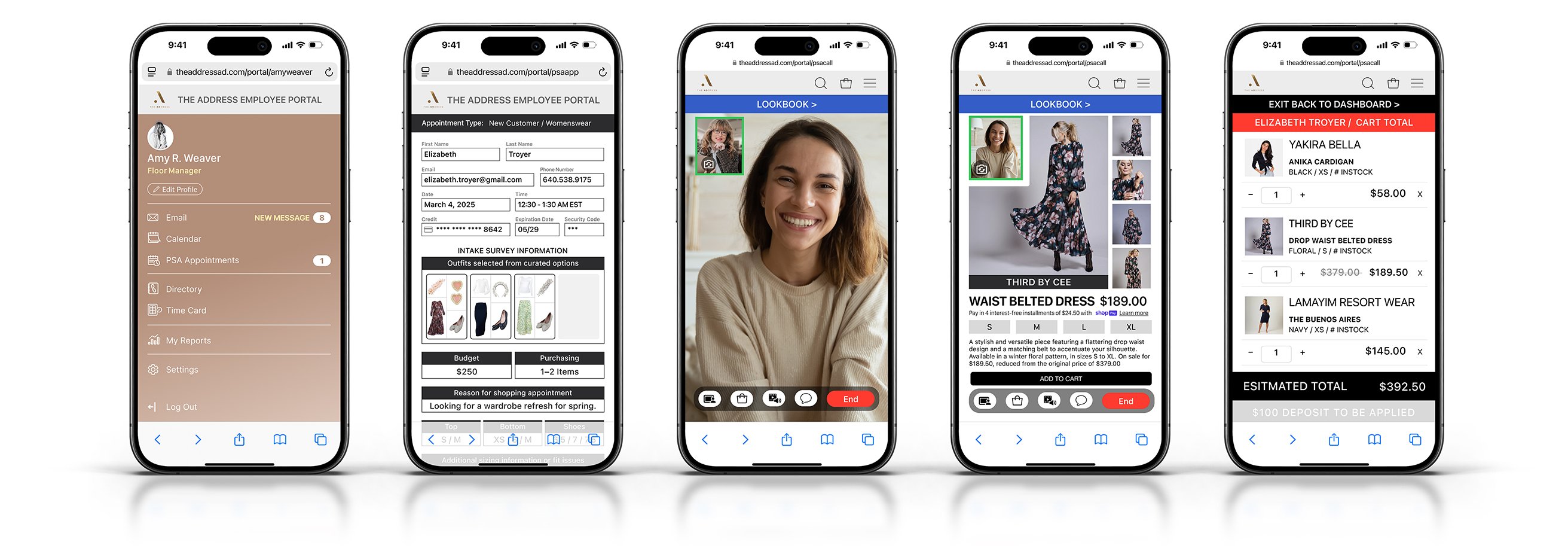

HIGH FIDELITY DESIGN R1 —

PROTOTYPE —

One of the most exciting and rewarding stages of the design process is the creation of the first iteration of nigh fidelity mock-ups. Seeing everything come together in color with more refined details is the moment where the product design comes to life. This first iteration is a direct reflection of the amount of time and effort put into the previous stages.

HIGH FIDELITY DESIGN R1 —

PROTOTYPE —

One of the most exciting and rewarding stages of the design process is the creation of the first iteration of nigh fidelity mock-ups. Seeing everything come together in color with more refined details is the moment where the product design comes to life. This first iteration is a direct reflection of the amount of time and effort put into the previous stages.

"The sizing page was clear and

straightforward, I didn't see the need

for the body shape questions." - Christina

"The sizing page was clear and

straightforward, I didn't see the need

for the body shape questions." - Christina

Survey participants felt

the curated outfit example

section needed to offer a

more diverse selection of

styles/outfits.

Respondents directly or

indirectly communicated a

desire for a larger product

area within each screen

over the video caller image.

Participants felt having the

ability to upload images of

their wardrobe or types of

clothing they were seeking

was very attractive feature.

Survey participants

acknowledged how useful

the service could be and

how it could increase their

purchasing frequency.

USABILITY TESTING THE PROTOTYPE REVEALED

VALIDATE R1 —

USABILITY TEST REPORT —

Usability testing of the first high-fidelity prototypes revealed that while participants could navigate the sales associate call interface with ease, the small screen space allocated to the apparel archive, Shop Together, and media share features caused visual strain and hindered comprehension. Participants also noted issues with the proximity of the call toolbar to other menus and the small font size of product descriptions. Based on this feedback, the design was refined to prioritize sales-driving features by expanding their screen presence, simplifying navigation, and improving visual hierarchy. Adjustments included making customer intake information and the apparel archive more accessible within the dashboard, replacing the gradient navigation with the standard branded menu for consistency, and adding clearer call initiation options within the appointment workflow.

ERROR RATING

PROBLEM

SOLUTION

CRITICAL

The space showcasing the presented products should be larger than the video feed area.

Rework design/layout so that the product section is the hero of each screen.

MINOR

Curated outfits "None match my preferences."

Update examples to include a more diverse selection

MINOR

Would more likely to use if available the same day.

Maybe offer "Drop in today section" for same day app.

MINOR

Having entered pertinent sizing information, questioned the need for "Describe my body shape." follow section.

Remove the "Describe my body shape," since the all it provides is additional descriptive value.

MINOR

Questioned the need for intake areas other than size information and brand preference for conusltation.

Possibly make the other intake information areas an option left up to the individual scheduling.

NORMAL

On a video call is there a need for chat?

Yes, to provide recordable information such as sizing….

VALIDATE R1 —

USABILITY TEST REPORT —

Usability testing of the first high-fidelity prototypes revealed that while participants could navigate the sales associate call interface with ease, the small screen space allocated to the apparel archive, Shop Together, and media share features caused visual strain and hindered comprehension. Participants also noted issues with the proximity of the call toolbar to other menus and the small font size of product descriptions. Based on this feedback, the design was refined to prioritize sales-driving features by expanding their screen presence, simplifying navigation, and improving visual hierarchy. Adjustments included making customer intake information and the apparel archive more accessible within the dashboard, replacing the gradient navigation with the standard branded menu for consistency, and adding clearer call initiation options within the appointment workflow.

ERROR RATING

PROBLEM

SOLUTION

CRITICAL

The space showcasing the presented products should be larger than the video feed area.

Rework design/layout so that the product section is the hero of each screen.

MINOR

Curated outfits "None match my preferences."

Update examples to include a more diverse selection

MINOR

Would more likely to use if available the same day.

Maybe offer "Drop in today section" for same day app.

MINOR

Having entered pertinent sizing information, questioned the need for "Describe my body shape." follow section.

Remove the "Describe my body shape," since the all it provides is additional descriptive value.

MINOR

Questioned the need for intake areas other than size information and brand preference for conusltation.

Possibly make the other intake information areas an option left up to the individual scheduling.

NORMAL

On a video call is there a need for chat?

Yes, to provide recordable information such as sizing….

HIGH FIDELITY DESIGN R2 —

PROTOTYPE —

Incorporating feedback from usability testing participants, fellow team members, and the client, a second iteration of high-fidelity mock-ups were developed with significant refinements. Insights from usability tests and team members highlighted areas that needed better clarity, accessibility, and usability. These perspec-

tives helped shape a more intuitive, visually balanced & functionally effective design for the next phase of development.

HIGH FIDELITY DESIGN R2 —

PROTOTYPE —

Incorporating feedback from usability testing participants, fellow team members, and the client, a second iteration of high-fidelity mock-ups were developed with significant refinements. Insights from usability tests and team members highlighted areas that needed better clarity, accessibility, and usability. These perspec-

tives helped shape a more intuitive, visually balanced & functionally effective design for the next phase of development.

VALIDATE R2 —

USABILITY TEST REPORT —

In the second round of usability testing, participants completed tasks smoothly without visual strain, showing that typography improvements enhanced readability. They requested additional intake details, such as contact numbers, mailing addresses, and payment information, while also expressing confusion between the Apparel Archive and Shop Together features. Although participants praised the media share tool for its potential to create virtual in-store experiences, it was removed due to internal team concerns. Significant redesigns to the intake and scheduling flows led to the omission of brand preference selection, a feature that could have improved personalization for the store’s niche, faith-based customer base but was ultimately excluded despite its relevance.

ERROR RATING

PROBLEM

SOLUTION

CRITICAL

Buttons not working correctly in intake process.

Fix prototype linking, make sure all CTA's are functional

MINOR

Intake process could be simplified and shortened.

Rework user flow to reduce number of screens in intake.

MINOR

Provide ability to select colors from color wheel, instead of a set selection of colors.

Rework intake screen to replace the selection of colors with a color wheel that allows users to select their own.

VALIDATE R2 —

USABILITY TEST REPORT —

In the second round of usability testing, participants completed tasks smoothly without visual strain, showing that typography improvements enhanced readability. They requested additional intake details, such as contact numbers, mailing addresses, and payment information, while also expressing confusion between the Apparel Archive and Shop Together features. Although participants praised the media share tool for its potential to create virtual in-store experiences, it was removed due to internal team concerns. Significant redesigns to the intake and scheduling flows led to the omission of brand preference selection, a feature that could have improved personalization for the store’s niche, faith-based customer base but was ultimately excluded despite its relevance.

ERROR RATING

PROBLEM

SOLUTION

CRITICAL

Buttons not working correctly in intake process.

Fix prototype linking, make sure all CTA's are functional

MINOR

Intake process could be simplified and shortened.

Rework user flow to reduce number of screens in intake.

MINOR

Provide ability to select colors from color wheel, instead of a set selection of colors.

Rework intake screen to replace the selection of colors with a color wheel that allows users to select their own.

FINAL PROTOTYPE —

PROTOTYPE —

FINAL PROTOTYPE —

PROTOTYPE —

THE RUNDOWN —

WHAT I LEARNED —

Working on the American Dream shopping mall’s The Address project allowed me to apply the product development process I learned through the Springboard program while collaborating with a team of designers under real-world project constraints. Collaborating from the ideation stage through to high-fidelity design enabled us to create a more robust, innovative, and user-centered solution by incorporating diverse perspectives. This collaborative approach also accelerated the project timeline, allowing us to develop a successful user-centered MVP much faster than a single designer could have on their own.

WHAT IT SOLVED —

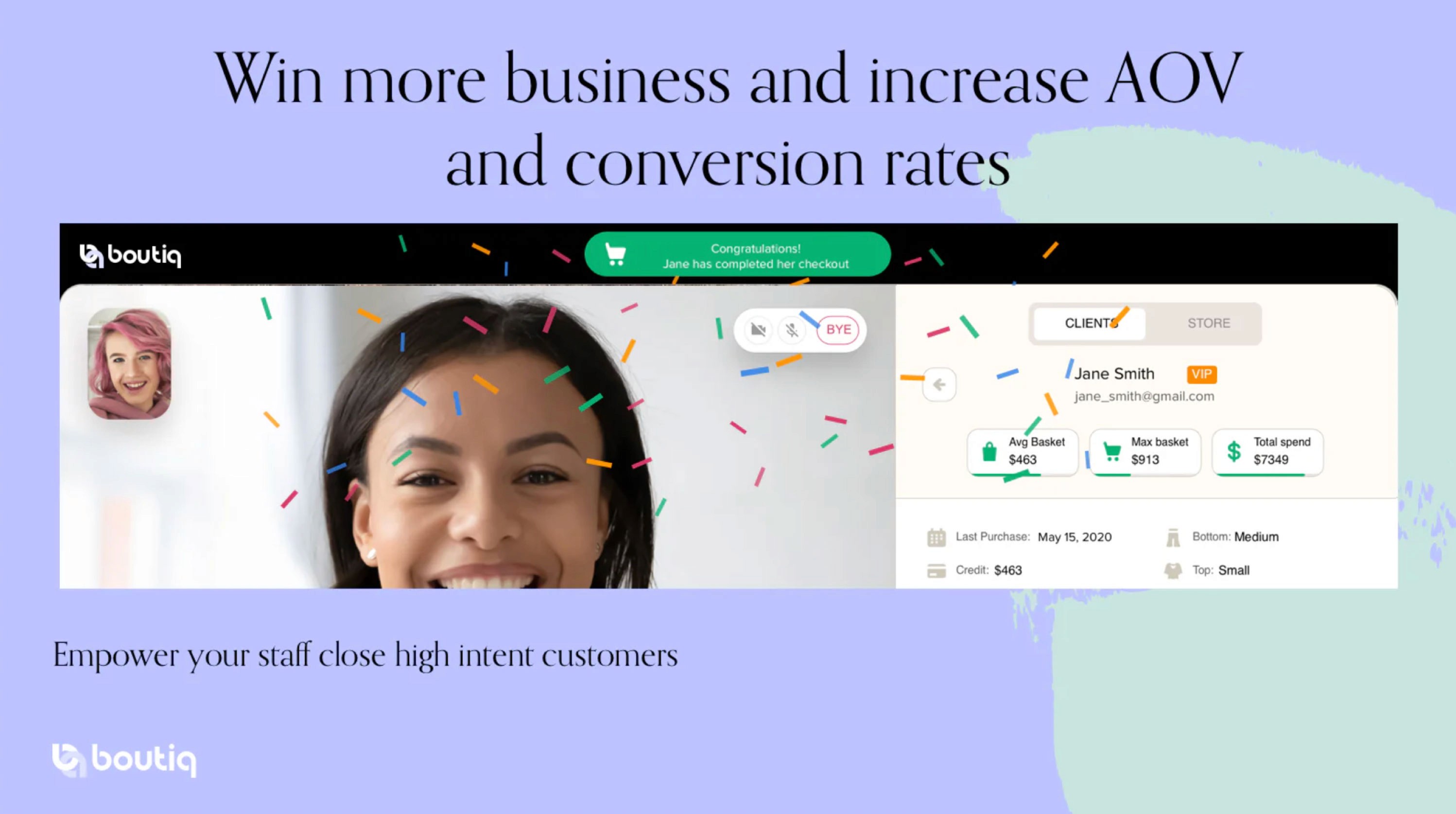

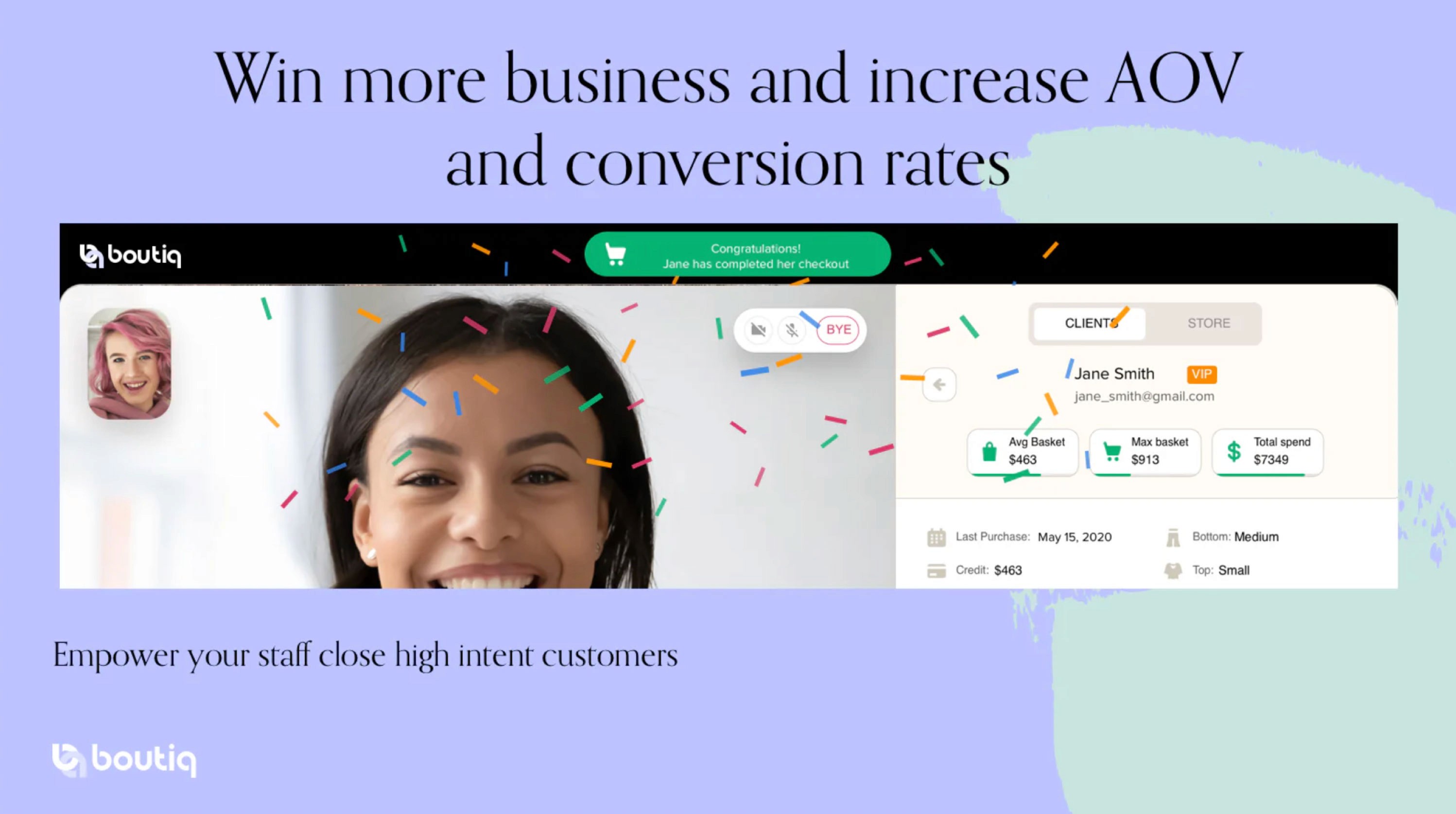

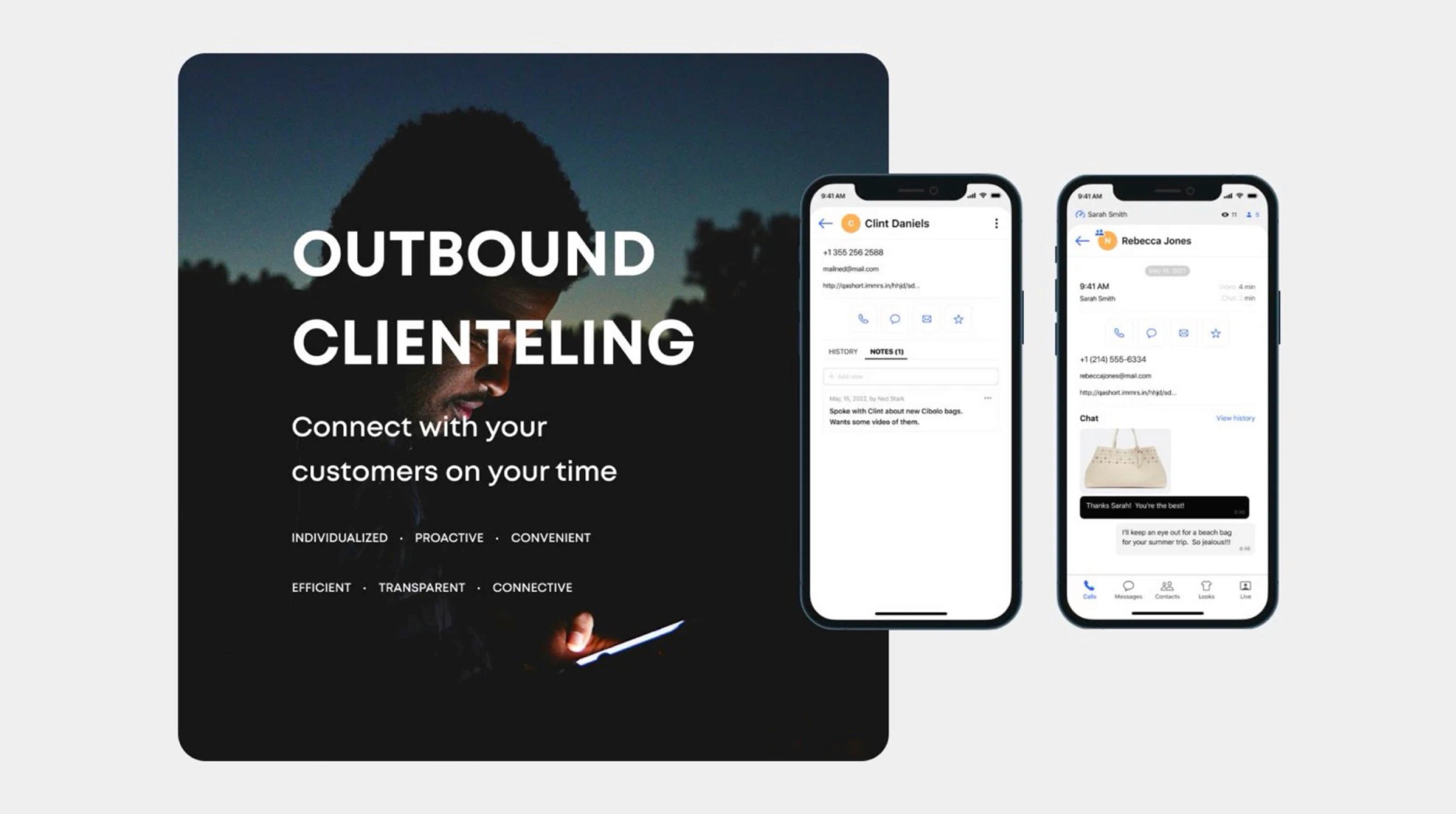

The browser-based solution we developed addressed the store's challenge of utilizing slow customer traffic periods by enabling sales associates to provide personalized shopping consultations remotely, allowing customers to shop from the comfort of their own homes during these times. By implementing a service model that required customers to pay a deposit, which could be applied toward any purchases made as a result of the consultation but retained if no purchase was made, allowing the store to continue generating revenue even during low traffic periods.

THE RUNDOWN —

WHAT I LEARNED —

Working on the American Dream shopping mall’s The Address project allowed me to apply the product development process I learned through the Springboard program while collaborating with a team of designers under real-world project constraints. Collaborating from the ideation stage through to high-fidelity design enabled us to create a more robust, innovative, and user-centered solution by incorporating diverse perspectives. This collaborative approach also accelerated the project timeline, allowing us to develop a successful user-centered MVP much faster than a single designer could have on their own.

WHAT IT SOLVED —

The browser-based solution we developed addressed the store's challenge of utilizing slow customer traffic periods by enabling sales associates to provide personalized shopping consultations remotely, allowing customers to shop from the comfort of their own homes during these times. By implementing a service model that required customers to pay a deposit, which could be applied toward any purchases made as a result of the consultation but retained if no purchase was made, allowing the store to continue generating revenue even during low traffic periods.

PROBLEM

Identifying restaurants that satisfy flavor preferences and food allergy needs remains a challenge, often leading to overlooked options and missed dining opportunities.

SOLUTION

Develop an innovative app that maps flavor profiles and tracks food allergies, enabling confident restaurant discovery.

MY ROLE

Conduct & synthesize research, and develop iterative solutions through user testing from low to high-fidelity prototyping.

RESEARCH PLAN —

SCHEDULE —

— PHASE 1 —

DISCOVERY

PLAN RESEARCH

1. Formulate Research Plan

2. Define User Audience

CONDUCT RESEARCH

1. Competitive Lanscape

2. Secondary Research

RESEARCH SYNTHESIZE

1. User Personas

2. Empathy Mapping

3. Mood Board

— PHASE 2 —

DESIGN R1

DESIGN INFORMATION ARCHITECTURE

1. User Flow Red Routes

DESIGN IN LOW FIDELITY

1. Computer Wireframes

2. Group Critique

3. Combine Concepts

DESIGN PROTOTYPE

1. Refine Design & Incorporate

Prototype Functionality

— PHASE 3 —

VALIDATE R1

PREPARE TO TEST

1. Create Test Script

2. Identify & Book Test Users